Sustainable Shoes Statistics

This is a comprehensive report with 40+ facts and figures about the growing sustainable footwear industry. The term “sustainable shoe” in today’s context, means that a product contains a percentage of material that is recycled, repurposed, or organically sourced. Also, the manufacturing practices contribute to gauging how sustainable a shoe is.

Top sustainable shoe statistics

- The sustainable footwear industry is projected to grow 6.8%, reaching $9.4 billion in 2023.

- By 2030, the sustainable shoe revenue is expected to reach $13.3 billion.

- Around 62.7% of all sustainable footwear products are non-athletic.

- 40% of all footwear tagged as sustainable was bought through specialty stores.

- Men’s shoes comprise 53.4% of all sustainable shoes manufactured. Women’s shoes account for 38.2% while the remaining 8.4% is for kids' shoes.

- 73% of GenZs are willing to buy sustainable shoe products. Meanwhile, only 42% of Baby Boomers are considering buying sustainable shoes.

- 330 million pairs of sustainable footwear are manufactured annually.

- The Footwear Distributors and Retailers of America (FEDRA), which is composed of 700 members, requires 20% minimum recycled content on leather and natural rubber on shoes.

- 64% of the American consumer population is willing to pay extra for sustainable shoes. Of this figure, 35% say a $1-5 premium is ideal.

