Tennis Apparel Statistics

From being a simple uniform to be worn in tennis events, tennis apparel has grown to become something that’s worn outside of the tennis courts. Non-players love it for its aesthetic which has become part of the fashion world. On the other hand, both tennis players and players of other sports also like it for the functionality it brings for sports.

Top tennis apparel statistics

- The global tennis apparel market generated $1,983 million in 2022.

- It’s expected to reach $2,167 million in 2028 with a CAGR of 1.49%, reflecting somewhat low yet healthy growth.

- The women’s segment contributed $870 million in 2022, amounting to 43.9% of the market.

- The children’s tennis apparel market is expected to have the highest growth, with a CAGR of 1.89% - exceeding the tennis apparel market by 0.4% annually. Despite this, it will only grow by 0.5% in terms of market share.

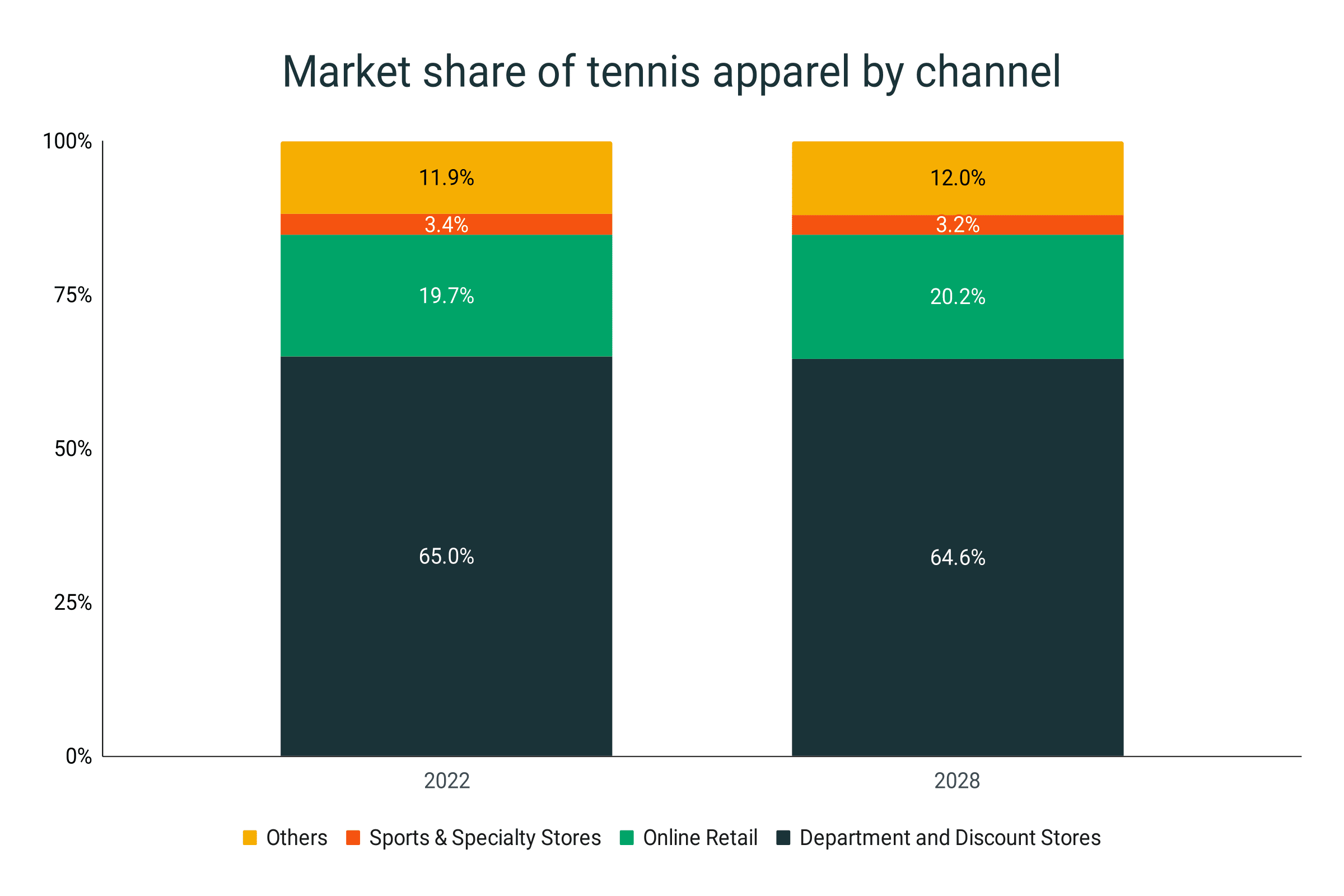

- Department and discount stores generated the most in terms of 2022 revenue with a figure of $1,290 - amounting to 65.0% of the market.

- Online retail is the fastest-growing channel with a CAGR of 1.89%. The segment will gain 0.5% market share at the expense of department and discount stores, as well as the sports and specialty stores segment.

- Tennis has more than 50 apparel brands.

- Of these, the top three are Nike, Adidas, and Under Armour. These contribute a total of 22% of the revenues combined.

- The US generated 33% of tennis apparel sales, while European countries contribute 22% in total.

