Online Shoe Sales Statistics

Top online shoe sales statistics

- Worldwide online shoe sales are valued at $113.04 billion as of 2023.

- At a 6.8% CAGR, these numbers are forecasted to reach $157.06 billion by the end of 2028.

- As of 2023, shoe sales via e-commerce take up about a third of the footwear market.

- Physical share in the same year takes 68.8% of the market.

- Mobile devices are the preferred means to purchase shoes online as of 2023, taking up a 58.8% share of the market.

- Desktop computers are responsible for 41.2% of online shoe revenue in the same year.

- Among footwear types, leather shoes have a big presence in online shoe sales, generating 69.37 billion as of 2023.

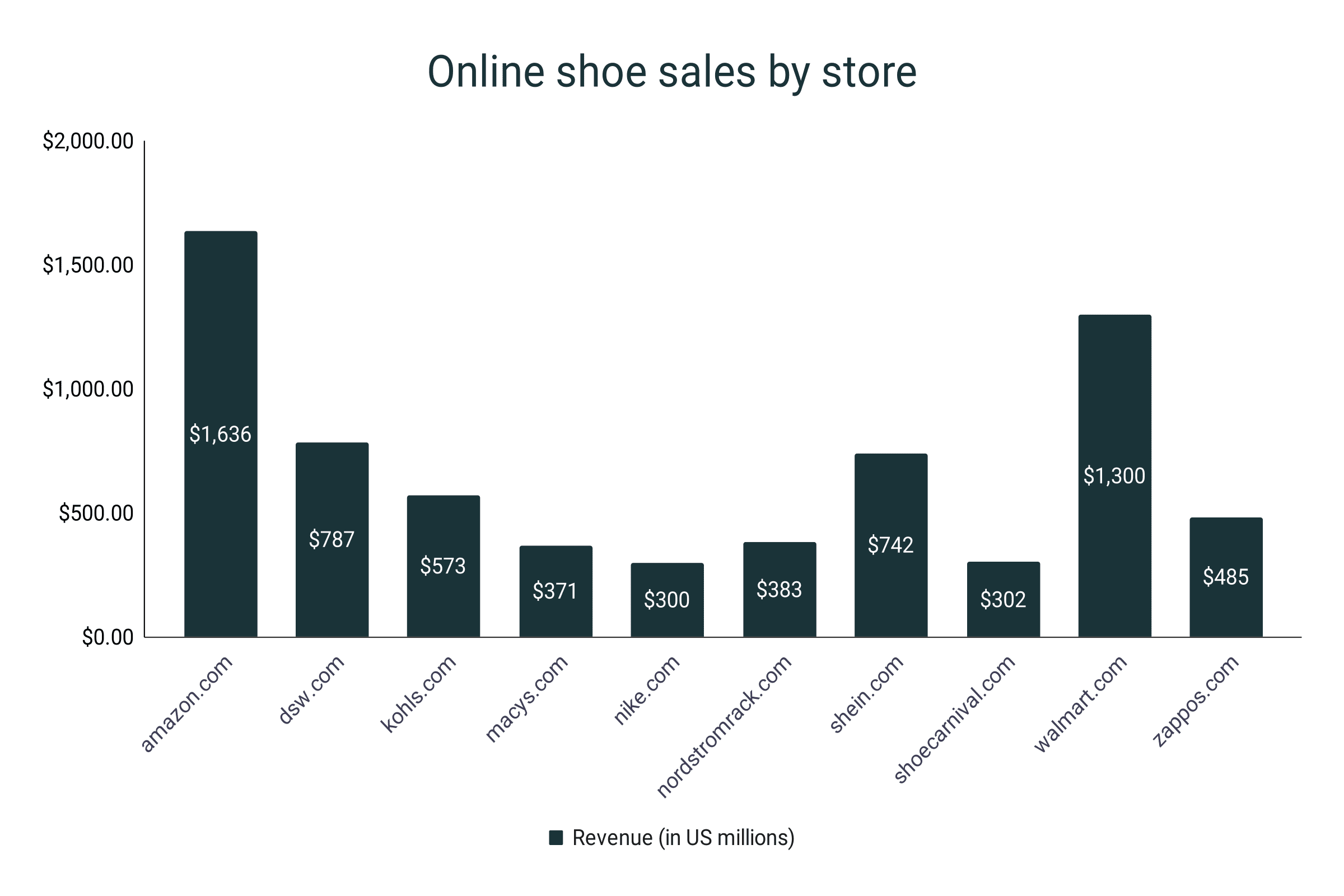

- Based on 2021 data, amazon.com and walmart.com dominated in online footwear revenue, with the former netting $1,636 million in sales.