Sustainable shoe revenue by year

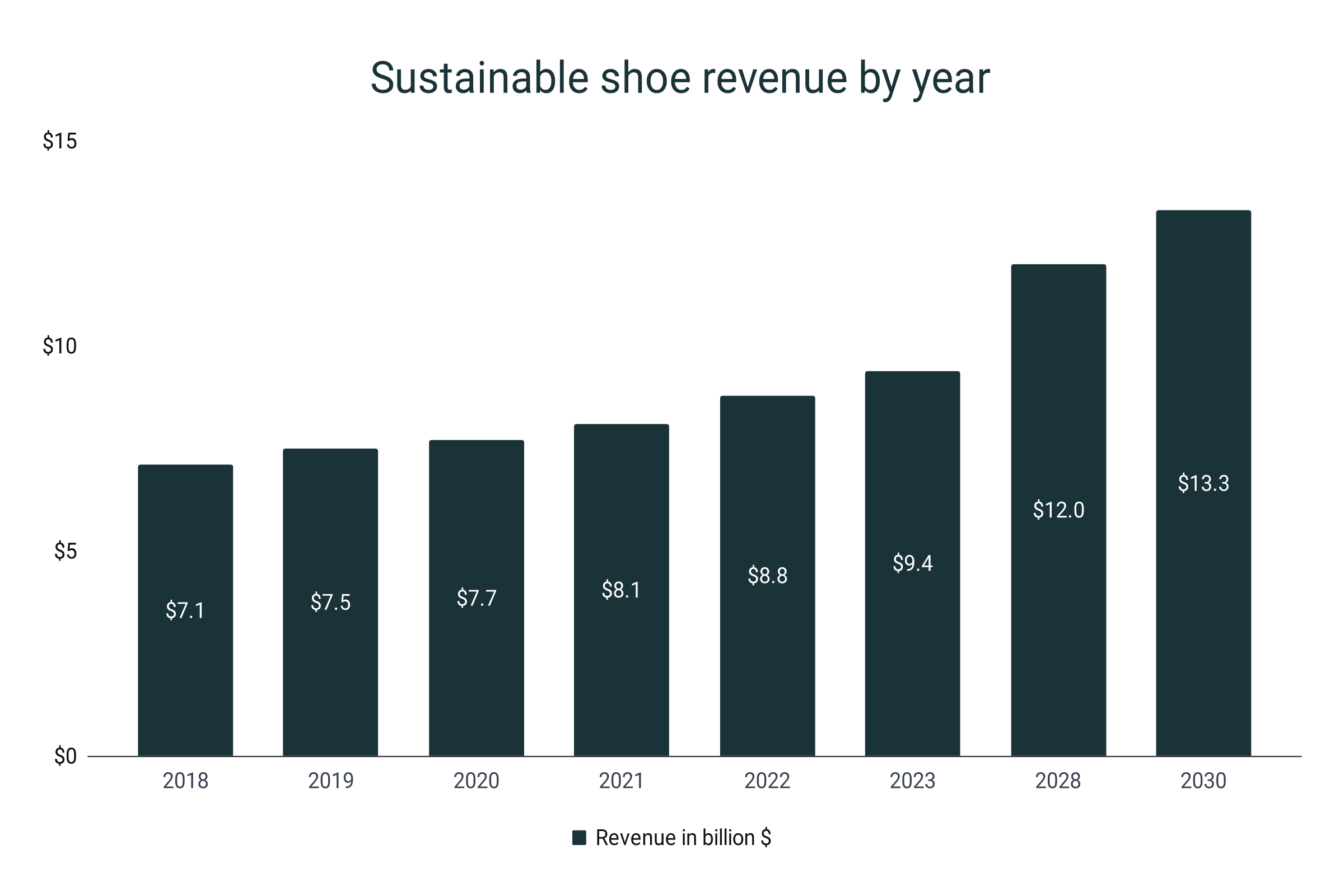

- By the end of 2023, the sustainable shoe market will have a total revenue of $9.4 billion.

- This is 6.8% better than the $8.8 billion figure in 2022.

- In 2021, the total revenue from sustainable shoes amounted to $8.1 billion.

- Compared to the $7.7 billion figure in 2020, the revenue of sustainable footwear has experienced a 5.2% year-on-year growth.

- Back in 2018, the sustainable footwear segment tallied $7.1 billion in revenue.

- Overall, from 2018 to 2021, the sustainable shoe segment has grown by 14.1%.

- By 2028, estimates say that the revenue from sustainable footwear will reach $12 billion, with a compound annual growth rate (CAGR) of 6.1% from 2021 to 2028.

- Furthermore, it is predicted to generate $13.3 billion by 2030, following a CAGR of 5.7% from 2021 to 2030.