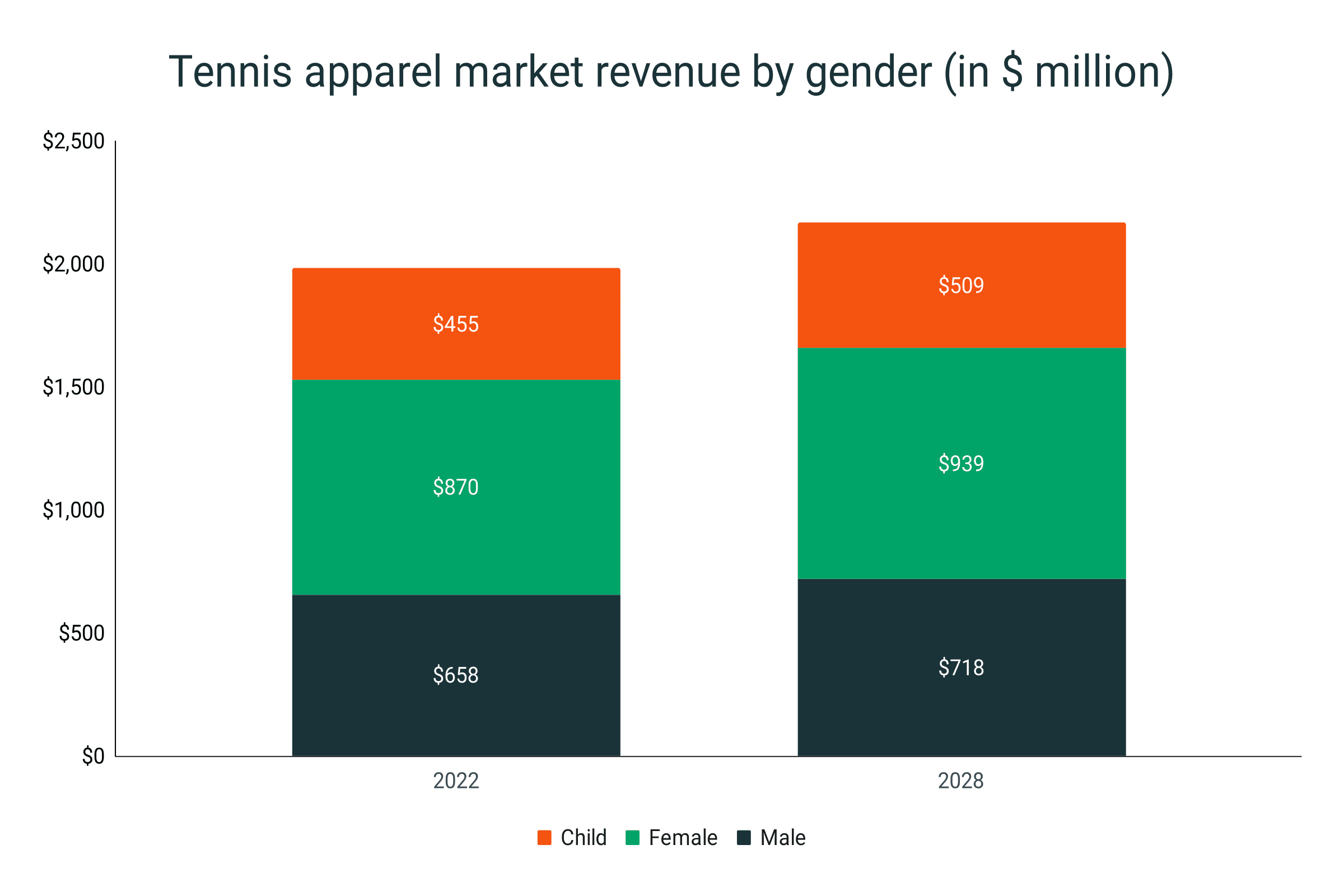

Tennis apparel revenue by gender

- The total tennis apparel sales amounted to $1,983 million in 2022 and will reach $2,167 million in 2028.

- The male segment generated $658 million in revenue in 2022 and is expected to generate $718 million in 2028.

- The female segment contributed $870 million in revenue in 2022, with an anticipated market revenue of $939 million in 2028.

- The children’s tennis apparel segment had a size of $455 million in 2022 which will grow to $509 million by 2028.

- The men’s segment is expected to grow virtually on par with the total tennis apparel market at 1.48% CAGR.

- The growth of the women’s segment is anticipated to be the lowest among the three groups, having a CAGR of 1.28%.

- The children’s segment is expected to post the highest growth with a CAGR of 1.89%.

