Tennis Shoes Statistics

As the 4th most popular sport in the world with over a billion fans, interest in tennis never seems to wane. The tennis shoe market reflects this excitement perfectly, with healthy growth from all segments.

Top tennis shoes statistics

- The global tennis shoes market size was valued at $2.5 billion in 2021.

- The market is projected to reach $3.6 billion by 2031, growing at a CAGR of 3.3% from 2022 to 2031.

- Hard-court tennis shoes contributed $ 1.26B in 2021, accounting for 51% of tennis shoe revenue. This strength is attributable to the availability of hard courts as playing areas.

- Grass-court tennis shoes are expected to have the highest growth among categories with a CAGR of 10.3%, but it will still contribute only 4% of sales in 2031.

- Specialty shops generated $ 1.60B in sales in 2021 - the most out of any channel.

- Specialty shops’ share of 64% in 2021 is expected to drop to 60% in 2031 with the growth of e-commerce channel shares.

- Men’s tennis shoes accounted for $ 1.25B in revenue in 2021 - a figure that’s projected to grow by 41.6% between 2021 and 2031.

- Men’s tennis shoes share leadership of 50% in 2021 is expected to drop by 1%, while women’s tennis shoes shares at 44% in 2021 are expected to increase by 2%.

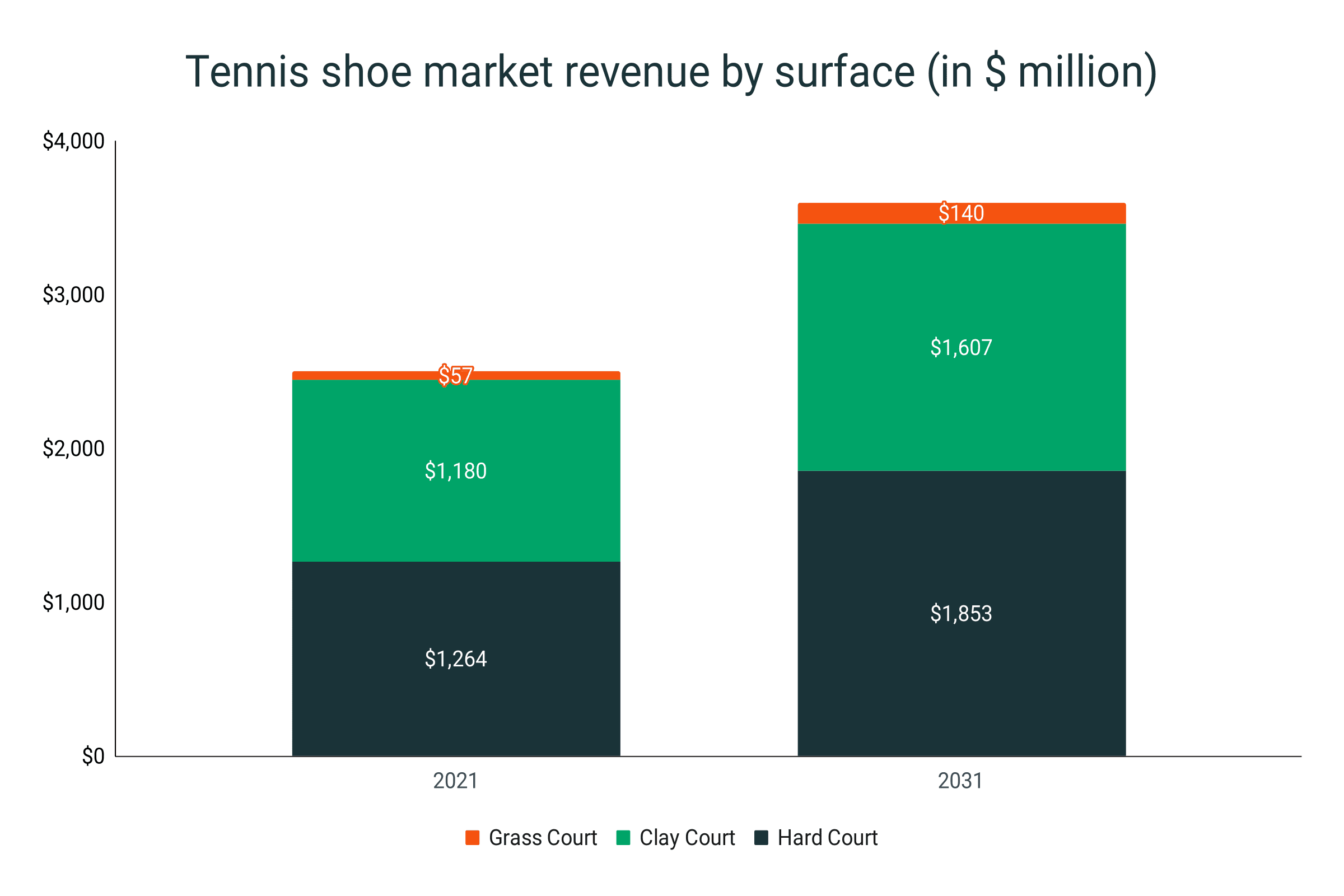

Tennis shoe market revenue by surface

- Hard-court tennis shoes have generated $ 1.26B in revenue in 2021 and are expected to grow by 46.8% in the next 10 years, reaching $1.85B in 2031.