Sustainable shoe revenue by year

|

Year |

Revenue in billion $ |

Growth |

|

2018 |

7.1 |

|

|

2019 |

7.5 |

5.6% |

|

2020 |

7.7 |

2.7% |

|

2021 |

8.1 |

5.2% |

|

2022 |

8.8 |

8.6% |

|

2023 |

9.4 |

6.8% |

|

2028* |

12.0 |

48.1% |

|

2030* |

13.3 |

10.8% |

*Projection

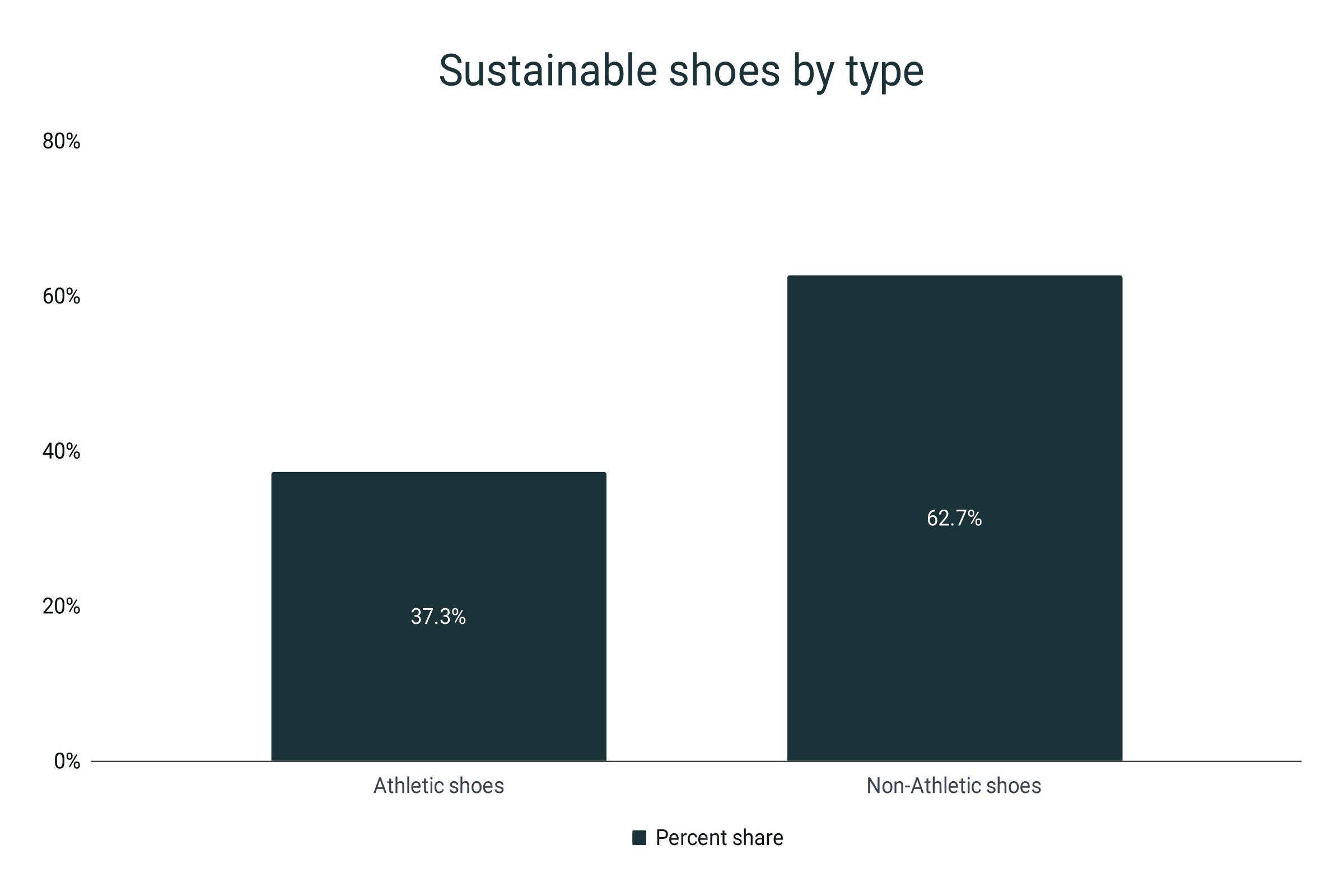

Sustainable shoe market by type

- In 2022, sports shoes tagged as sustainable generated $3.3 billion in revenues.

- 37.3% of all sustainable shoes produced in 2022 were comprised of athletic footwear models

- Meanwhile, the remaining 62.7% of all sustainable shoes are non-athletic.

- By 2030, the revenue from non-athletic sustainable shoes will reach $8.3 billion.