|

Revenue (in $ million) |

2022 |

2028 |

CAGR |

|

Male |

$ 658 |

$ 718 |

1.48% |

|

Female |

$ 870 |

$ 939 |

1.28% |

|

Child |

$ 455 |

$ 509 |

1.89% |

|

Total |

$ 1,983 |

$ 2,167 |

1.49% |

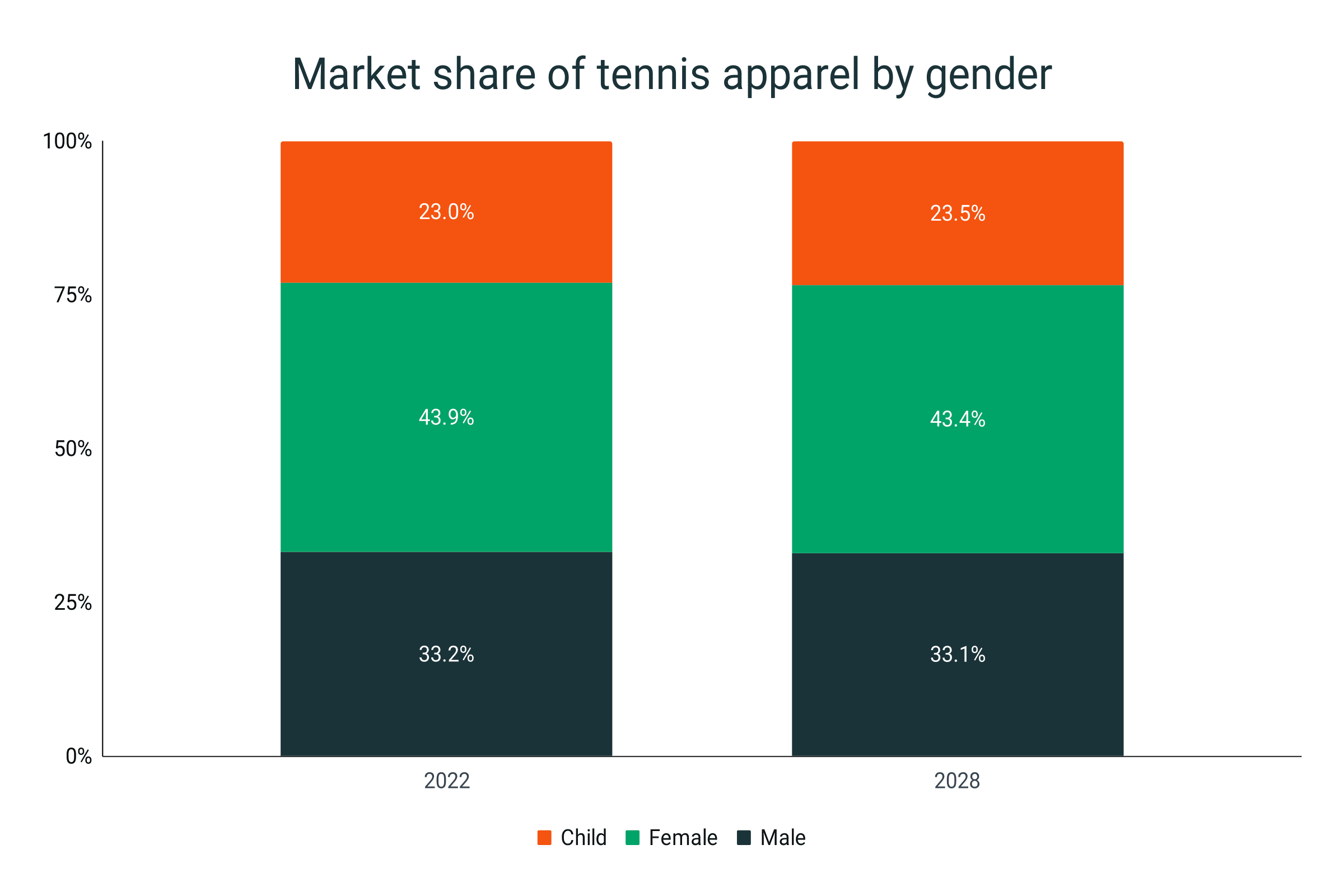

- The men’s segment - with a market share of 33% sits comfortably between the women’s and children’s segments, reflecting minimal change between 2022 and 2028.

- The women’s segment contributes the most in terms of revenue - amounting to 43.9% of tennis apparel sales this figure will experience a very slight decline of 0.5% between 2022 and 2028.

- The children’s segment currently sits at 23.0% market share, taking in the most growth within the period (0.5%) at the expense of the women’s segment.

