COVID's Impact on the Fitness Industry [35+ Stats and Facts]

The global pandemic is the biggest disruption the fitness industry has ever faced. To develop a greater understanding of just how the industry is being impacted and shifting, we spent hours researching, analyzing, and compiling the newest research, stats, facts, and data.

Specifically, the research compiled addresses:

- Gym closures and bankruptcy during the pandemic

- Job loss in the fitness industry during the pandemic

- Impact of COVID-19 on gym memberships

- Member attitudes toward returning to gyms

- Growth of digital and at-home fitness

- Investing in at-home equipment

- COVID-19’s impact on exercise behavior

For additional gym statistics, like our research review on the benefits of exercise, our newest reports on the top fitness trends in 2021, the 75+ gym membership statistics, quarantine weight gain study, average gym membership cost in 2021, and the 200+ gym industry statistics that we have published.

Gym closures and bankruptcy during the pandemic

- It is estimated that the US gym and health club industry lost $13.9 billion from mid-March to August 31 [IHRSA, October 2020]

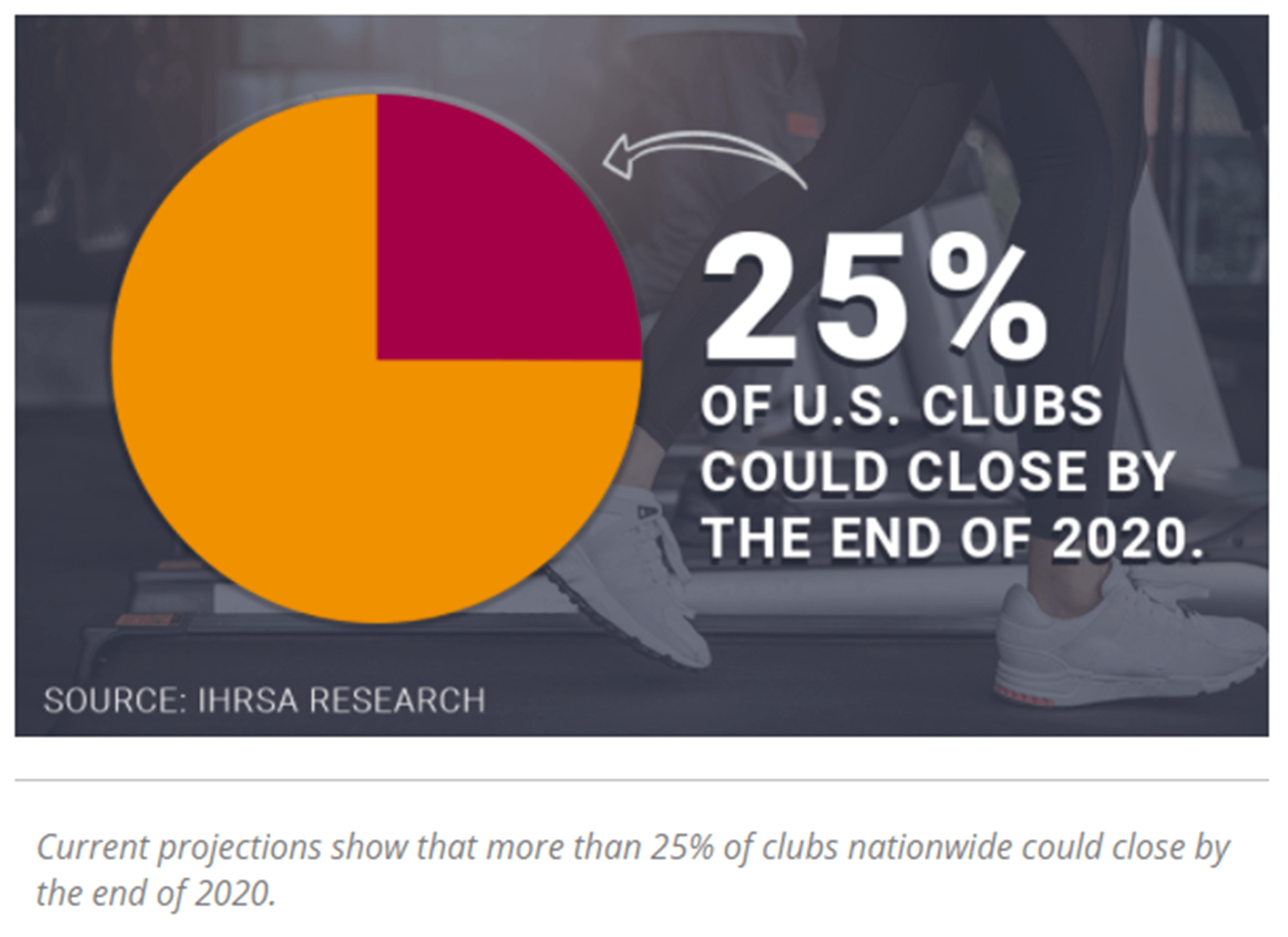

- It’s predicted that about 25% of gyms in the US will be closing by 2020 [IHRSA, October 2020]

- More than 38,000 gyms and health clubs have been closed down because of the virus as of May 2020 [Harrison Co., May 2020]

- 23.9% of US gym members report that their gym is still closed as of August 2020 [RunRepeat]

- Gyms that filed for bankruptcy include: Cyc Fitness, YogaWorks, Flywheel Sports, Town Sports International, 24 Hour Fitness, Gold's Gym, and Modell's Sporting Goods [Business Insider, Oct 2020]

- 50% of Gold’s Gym location plan to close permanently (not including franchises) and the rest hope to re-open in August [Eisneramper, 2020]

- ClassPass Inc.’s revenue decreased by 95% in April leading the company to lay off 50% of its workforce [Eisnerramper, 2020]

Job loss in the fitness industry during the pandemic

- Around 500,000 gym industry employees have been laid off due to COVID [Harrison Co., May 2020]

