Fitness Industry Statistics 2021-2028 [Market Research]

The fitness industry is poised for incredible growth post-pandemic, with fitness trends undergoing a seismic shift away from gyms and towards outdoors, home fitness, and digital options. Although each segment in the industry is looking to provide consumers the benefits of exercise, they are in direct competition with one another to stand out as the best option.

The fitness industry is poised for incredible growth post-pandemic, with fitness trends undergoing a seismic shift away from gyms and towards outdoors, home fitness, and digital options. Although each segment in the industry is looking to provide consumers the benefits of exercise, they are in direct competition with one another to stand out as the best option.

To better understand the current state of the fitness industry and the future of fitness, we researched and analysed hundreds of studies on each individual segment and compiled them into an overview of 15+ fitness industry statistics.

Top Fitness Industry Statistics 2021

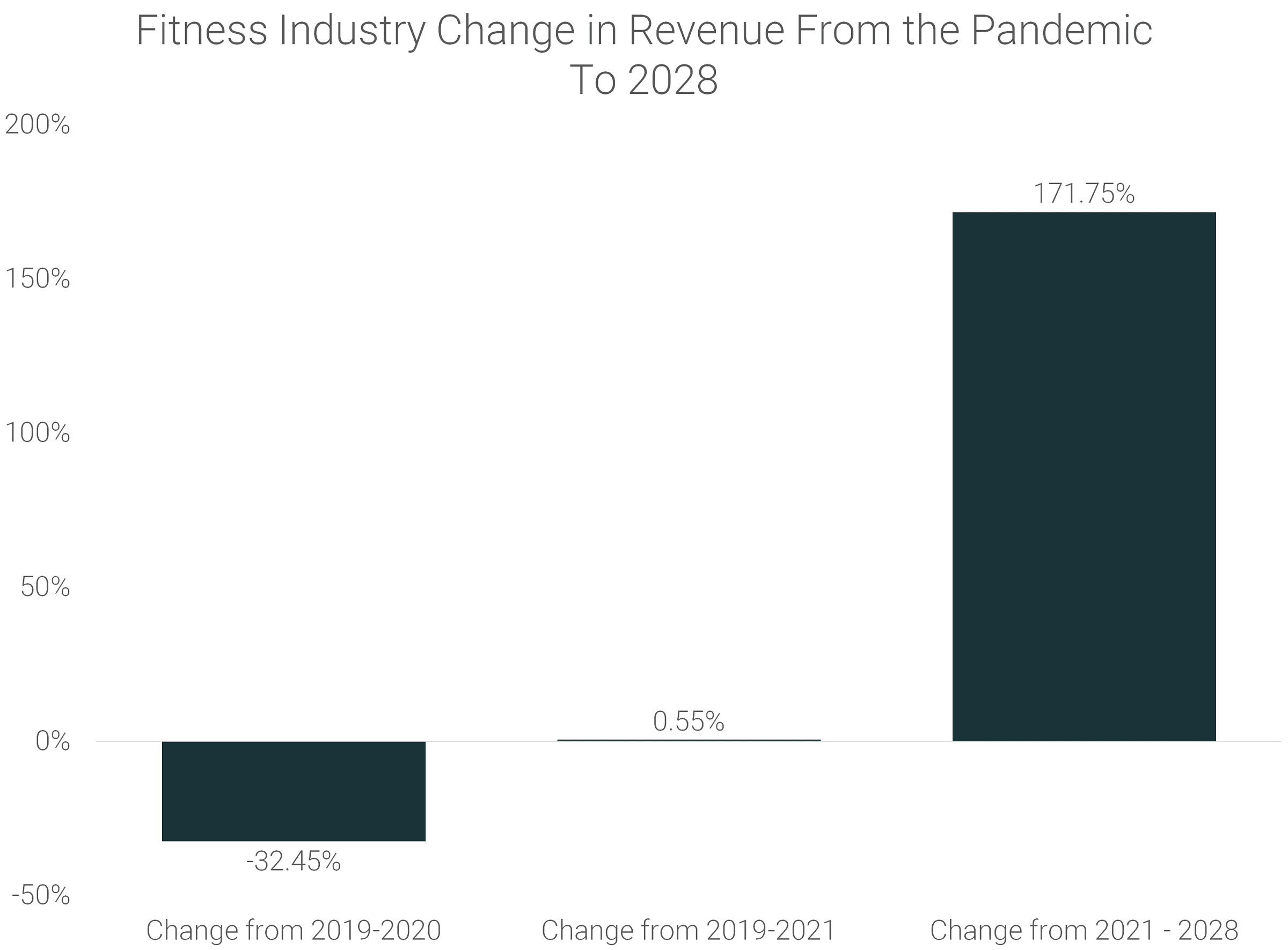

- The fitness industry experienced a 32.45% decline in revenue during 2020 but is projected to rebound to 0.55% pre-pandemic levels by the end of 2021

- Worth nearly 160 billion in 2021, the fitness industry is expected to grow 171.75% to 434.74 billion USD by 2028

- The industries hit the hardest by the pandemic were the gym, health club, and boutique fitness studio industries

- They declined up to 58.30% in the first year of the pandemic

- In 2021, they are projected to still be down 22.5% from their pre-pandemic revenue levels in 2019