- Roughly 63% of consumers look forward to doing their shoe footwear shopping online during the 2023 holidays.

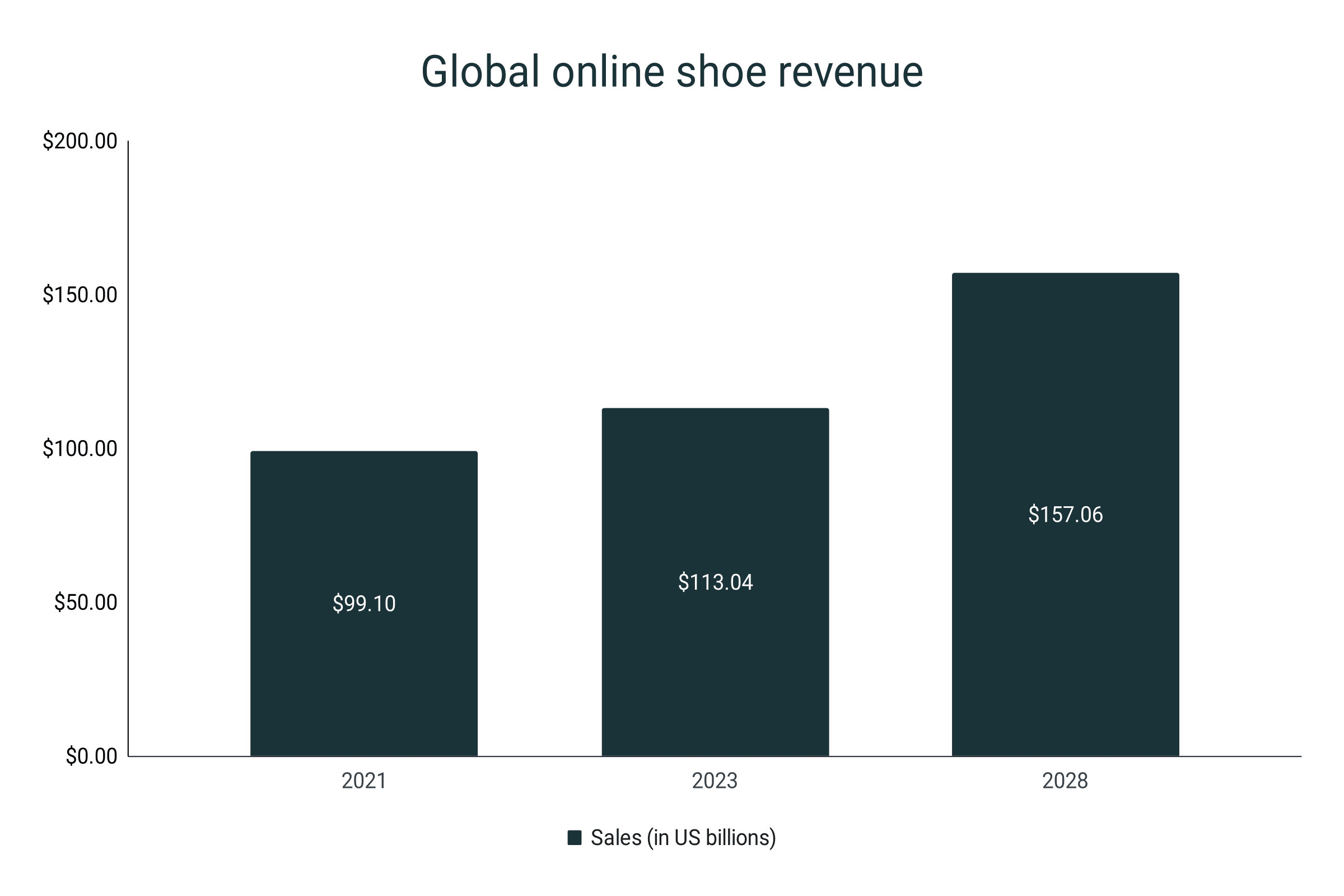

Global online shoe revenue

- As of 2023, global online shoe sales sit at $113.04 billion.