- The clay-court tennis shoes market is sized at $1.18B in 2021 and is projected to grow to $ 1.61B by 2031.

- Grass-court tennis shoes sales in 2021 are at $ 0.06B and are expected to reach $ 0.14B in 2031.

- A 4.8% CAGR in hard-court tennis shoes is expected between 2021 and 2031.

- Clay-court tennis shoes are projected to have the lowest growth among the three categories. However, consistent growth is still expected at 4.0% CAGR.

- Grass court tennis shoes are expected to have the fastest growth at 10.3% CAGR (2021-2031), but will still have a relatively small market share by 2031 (4%).

|

Revenue (in $ million) |

2021 |

2031 |

CAGR |

|

Hard Court |

$1,264 |

$1,853 |

4.8% |

|

Clay Court |

$1,180 |

$1,607 |

4.0% |

|

Grass Court |

$57 |

$140 |

10.3% |

|

Total |

$2,501 |

$3,600 |

4.6% |

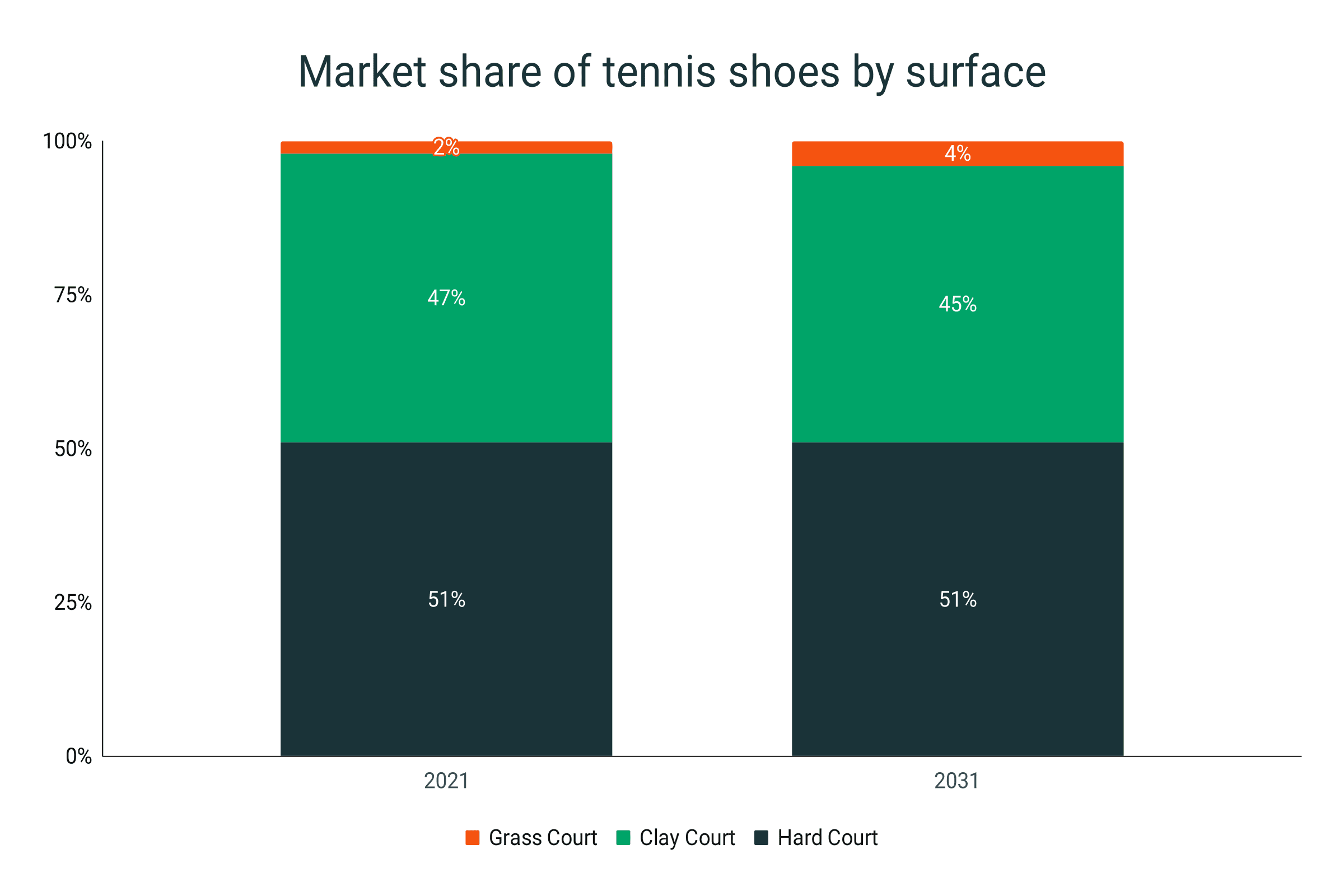

- Hard-court tennis shoes dominated the market with a 51% share in 2021. This share is expected to be maintained until 2031 because hard courts are the most cost-efficient and available surface to play on.

- Clay-court tennis shoes had a share of 47% in 2021, expected to drop by 2% in the next decade.