Sustainable shoes by type in 2022

|

Type |

Percent share |

|

Athletic shoes |

37.3% |

|

Non-Athletic shoes |

62.7% |

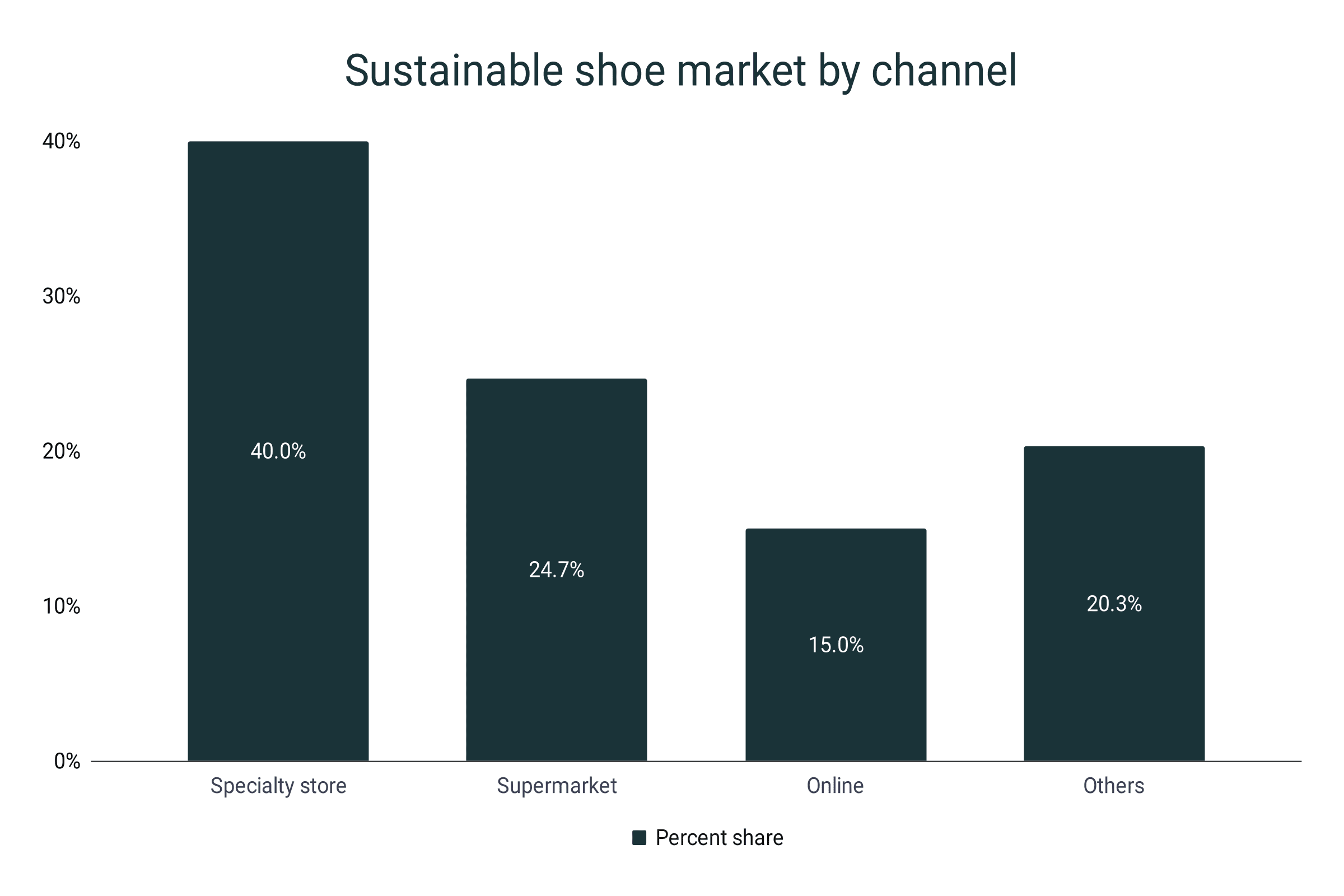

Sustainable shoe market by channel

- 40% of all sustainable shoes are bought through specialty stores.

- Supermarket is the second biggest channel contributing 24.7% of all sustainable footwear sold.

- Meanwhile, online-bought sustainable shoes accounted for 15%.

- The remaining 20.3% is attributed to other channels including local stores and outlets.