- These numbers are forecasted to grow at a CAGR of 6.8% until 2028.

- By the end of the projected period (2022-2028), shoe sales through e-commerce are expected to reach a total of $157.06 billion.

- The estimated 2028 revenue is roughly a 39% sales growth from the 2023 numbers.

- Worldwide online shoe sales back in 2021 almost broke the 100-billion mark at $99.1 billion.

|

Year |

Total revenue (in US billions) |

|

2021 |

$99.1 |

|

2023 |

$113.04 |

|

2028 |

$157.06 |

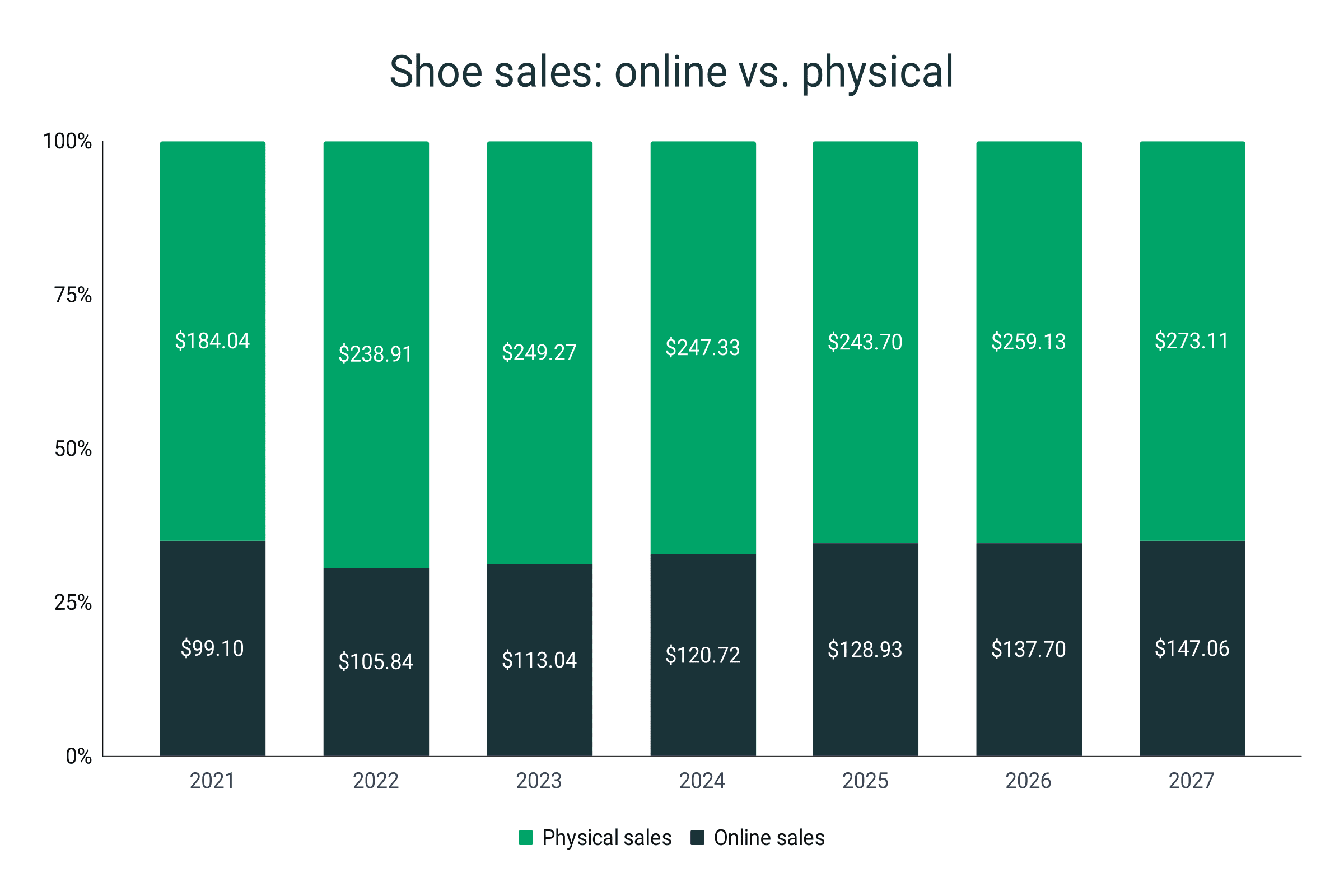

Online shoe sales vs. physical sales

- 31.2% of the 2023 footwear market share belongs to online sales, while physical retail takes 68.8%.