- Grass-court tennis shoes accounted for 2% of the tennis shoe market in 2021, expected to double to 4% by 2031 at the expense of clay-court shoes.

|

Market Share |

2021 |

2031 |

|

Hard Court |

51% |

51% |

|

Clay Court |

47% |

45% |

|

Grass Court |

2% |

4% |

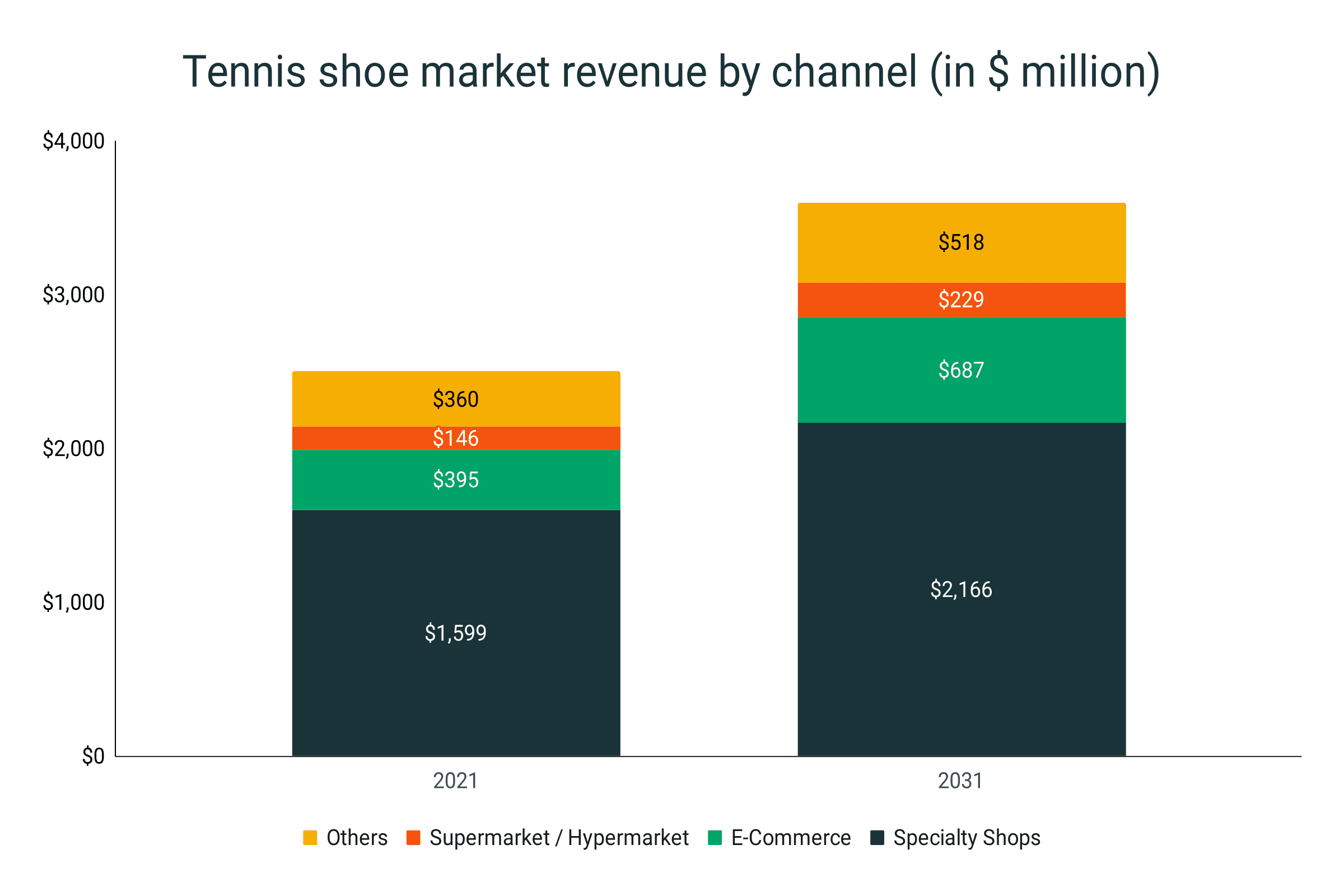

Tennis shoe market revenue by channel

- Specialty stores contribute the largest amount of revenue to the tennis shoe market, generating $ 1.60B in 2021 which is expected to grow to $ 2.17B in 2031.

- The sales of tennis shoes from e-commerce channels are expected to jump from $ 0.39B in 2021 to $ 0.69B in 2031.

- Supermarket & hypermarket tennis shoe sales are expected to grow from $ 0.15B to $ 0.23B (53% growth) between 2021 and 2031.

- Other channels account for $ 0.36B in tennis shoe revenue in 2021, projected to reach $ 0.52B in 2031.

- Specialty shops post the slowest growth of tennis shoe sales, reflecting a CAGR of 3.2% in 2021-2031 versus the average of 3.8%

- E-commerce sales have the fastest growth with a CAGR of 5.8% from 2021-2031.

- Supermarket & Hypermarket sales grow quickly with a CAGR of 4.7% between 2021 and 2031.