|

Market Share |

2022 |

2028 |

|

Male |

33.2% |

33.1% |

|

Female |

43.9% |

43.4% |

|

Child |

23.0% |

23.5% |

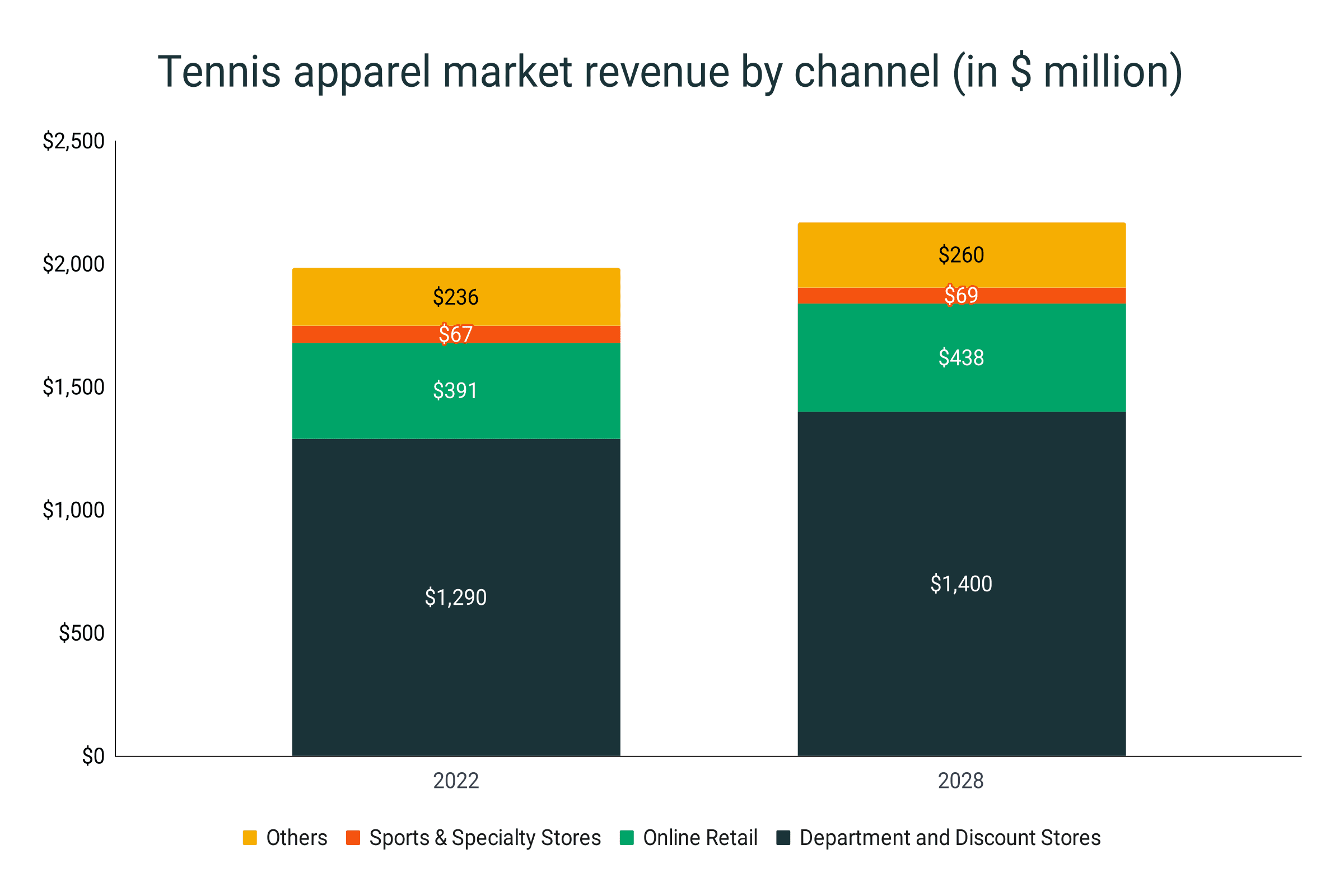

Tennis apparel market revenue by channel

- Department and discount stores contributed $1,290 million of revenue in 2022 - a figure that’s expected to reach $1,400 million in 2028.

- Online retail stores delivered $391 million in sales in 2022, and is expected to deliver $438 million more in 2028.

- Sports and specialty stores provided $67 million in revenue in 2022, which is expected to grow to $69 million by 2028.

- The sales of other channels are expected to reach $260 in 2028 which is $24 million higher than it’s 2022 figure.

- The growth of department and discount stores (with a CAGR of 1.38%) will be lower than the total market (1.49%).

- The online retail store sales will grow the most in the period, with a CAGR of 1.89%.

- Although it’s the slowest growing channel, sports & specialty stores will still post growth with a CAGR of 0.56%.

- The growth of other channel tennis apparel sales (1.66%) will exceed the total tennis apparel market’s growth.

|

Sales channel |

2022 revenue ($ million) |

2028 revenue ($ million) |

CAGR |

|

Department and Discount Stores |

$ 1,290 |

$ 1,400 |

1.38% |

|

Online Retail |

$ 391 |

$ 438 |

1.89% |

|

Sports & Specialty Stores |

$ 67 |

$ 69 |

0.56% |

|

Others |

$ 236 |

$ 260 |

1.66% |

|

Total |

$ 1,983 |

$ 2,167 |

1.49% |

- Department and discount stores generate the most in terms of revenue (65% in 2022) - a figure that will dip by an insignificant amount (0.4% between 2022 and 2028).

- Coming from a market share of 19.7% in 2022, online retail stores will break the 20% threshold, contributing more than one-fifth of tennis apparel sales with a market share of 20.2%.

- Sports and specialty stores’ already low market share of 3.4% in 2022 will decline further, falling to 3.2% in 2028.