Sustainable shoe market by channel

|

Channel |

Percent share |

|

Specialty store |

40% |

|

Supermarket |

24.7% |

|

Online |

15% |

|

Others |

20.3% |

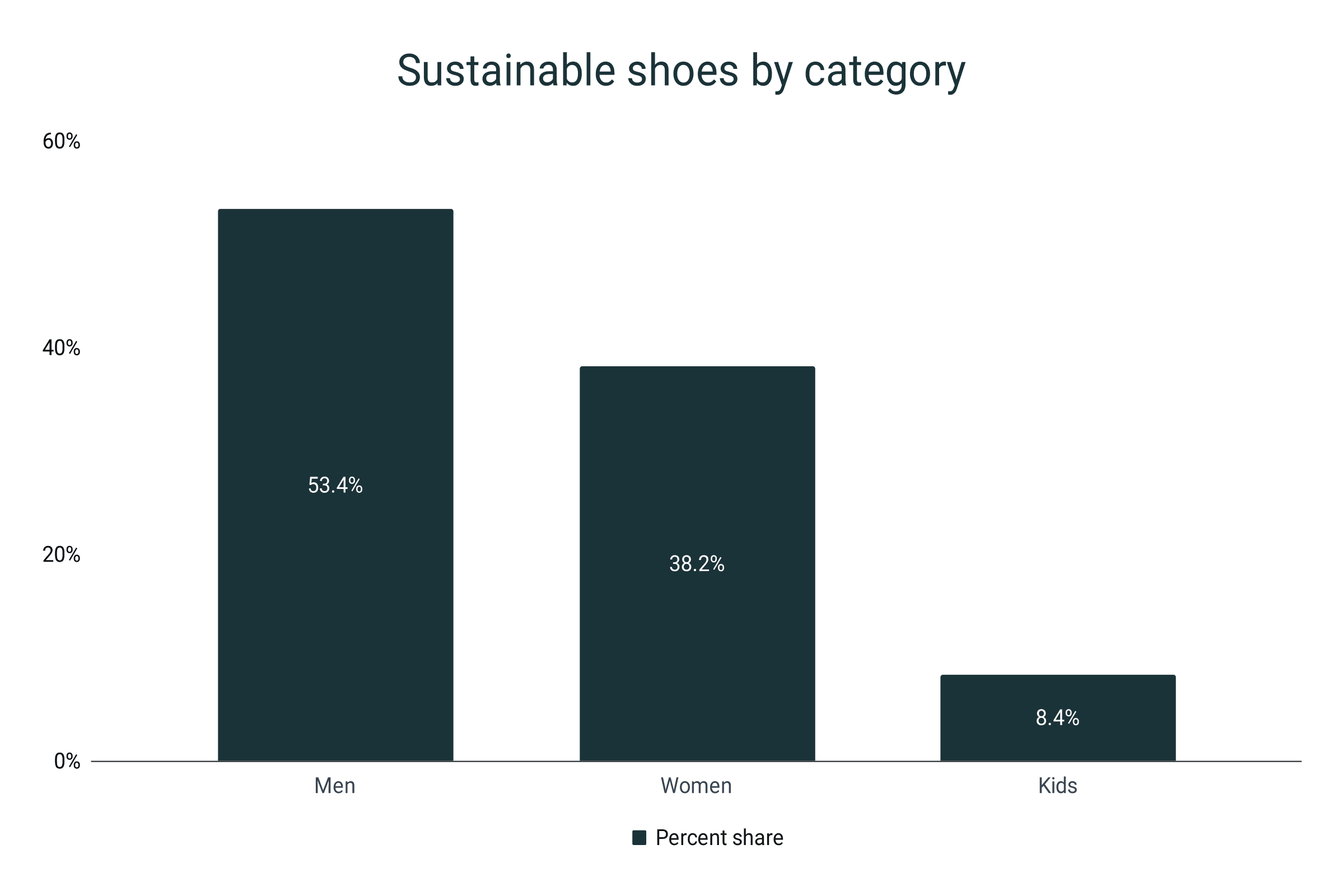

Sustainable shoe market by category

- Meanwhile, 53.4% of sustainable footwear manufactured annually are men’s shoes.

- Meaning, by the end of 2023, men’s sustainable footwear segment will be valued at around $5 billion.

- 38.2% of all sustainable shoes are women’s shoes while 8.4% are for kids.