- Other channel tennis shoe sales match the growth of the industry at 3.8% between 2021 and 2031.

|

Revenue (in $ million) |

2021 |

2031 |

CAGR |

|

Specialty Shops |

$1,599 |

$2,166 |

3.2% |

|

E-Commerce |

$395 |

$687 |

5.8% |

|

Supermarket / Hypermarket |

$146 |

$229 |

4.7% |

|

Others |

$360 |

$518 |

3.8% |

|

Total |

$2,500 |

$3,600 |

3.8% |

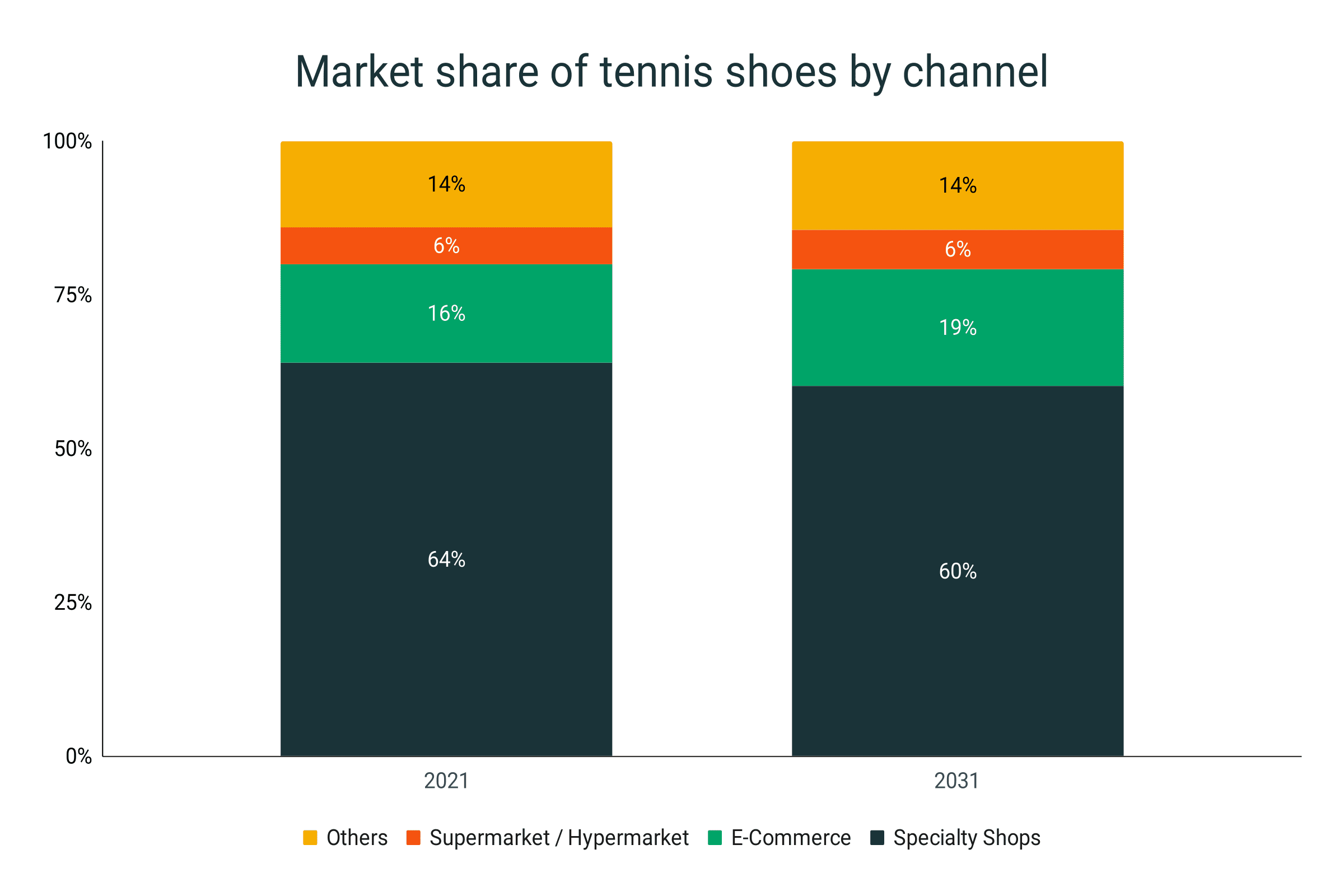

- Specialty stores are the most common channel from which tennis players buy tennis shoes, accounting for 64% in terms of 2021 revenue because of the store experience, the availability of complementary products, and promotions.

- E-commerce is expected to eat up some specialty store shares, reaching 19% in 2031 from only 16% in 2021.

- Supermarket & hypermarket tennis shoe shares are expected to stagnate between 2021 and 2031.

- Other channel tennis shoe shares are projected to remain the same between 2021 and 2031.