- Other channel sales contributed a healthy 12% of sales in 2022 - a figure that will remain unchanged by 2028.

|

Sales channel |

2022 market share |

2028 market share |

|

Department and Discount Stores |

65.0% |

64.6% |

|

Online Retail |

19.7% |

20.2% |

|

Sports & Specialty Stores |

3.4% |

3.2% |

|

Others |

11.9% |

12.0% |

Top 75 ATP-ranked players and their apparel sponsors

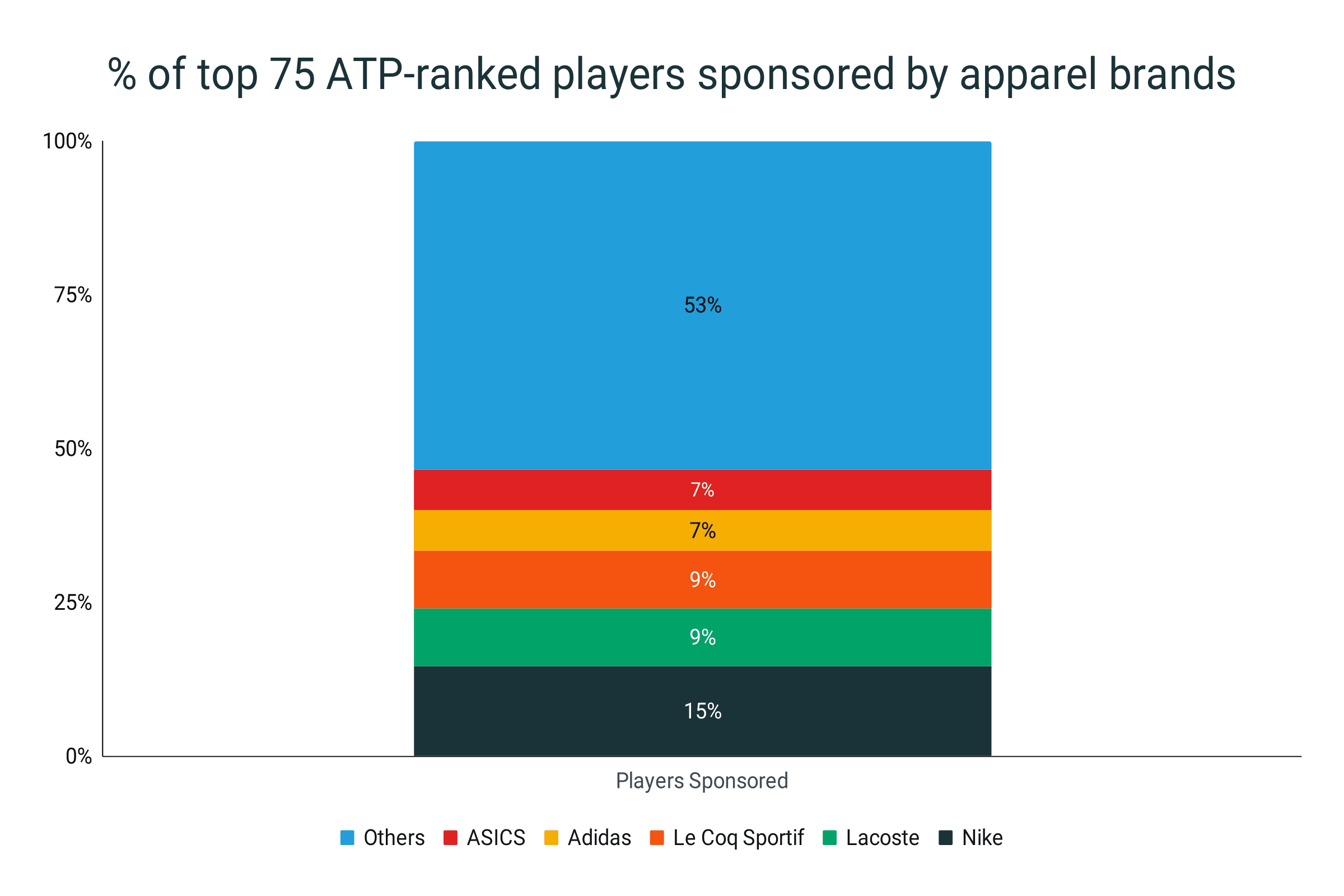

- Nike sponsors the most Top 75 ATP-Ranked players with 11 sponsored players.

- Nike sponsors 5 out of the top 10 ATP-Ranked players.

- Lacoste and Le Coq Sportif sponsor 7 of the top 75 ATP-Ranked players each.