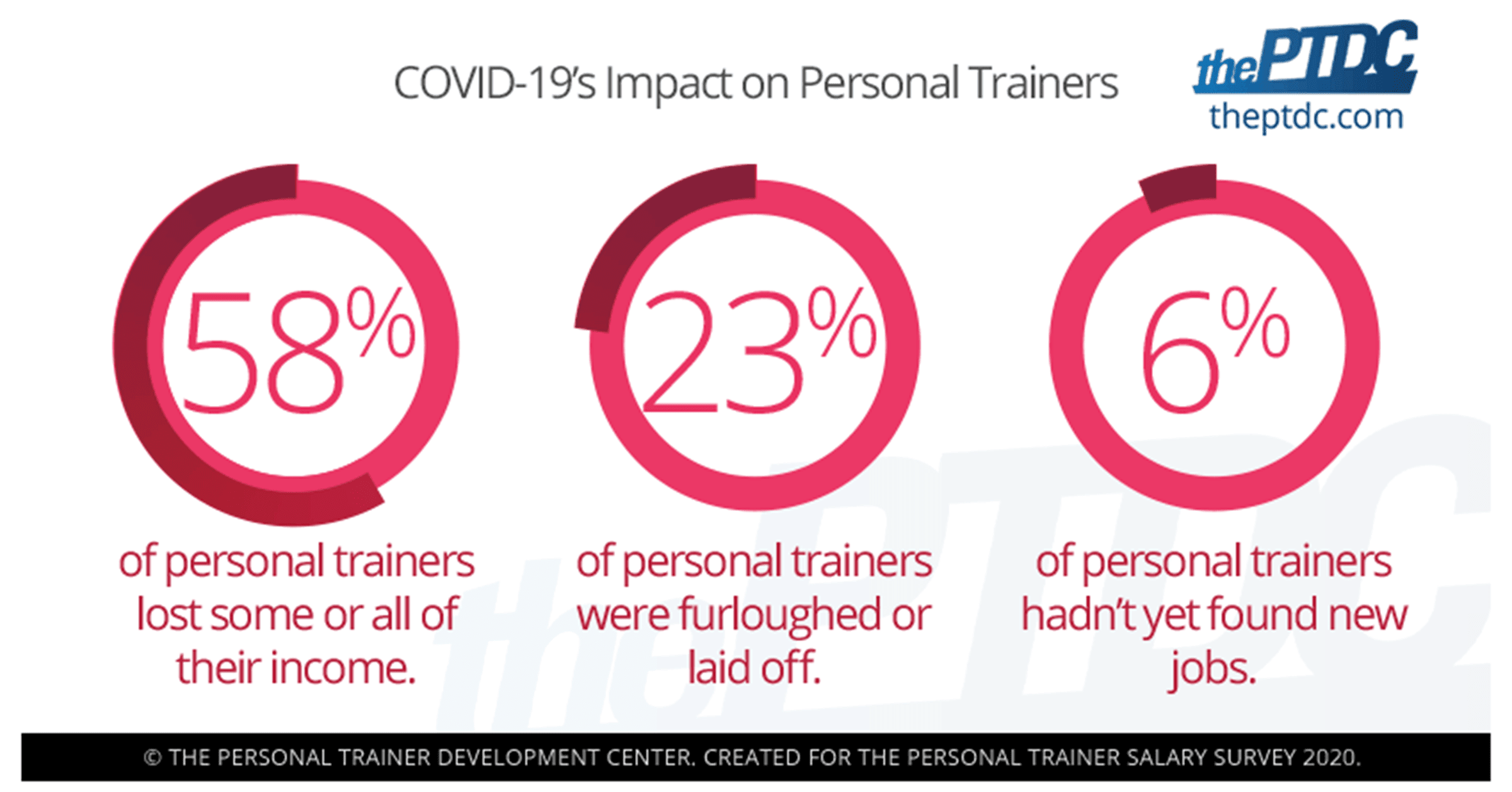

- 58% of trainers lost some or all of their income [The Personal Trainer Development Center, 2020]

- 1% of trainers say that they’re going to leave the fitness industry [The Personal Trainer Development Center, 2020]