Market Share of Tennis Shoes by Sales Channel

|

Market Share |

2021 |

2031 |

|

Specialty Shops |

64% |

60% |

|

E-Commerce |

16% |

19% |

|

Supermarket / Hypermarket |

6% |

6% |

|

Others |

14% |

14% |

Tennis shoe market revenue by demographic

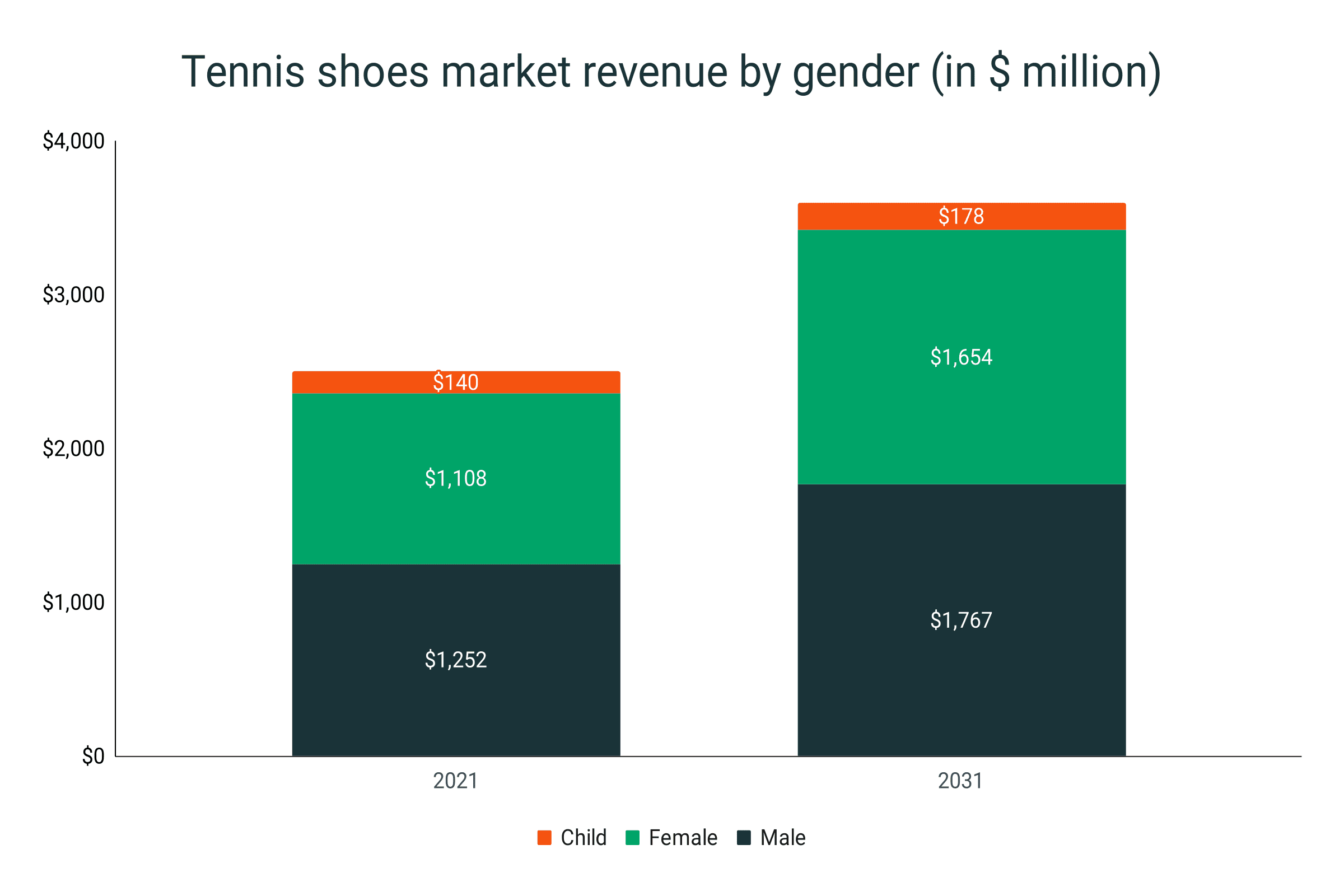

- Men’s tennis shoes generate the most revenue among any demographic with sales of $ 1.25B in 2021 and $ 1.77B in 2031.

- Women’s tennis shoes are expected to grow from $ 1.11B in 2021 to $ 1.65B in 2031, posting a growth of 48.6% within the period.

- Children’s tennis shoes sales were at $ 0.14B in 2021. The segment is expected to increase to $ 0.18B by 2031.

- Men’s tennis shoes’ CAGR of 3.5% between 2021 and 2031 is slower than the industry average (3.8%).

- Women’s tennis shoes are expected to grow slightly faster (4.1%) than the industry, explaining the growth in shares.