- Lacoste sponsored 2 out of the top 10 ATP-Ranked players.

- Despite their high number of sponsored players, Le Coq Sportif doesn’t sponsor any of the top 10 players. Most of their sponsored players are ranked between the 50th and 75th places.

- Adidas, ASICS, and Yonex each sponsor 5 out of the top 75 ATP-Ranked players.

- Other brands (K-Swiss, Lotto, Fila, New Balance, Joma, Diadora, EA7, Indian Maharadja, HEAD) have between 2 to 4 sponsored players out of the top 75 ATP-Ranked players.

- Rublo, LUKE, Hugo Boss, Dunlop, On, Castore (AMC), Grayson, Hydrogen, Original Penguin, Australian, and Vuora each have only 1 sponsored player ranked in the top 75 ATP players.

- Only 1 out of the top 75 ATP-ranked tennis players doesn’t have a disclosed apparel sponsor.

|

Apparel Brand |

# of Players Sponsored |

|

Nike |

11 |

|

Lacoste |

7 |

|

Le Coq Sportif |

7 |

|

Adidas |

5 |

|

ASICS |

5 |

|

Yonex |

5 |

|

K-Swiss |

4 |

|

Lotto |

4 |

|

Fila |

3 |

|

New Balance |

2 |

|

Joma |

2 |

|

Diadora |

2 |

|

EA7 |

2 |

|

Indian Maharadja |

2 |

|

HEAD |

2 |

|

Rublo |

1 |

|

LUKE |

1 |

|

Hugo Boss |

1 |

|

Dunlop |

1 |

|

On |

1 |

|

Castore (AMC) |

1 |

|

Grayson |

1 |

|

Hydrogen |

1 |

|

Original Penguin |

1 |

|

Australian |

1 |

|

Vuora |

1 |

|

Undisclosed |

1 |

Top 75 WTA-Ranked players and their apparel sponsors

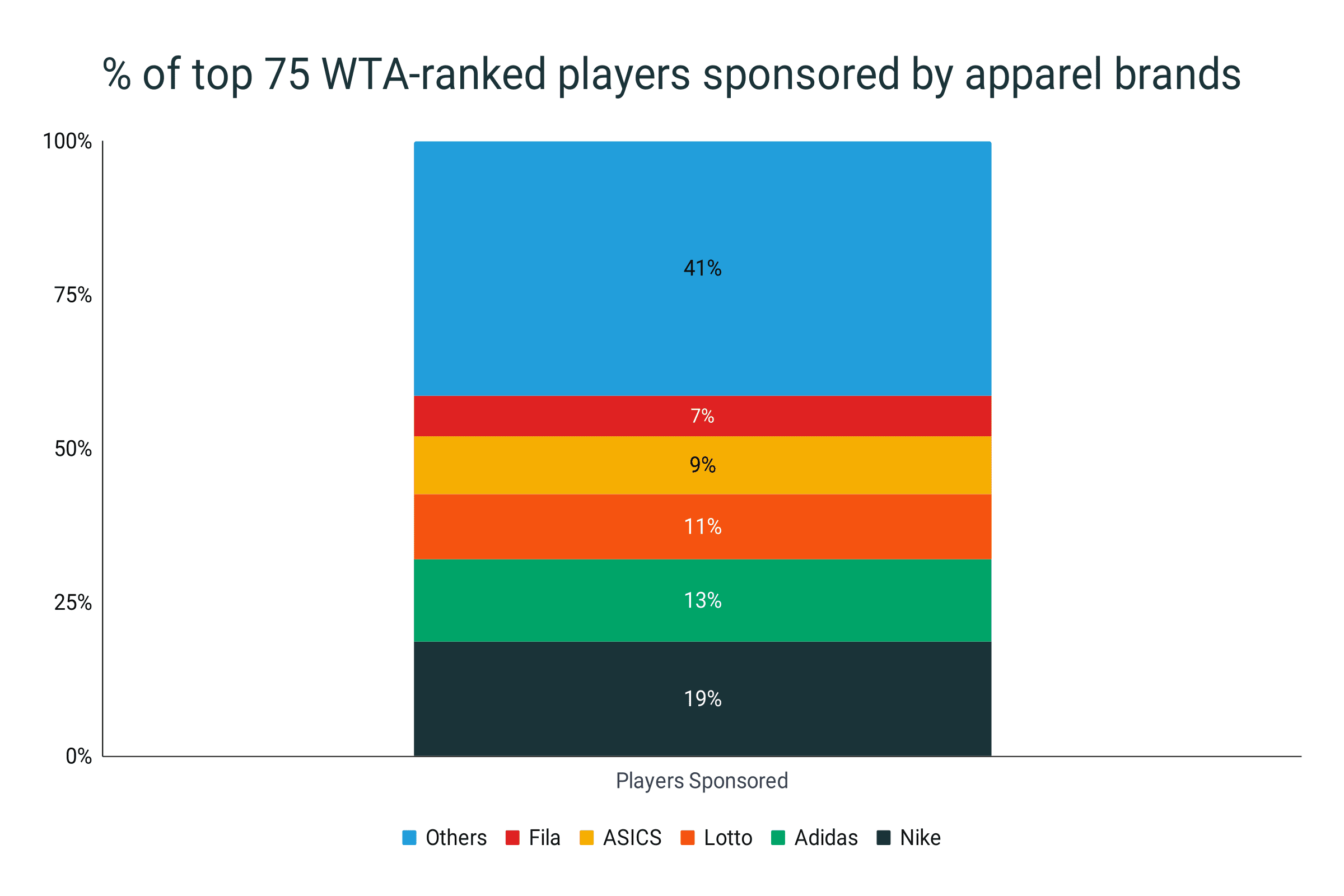

- Nike has the most top 75 WTA-Ranked players sponsored with apparels with 14 players.

- The brand that sponsors the second-most number of top 75 WTA-Ranked players, sponsoring 10 player.s

- Lotto follows them with 8 sponsored players, while Fila and ASICS sponsor 7 and 5, respectively.