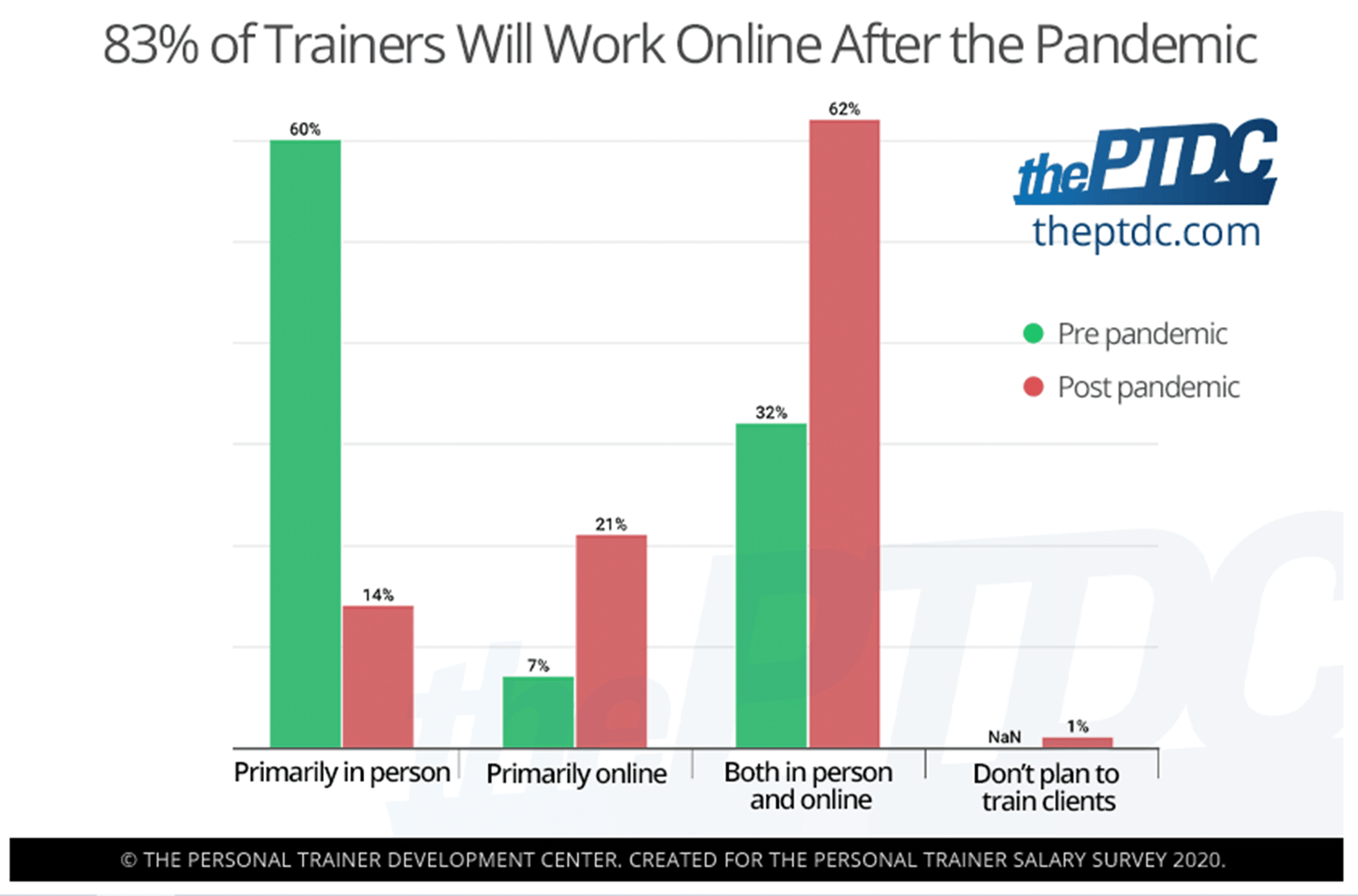

- 83% of trainers say that they’ll work primarily online after the pandemic [The Personal Trainer Development Center, 2020]

Impact of COVID-19 on gym memberships

- 60% of Americans plan to cancel their memberships [Freeletics, July 2020]

- 59% of Americans don’t plan to renew their gym memberships after COVID [TD Ameritrade, 2020]

- 59.06% of gym members are considering to cancel or have canceled their memberships [Runrepeat, September 2020]

Member attitudes toward returning to gyms

- 25% of Americans don’t plan to go back to the gym [Lifeaid, June 2020]

- In a Morning Consult poll, only 20% of Americans are comfortable going to the gym as of July [Morning Consult]

- In April 2020, 68% of Americans stated that they are much less likely to go back to the gym based on what they know about COVID-19 [Statista]

- In April 2020, 18% of Americans stated that they’re not anticipating to go back to the gym or exercise classes for the next 6 months at the very least [Statista]

Growth of digital and at-home fitness

- 40% of respondents exercised at home for the first time because of COVID-19 [Harrison Co., May 2020]