- Children’s tennis shoes post the lowest CAGR among all demographic groups - only 2.5% between 2021 and 2031.

|

Revenue (in $ million |

2021 |

2031 |

CAGR |

|

Male |

$1,252 |

$1,767 |

3.5% |

|

Female |

$1,108 |

$1,654 |

4.1% |

|

Child |

$140 |

$178 |

2.5% |

|

Total |

$2,500 |

$3,600 |

3.8% |

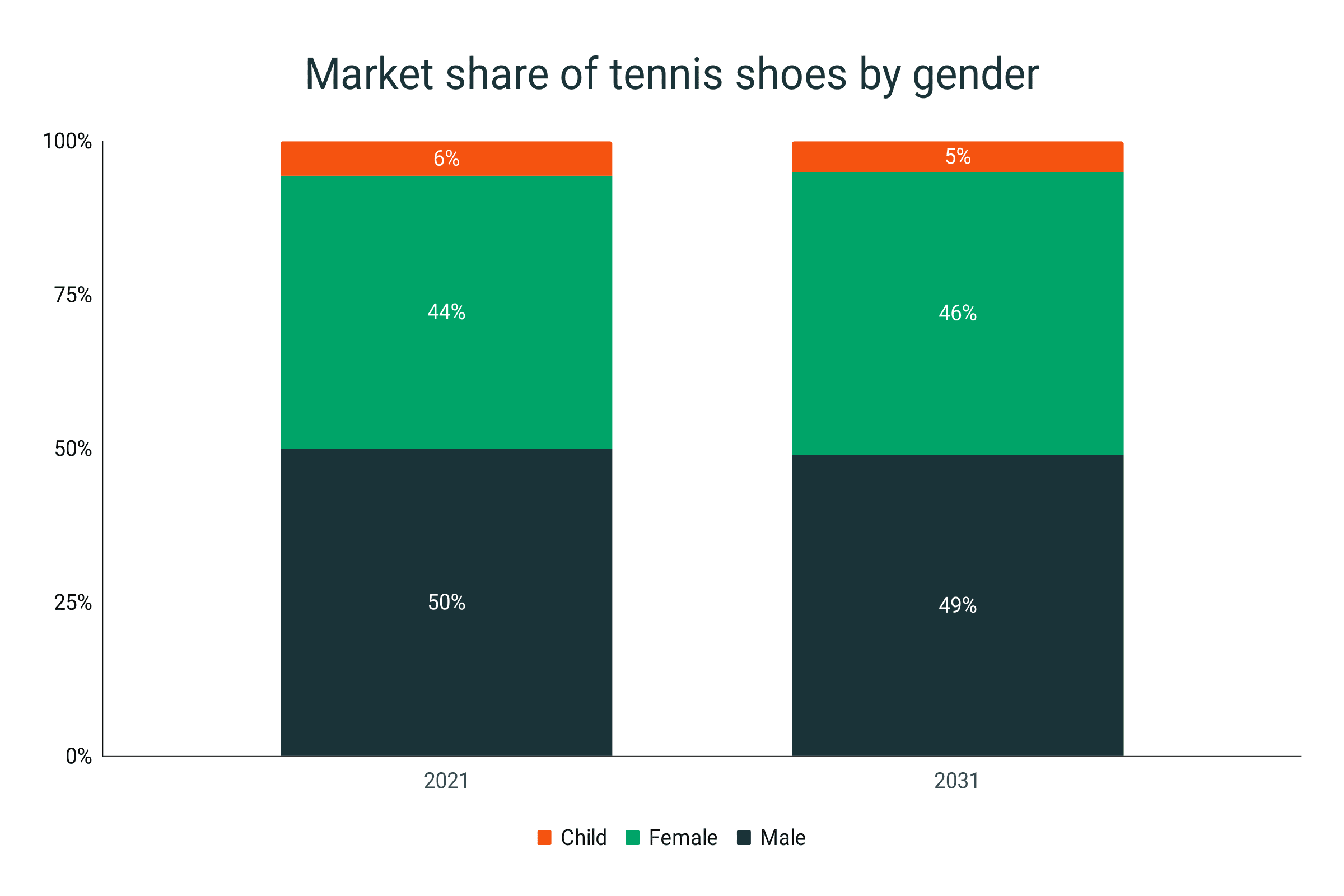

- Men’s tennis shoes are expected to retain share leadership throughout the period, losing only 1% of shares.

- The women’s category is a close second at 44% in 2021 and will inch closer to the men’s category, reaching 46% in 2031.

- Children’s tennis shoes, which provided 6% of the revenues in 2021, are expected to contribute a lower percentage of sales by 2031 (5%).