- Other brands (Yonex, Joma, K-Swiss, and New Balance) have between 2 and 4 sponsored players ranked in the top 75 players of the WTA.

- On, EA7, DK One, Donna Sport, Australian, Wilson, J.Lindeberg, Free People Movement, Hydrogen, Alo Yoga, Lacoste, Bidi Badu, Original Penguin, Giomila, and Diadora sponsor 1 player in the top 75 WTA-Ranked players each.

- 3 Top 75 WTA-Ranked players have not declared their apparel sponsors publicly.

- Nike, Adidas, and Yonex each sponsor 2 out of the top 10 WTA-Ranked players.

- On, Lotto, and New Balance each sponsor 1 out of the top 10 WTA-Ranked players.

|

Apparel Brand |

# of Players Sponsored |

|

Nike |

14 |

|

Adidas |

10 |

|

Lotto |

8 |

|

Fila |

7 |

|

ASICS |

5 |

|

Yonex |

4 |

|

Joma |

4 |

|

K-Swiss |

3 |

|

New Balance |

2 |

|

On |

1 |

|

EA7 |

1 |

|

DK One |

1 |

|

Donna Sport |

1 |

|

Australian |

1 |

|

Wilson |

1 |

|

J.Lindeberg |

1 |

|

Free People Movement |

1 |

|

Hydrogen |

1 |

|

Alo Yoga |

1 |

|

Own brand |

1 |

|

Lacoste |

1 |

|

Bidi Badu |

1 |

|

Original Penguin |

1 |

|

Diadora |

1 |

|

Undisclosed |

3 |

Tennis apparel facts

- The rise of Pickleball activity also contributes to the growth of tennis apparel sales.

- Tennis skirts and dresses in the US grew by 24% in 2022, reaching a figure that’s more than double its amount in 2019.

- Tennis outfits are generally breathable (sometimes water-repellent), have a good fit, provide comfort, and are lightweight.

- Tennis apparel includes shirts, skirts, dresses, leggings, hats, shorts, and socks.

- Wimbledon started having a “predominantly white” rule for tennis attires in 1963. This extended to the “almost entirely in white” rule in 1995 and was extended to include accessories in 2014.

- Tenniscore is a fashion trend derived from tennis apparel.