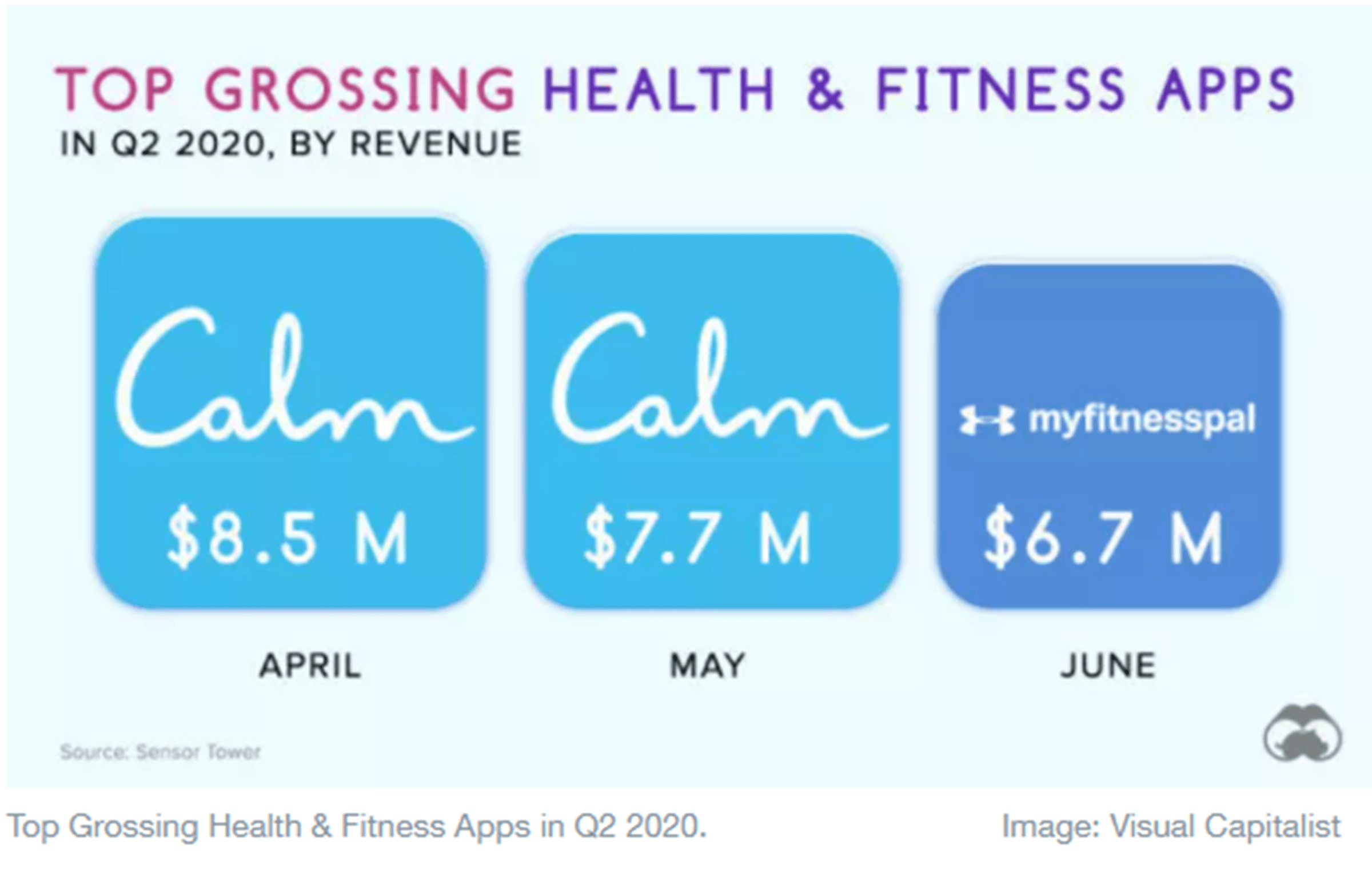

- During the quarantine, 74% of Americans used at least one fitness app [Freeletics, July 2020]

- Between Q1 and Q2 of 2020, at the start of the pandemic, home fitness app downloads grew globally by 46% [Visual Capitalist]