Market Share of Tennis Shoes by Demographic

|

Market Share |

2021 |

2031 |

|

Male |

50% |

49% |

|

Female |

44% |

46% |

|

Child |

6% |

5% |

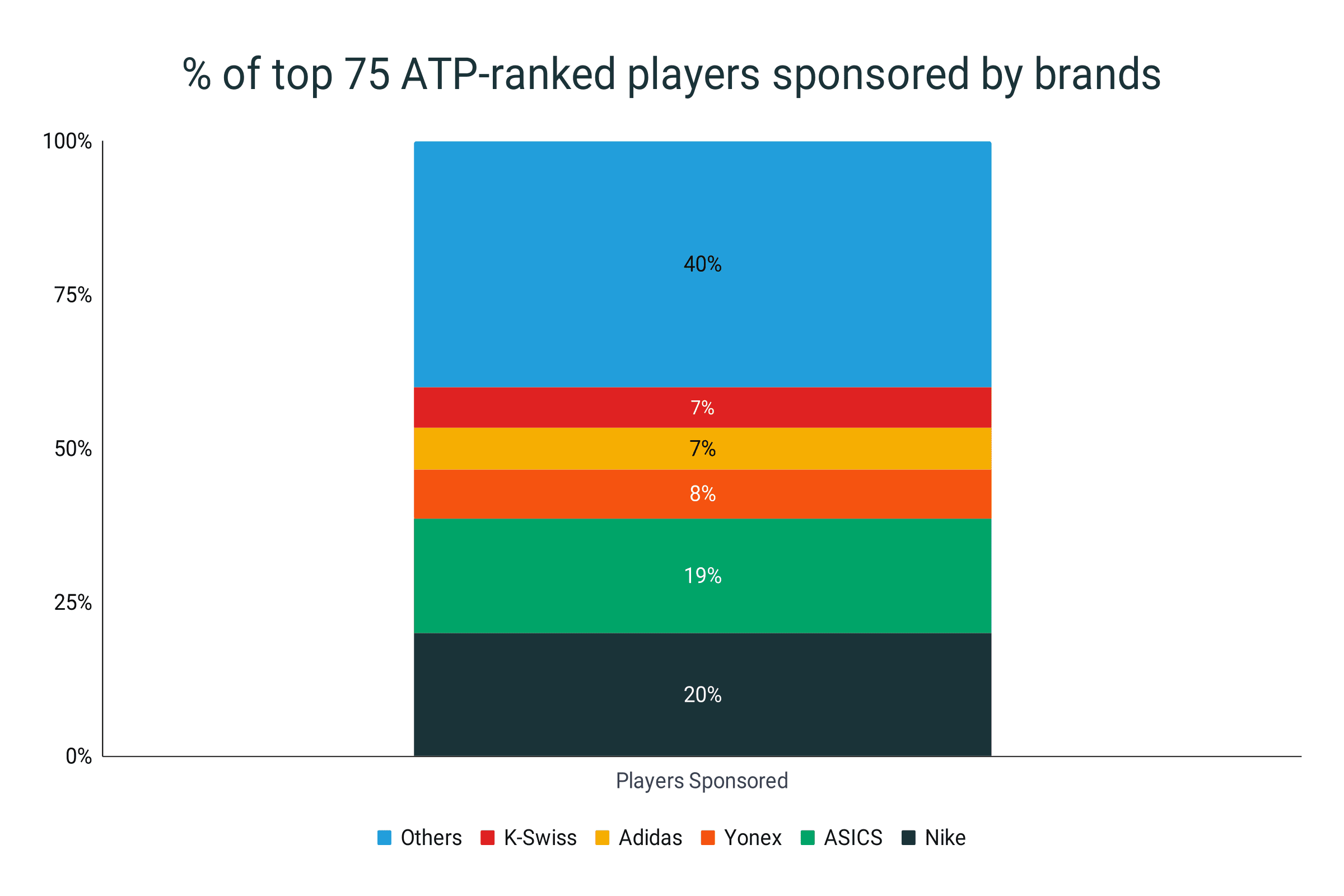

Top 75 ATP-ranked players and their shoe sponsors

- Nike sponsors the most Top 75 ATP-Ranked players versus other brands with 15

- Nike is able to sponsor 6 out of the top 10 ranked players

- ASICS is a close second, sponsoring 14 Top 75 ATP-Ranked Players

- There’s a steep drop in number of sponsorships of remaining brands with Yonex leading the way with 6 sponsored players, with Adidas, K-Swiss and Lotto each having 5.

- Other brands (Lacoste, Fila, New Balance, Joma, Diadora, Mizuno, Wilson, Le Coq Sportif, On, Under Armour, Head) have 3 or less signed players.

- Only 4 out of the top 75 ATP-ranked tennis players are either unsigned or don’t have disclosed shoe sponsors.

- Most commonly worn shoe line among the top 20 ATP-Ranked Players is the Nike Air Zoom Vapor Pro line, worn by 6 players (combined Vapor Pro and Vapor Pro 2).

- 3 of the top 20 ATP-Ranked players wear the Adidas Barricade.

- 2 of the top 20 ATP-Ranked players wear the ASICS Court FF line. The same goes for the Yonex Power Cushion Eclipsion line.