Sustainable shoes by category

|

Category |

Percent share |

|

Men |

53.4% |

|

Women |

38.2% |

|

Kids |

8.4% |

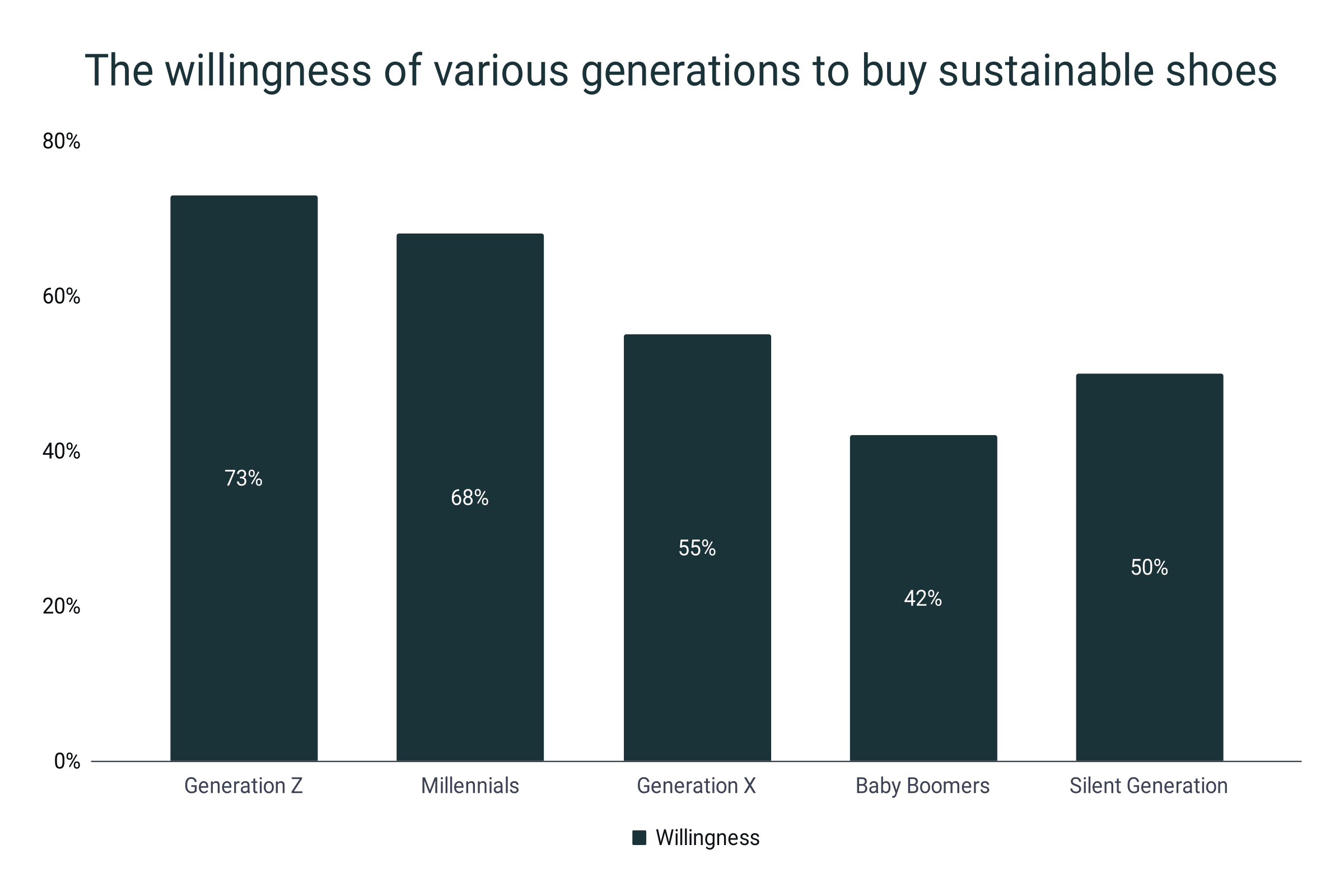

Sustainable shoe market by age

- Gen Zs were found to be most willing to consume sustainable footwear products. About 73% of those born from 1995-2012 expressed willingness.

- 68% of millennials, people born from 1980-1994, are inclined to buy sustainable shoes.

- On the other hand, 55% of Gen X (1965-1979) while 50% of the Silent Gen (1925-1945) are keen on purchasing shoes tagged as sustainable.

- Baby Boomers (1946-1964) are the least enthusiastic about buying sustainable footwear. Only 42% expressed willingness to buy them.

The willingness of various generations to buy sustainable shoes

|

Generation |

Willingness |

|

Generation Z |

73% |

|

Millennials |

68% |

|

Generation X |

55% |

|

Baby Boomers |

42% |

|

Silent Generation |

50% |

Sustainable shoe production

- Approximately 330 million pairs of sustainable shoes are manufactured annually and is expected to grow in the coming years.