- This means that, as of 2023, physical shoe sales sit at $249.27 billion.

- By 2027, the online shoe market is anticipated to increase to 35%, taking 3.8% from physical retail based on 2023 numbers.

- Back in 2021, online and physical shares were at 35% and 65%, respectively.

- Worldwide footwear sales in the same year reached $283.14 billion, with offline revenue making up $184.04 billion of it.

|

Year |

Online sales (in US billions) |

Physical sales (in US billions) |

|

2021 |

$99.10 |

$184.04 |

|

2022 |

$105.84 |

$238.91 |

|

2023 |

$113.04 |

$249.27 |

|

2024 |

$120.72 |

$247.33 |

|

2025 |

$128.93 |

$243.70 |

|

2026 |

$137.70 |

$259.13 |

|

2027 |

$147.06 |

$273.11 |

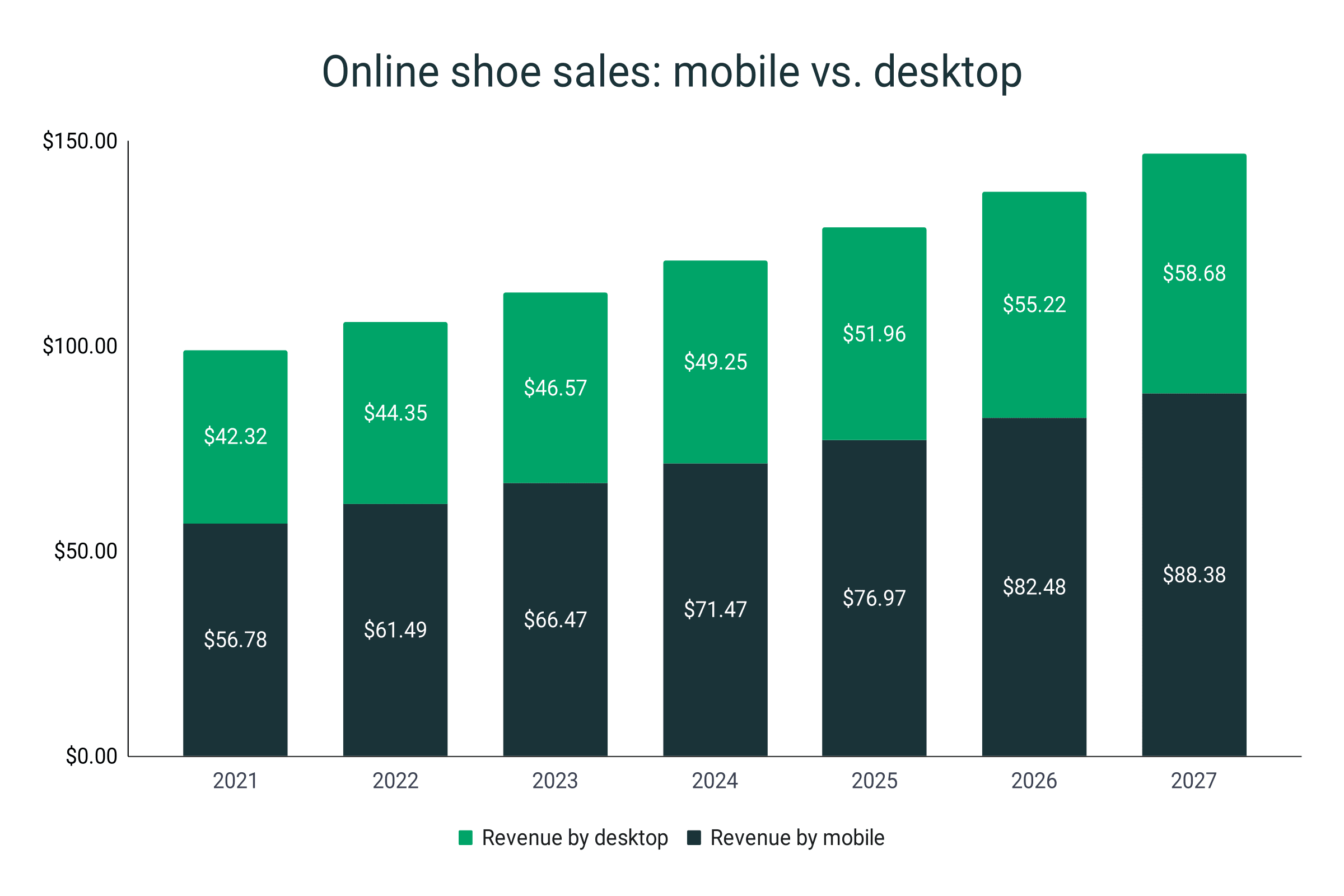

Global footwear e-commerce sales by device

- 58.8% of online shoe sales are expected to be generated via mobile devices as of 2023.

- This percentage is equivalent to $66.47 billion.

- On the other hand, 41.2% of online shoe revenue is expected to be earned through desktop computers, which amounts to $46.57 billion.

- By the end of the 2017-2027 prediction period, sales of shoes by mobile are anticipated to reach $88.38 billion or 60.1% of the market share.

- In the same forecasted year, footwear revenue via desktop is estimated to take 39.9% of the market share or $58.68 billion in sales.

- That’s a 1.3% desktop share drop from the 2023 percentage.