|

Brand |

Players Sponsored |

|

Nike |

15 |

|

ASICS |

14 |

|

Yonex |

6 |

|

Adidas |

5 |

|

K-Swiss |

5 |

|

Lotto |

5 |

|

Lacoste |

3 |

|

Fila |

3 |

|

New Balance |

2 |

|

Joma |

2 |

|

Diadora |

2 |

|

Mizuno |

2 |

|

Wilson |

2 |

|

Le Coq Sportif |

2 |

|

On |

1 |

|

Under Armour |

1 |

|

Head |

1 |

|

Undisclosed |

4 |

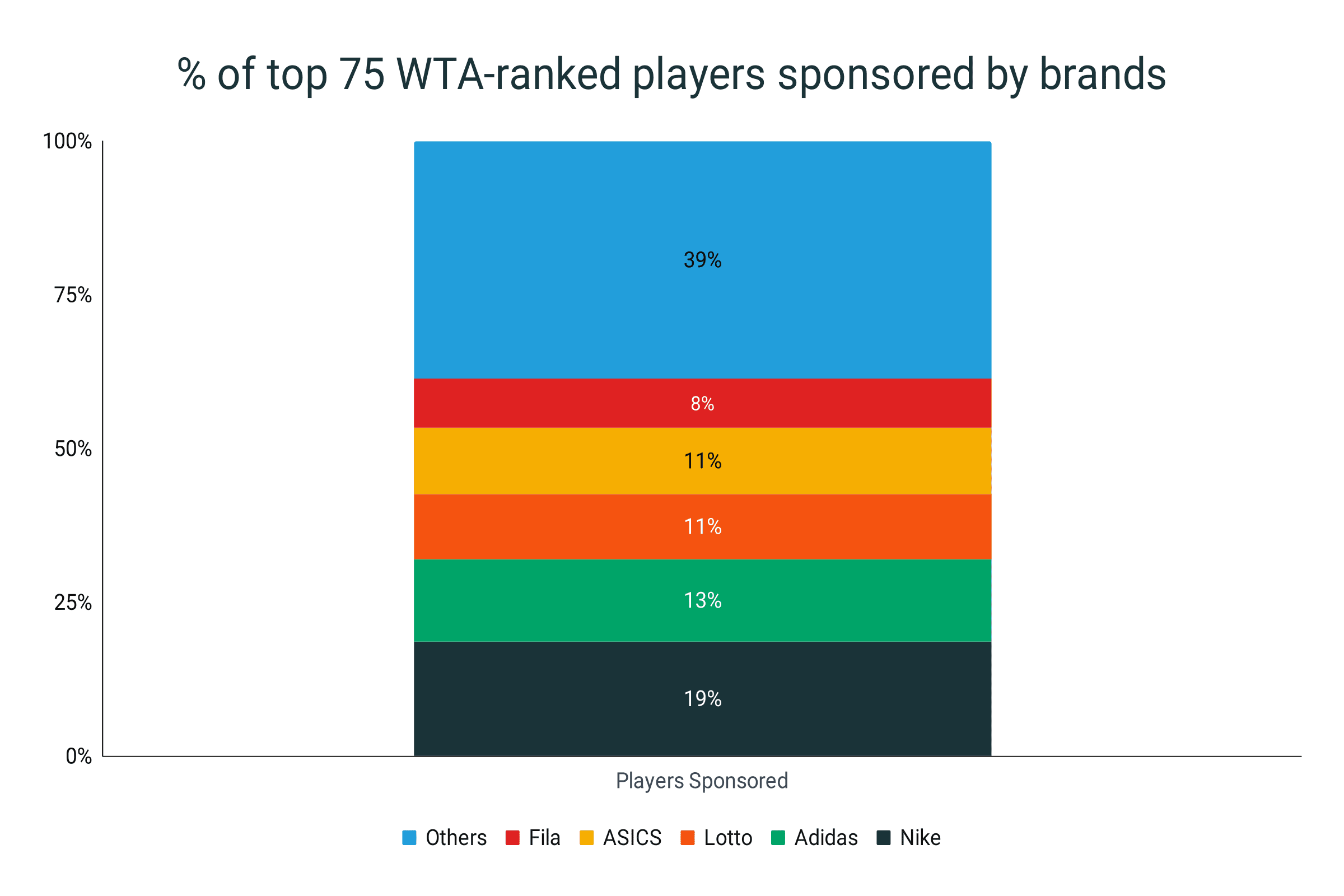

Top 75 WTA-ranked players and their shoe sponsors

- Nike has the most top 75 WTA-ranked players sponsored with 14.

- Adidas follows with 10 sponsored players.

- Lotto and ASICS follows with 8, while Fila has 6 sponsored players.

- Other brands (Joma, Wilson, K-Swiss, Yonex, New Balance, On, EA7, Mizuno, Diadora) have 4 or less sponsored players.

- 10 Top 75 WTA-ranked players are either unsigned or have not declared their shoe sponsors publicly.

- There’s no dominant brand in the top 10.

- The Adidas Barricade is the most commonly used shoe by the top 20 WTA-Ranked Players with 4 users.

- The Nike Air Zoom Pro line (inclusive of Pro and Pro 2) is used by 4 of the top 20 WTA-Ranked Players.

- The Adidas Avacourt and the ASICS Solution Speed FF 2 both have 2 players each from the top 20 WTA-ranked players.

|

Brand |

Players Sponsored |

|

Nike |

14 |

|

Adidas |

10 |

|

Lotto |

8 |

|

ASICS |

8 |

|

Fila |

6 |

|

Joma |

4 |

|

Wilson |

3 |

|

K-Swiss |

3 |

|

Yonex |

3 |

|

New Balance |

2 |

|

On |

1 |

|

EA7 |

1 |

|

Mizuno |

1 |

|

Diadora |

1 |

|

Undisclosed |

10 |

Tennis shoe facts

- Tennis shoes usually wear out after 45-60 hours of use, equivalent to about 1 shoe per year for those who play one hour per week.

- In a singles match, a tennis shoe runs for an average of 3 miles due to the width of the court.

- Grass-court tennis shoes usually have nubs that help grip the slippery court.

- Clay-court tennis shoes are usually mud-resistant, have high levels of lateral support, and grip well.

- Hard-court tennis shoes need sturdy outsoles because of the tough court.

- Tennis shoes were originally called plimsolls in 1892 - these became the prototype for sneakers.

- Keds is the oldest tennis shoe brand.