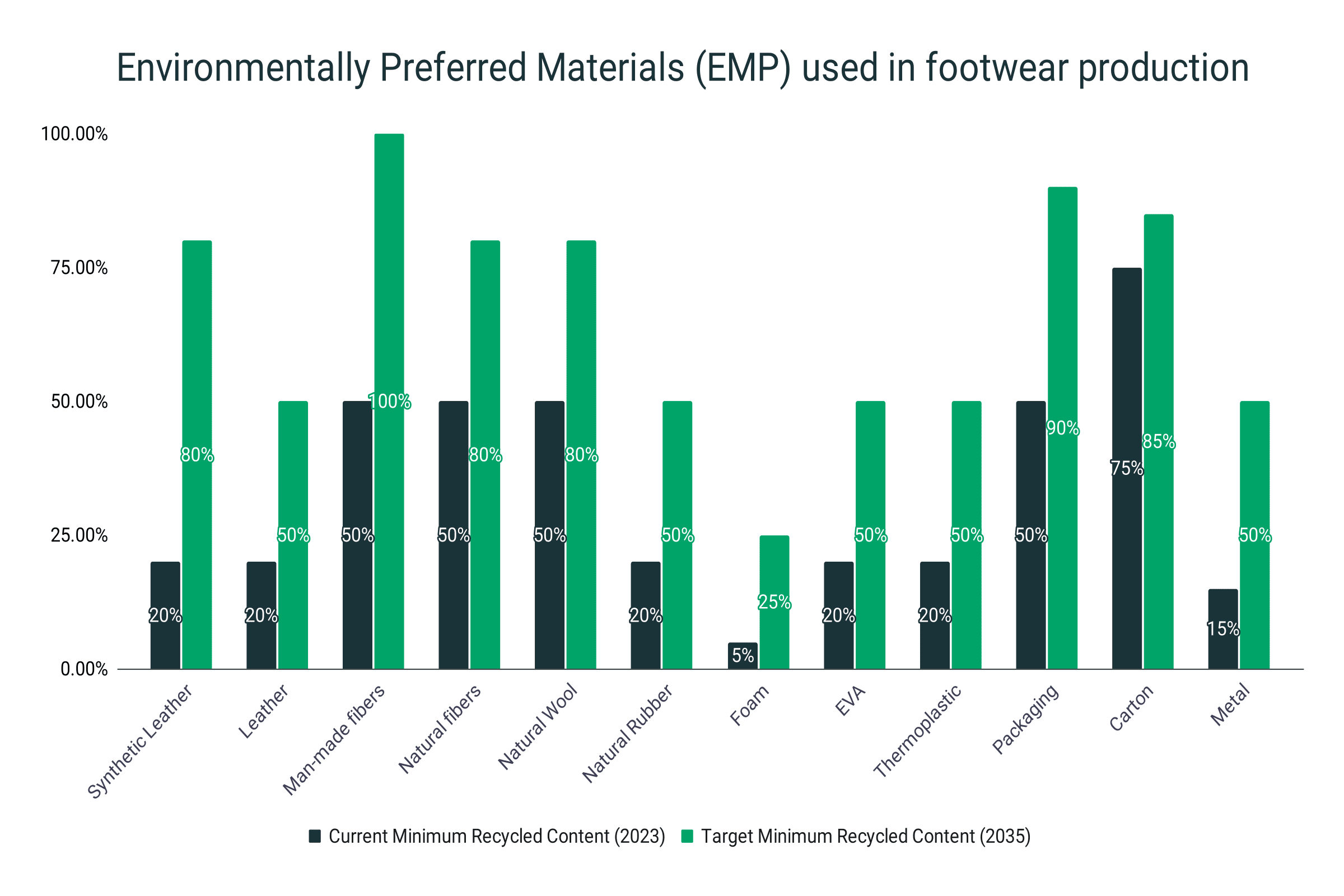

- Over 700 brands and retailers are members of the Footwear Distributors and Retailers of America (FEDRA), which is an organization that promotes a standard for Environmentally Preferred Materials (EMP) on shoes.

- Based on the EMP standards of FEDRA, a minimum of 20% recycled content should be observed in using synthetic leather.

- By 2035, the target is 80% recycled content in PU or synthetic leather.

- For leather, the current minimum is 20%.

- The standard would be at least 50% recycled leather content by 2035.

- For foam, as of 2023, only 5% recycled content is needed. The minimum will be raised to 25% by the end of 2035.

- FEDRA also targets to increase the recycled content in shoe packaging from 50% in 2023 to 90% by 2035.

- In cartons, the 75% minimum recycled content will be raised to 85% in 2035.

- In 2023, Saucony released its Triumph RFG which is composed of a midsole that is 55% corn-based and an outsole that is 80% natural rubber.

Environmentally Preferred Materials (EMP) used in footwear production

|

Material |

Current Minimum Recycled Content (2023) |

Target Minimum Recycled Content (2035) |

|

Synthetic Leather (PU) |

20% |

80% |

|

Leather |

20% |

50% |

|

Man-made fibers (Polyester, Nylon, Spandex, etc.) |

50% |

100% |

|

Natural fibers (cotton, hemp, jute, linen) |

50% |

80% |

|

Natural Wool |

50% |

80% |

|

Natural Rubber |

20% |

50% |

|

Foam |

5% |

25% |

|

EVA |

20% |

50% |

|

Thermoplastic (BPU, TPU, PP, TPR, Synthetic Rubber) |

20% |

50% |

|

Packaging (Paper and plastic) |

50% |

90% |

|

Carton (Corrugated/Shoebox) |

75% |

85% |

|

Metal |

15% |

50% |

Sustainable shoe consumption trends

- 23% of shoe consumers in the US say that the sustainable aspect of shoes is extremely important.