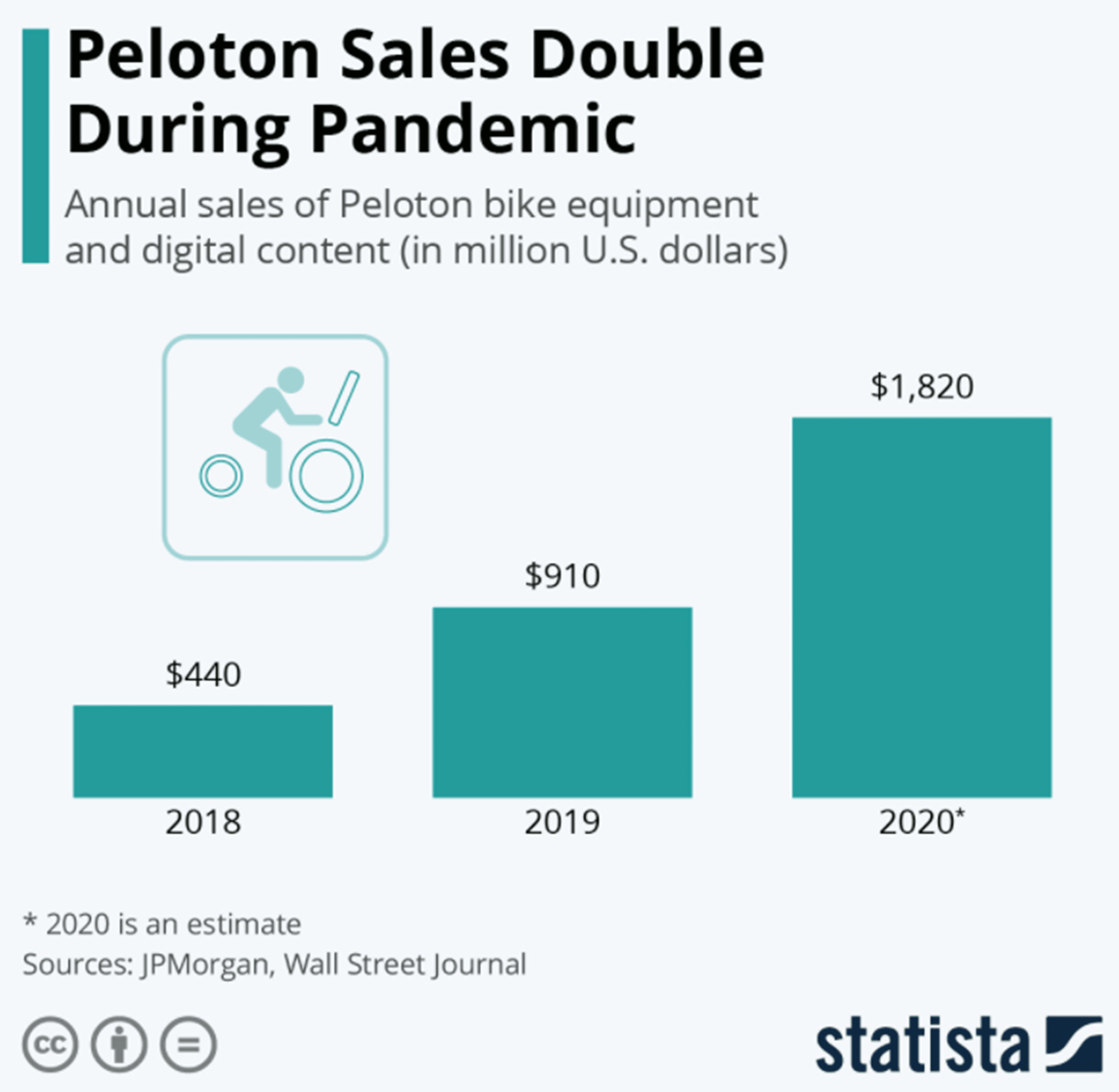

- Peloton is estimated to make around $1.8 billion in sales for 2020 [Statista, September 2020]

- Beachbody, the fitness company, experienced a 200% growth in subscribers since shifting to online classes [Gulfnews, March 2020]

- Tonal, a company that offers a $3000 home workout system, reported to having tripled their sales in the third week of March [Business Insider, March 2020]

- India had the highest increase of fitness app downloads at 156% as well as the largest increase in Daily Active Users with 84% more people using fitness apps each day [World Economic Forum, September 2020]

- Daily Active Users of fitness apps in the US is the largest in the world and manage to grow by 8% in Q2 of 2020 [World Economic Forum, September 2020]

Investing in at-home equipment

- An average of $95.79 has been invested by Americans toward at-home fitness in the last three months [Freeletics, July 2020]

- Yoga mats, resistance bands, and dumbbells are the top fitness equipment that people invest in during the pandemic [Freeletics, July 2020]

- 25% of Americans bought an exercise bike while 21% purchased a treadmill or elliptical [Freeletics, July 2020]

- 60% of gym members enjoyed their home workouts to the point where they plan to cancel their gym memberships [Visual Capitalist]

COVID-19’s impact on exercise behavior

- There’s been an 88% average increase in exercise for people who normally exercise 1-2 times per week [RunRepeat]

- In a survey, 37% out of a thousand fitness club users state that they will work out more after COVID. Over 50% said that this is due to their “renewed appreciation for their health and well-being” [Harrison Co.]

- 50% of Americans say that they are less active during the pandemic-related shutdowns [IHRSA, 2020]

- 65% of respondents report that working out at home alone during the lockdown boosted their confidence [Freeletics, July 2020]

- 60% of men said their top reason for working out during the pandemic was for their mental health [Freeletics, July 2020]

- Reducing boredom (52%) was the top reason why women are working out during the pandemic [Freeletics, July 2020]