|

Year |

Sales by mobile (in US billions) |

Sales by desktop (in US billions) |

|

2021 |

$56.78 |

$42.32 |

|

2022 |

$61.49 |

$44.35 |

|

2023 |

$66.47 |

$46.57 |

|

2024 |

$71.47 |

$49.25 |

|

2025 |

$76.97 |

$51.96 |

|

2026 |

$82.48 |

$55.22 |

|

2027 |

$88.38 |

$58.68 |

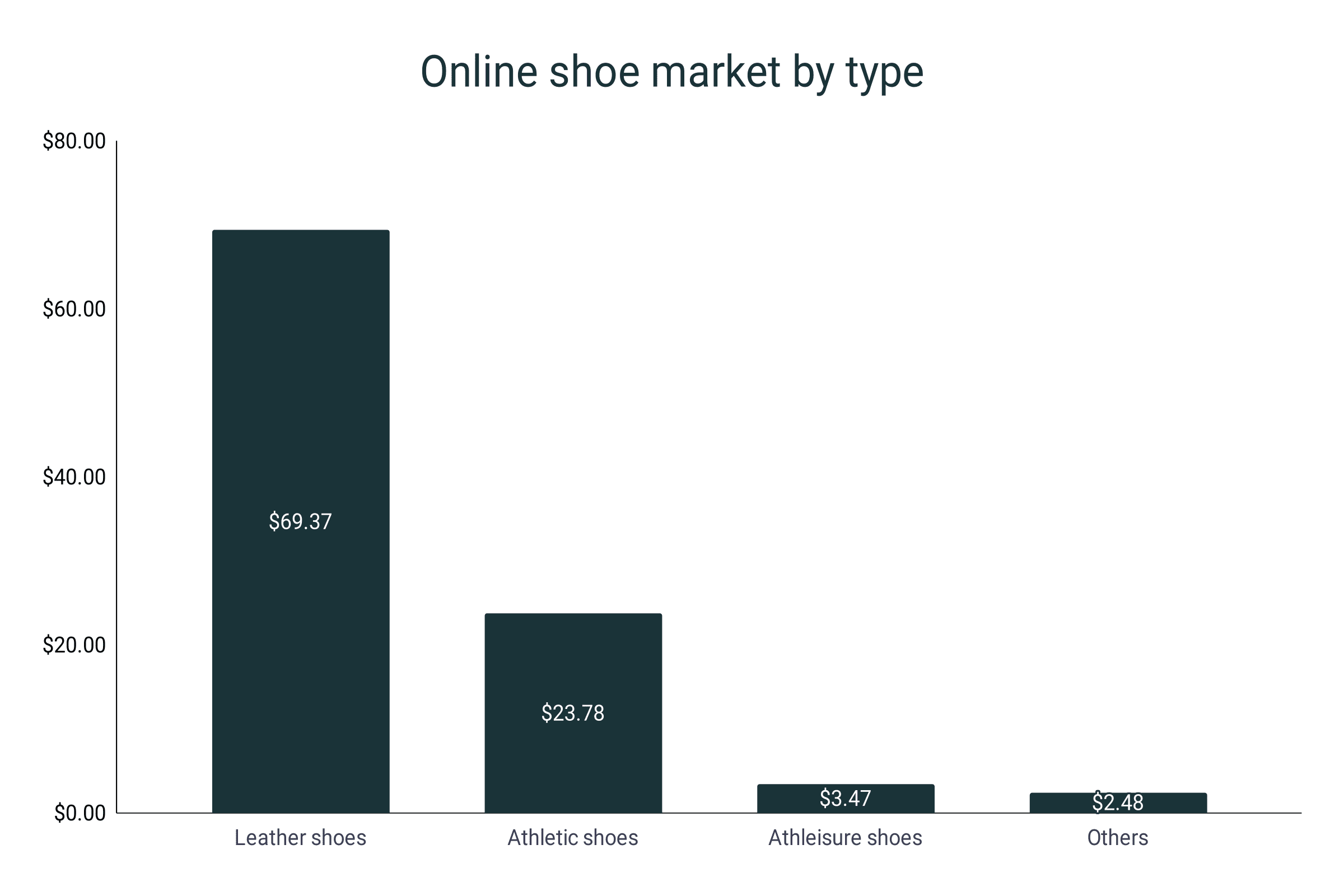

Online shoe market by type

- As of 2021, leather shoes bought online had a market share of 70%, bagging sales of $69.37 billion.

- Roughly 24% went to athletic footwear, with online revenue reaching $23.78 billion.

- In the same year, athleisure shoes generated $3.47 billion in revenue.

- This figure netted the type 3.5% market share.

- Other footwear types made up the remaining 2.5% market share, reaching e-commerce sales of $2.48 billion.

|

Footwear type |

Sales (in US billions) |

|

Leather shoes |

$69.37 |

|

Athletic shoes |

$23.78 |

|

Athleisure shoes |

$3.47 |

|

Others |

$2.48 |

E-commerce footwear sales by online store

- Amazon.com led in this segment as of 2021 with net sales of $1,636 million.

- This figure was about 1.6% of the global online shoe sales in the same year.

- $1,300 million worth of revenue was secured by walmart.com in the same year.

- In third place was dsw.com with $787 million.

- Zappos.com couldn’t break the half-a-billion mark, ending up with online shoe sales of only $485 million.