- On the other hand, 15% say sustainability on footwear is not an important consideration when buying shoes.

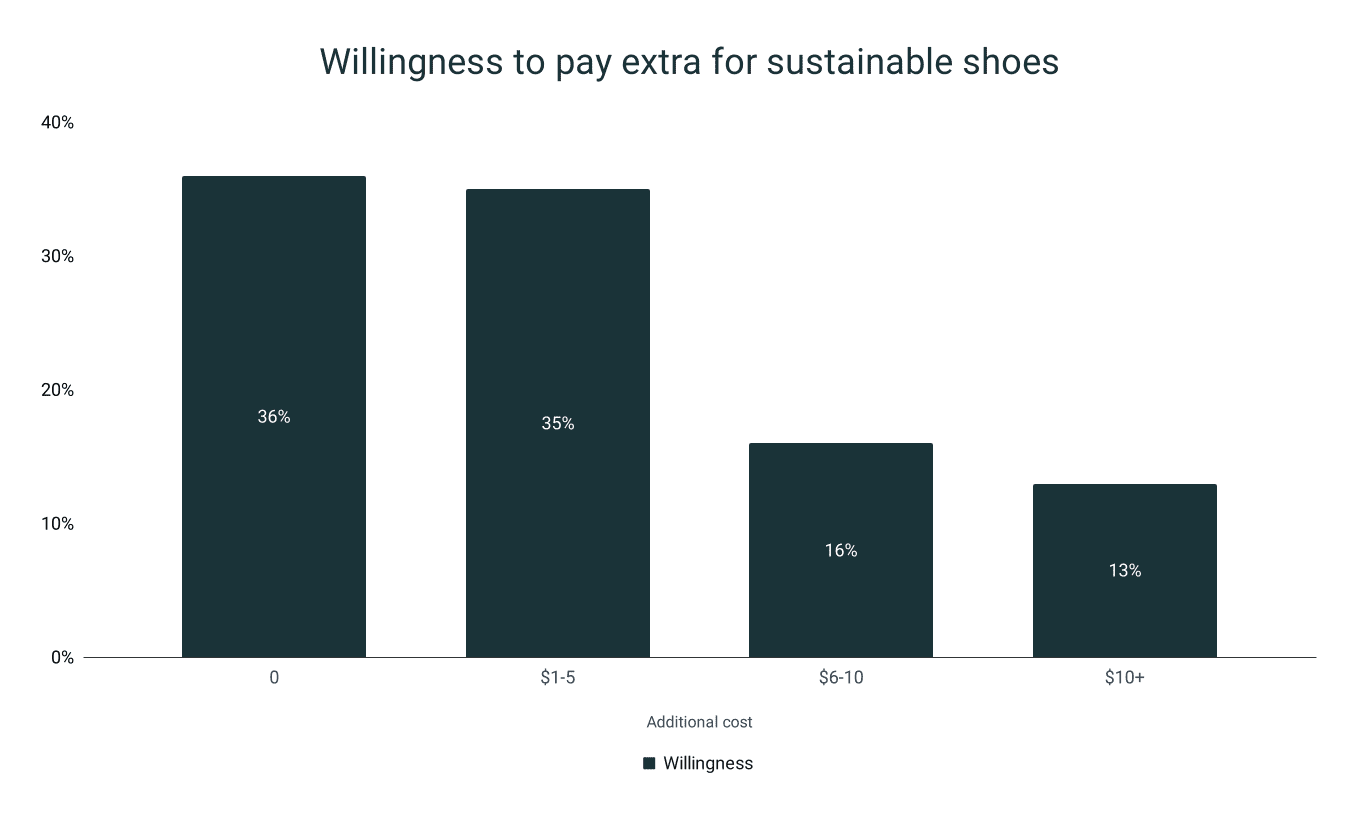

- 64% of consumers say they are willing to pay more when buying sustainable shoes.

- Meanwhile, 36% are not keen on paying additional.

- 35% say they are fine with paying $1-5 extra for sustainable footwear products.

- About 16% are willing to pay $6-10.

- Additionally, 13% of Americans are willing to pay $10 or more when buying sustainable shoes.

Willingness to pay extra for sustainable shoes

|

Additional cost |

Willingness |

|

0 |

36% |

|

$1-5 |

35% |

|

$6-10 |

16% |

|

$10+ |

13% |