- Nike.com came in last with $300 million in online footwear revenue.

|

Online store |

Revenue (in US millions) |

|

amazon.com |

$1,636 |

|

dsw.com |

$787 |

|

kohls.com |

$573 |

|

macys.com |

$371 |

|

nike.com |

$300 |

|

nordstromrack.com |

$383 |

|

shein.com |

$742 |

|

shoecarnival.com |

$302 |

|

walmart.com |

$1,300 |

|

zappos.com |

$485 |

Online shoe buying intent and confidence stats

- As of 2023, 63% of shoppers expect to buy footwear online in the coming holiday season.

- 30% of consumers are willing to purchase more than one pair of shoes through e-commerce, with all of them intending to return shoes that don’t give an exact fit.

- About 20% of purchasers aren’t very confident with the fit of the shoes they buy online.

- 57% of online shoppers experienced having to return ill-fitting shoes

- Roughly 10% of footwear buyers are quite confident with the fit of the shoes they purchase online.

- Over 80% of shoppers would be emboldened to buy footwear via e-commerce if they had access to a technology that can give them pin-point fit accuracy.

Sources

E-commerce Footwear Market Size | Global Report, 2028 (grandviewresearch.com)

Global footwear e-commerce sales distribution by device 2027 | Statista

Top Footwear online stores United States 2021 | Statista

Footwear - Worldwide | Statista Market Forecast

Research Shows More Shoppers Buying Footwear Online – WWD