- Meanwhile, online/digital fitness, fitness apps, fitness equipment, and fitness tracker markets all experienced significant growth due to the pandemic

- Experiencing a revenue growth of 40.61% in 2020

- Projected to be up 66.32% by the end of 2021, in comparison to their pre-pandemic levels

- From 2021 to 2028, the online/digital fitness industry is projected to have the highest growth rate of 33.10% per year

- The industry with the lowest compound annual growth rate (CAGR) is the gym industry, growing at a rate of 7.21% per year

The research and data provided come from hundreds of hours spent researching and analysing data on the different segments within the fitness industry. Specifically, the data is referencing research from:

- 77 Gym Membership Statistics, Facts, and Trends [2020/2021]

- 200+ Gym Industry Statistics 2021 [Global Analysis]

- 45+ Boutique Fitness Statistics 2021 [Research Review]

- 90+ Fitness Equipment Statistics 2021/2022 [Research Review]

- 40+ Online Fitness Statistics for 2021/2022 [Research Review]

- 100+ Fitness App Statistics 2021/2022 [Research Review]

- 50+ Wearable Fitness Tracker Statistics 2021

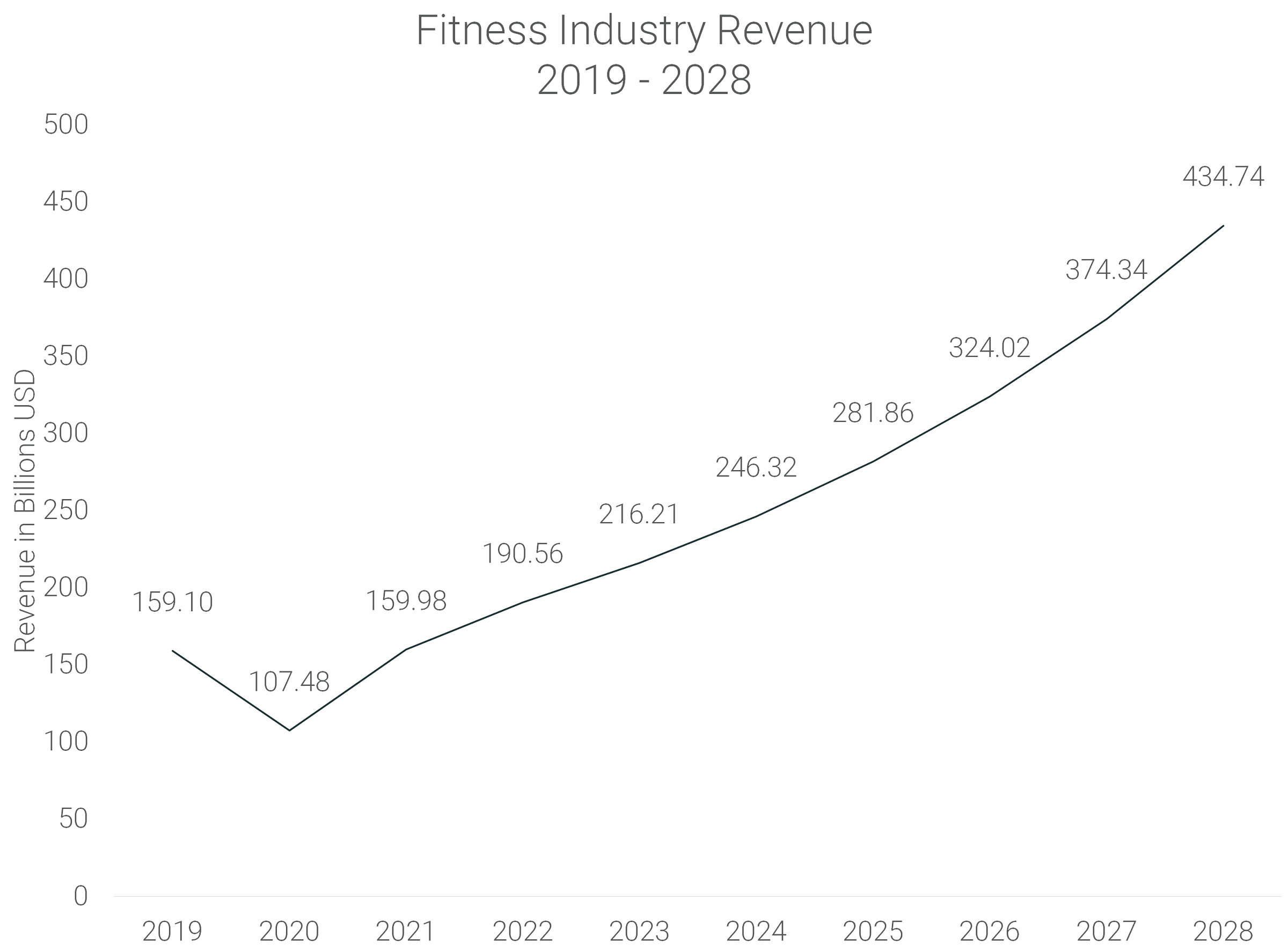

Fitness industry revenue: 2019 - 2028

As of 2019, the Fitness Industry was worth approximately 159.10 billion, hitting a peak before experiencing a 32.45% decline in 2020.

It is projected that the industry will rebound to its pre-pandemic levels by the end of 2021, to an approximate revenue of 159.98 billion USD, and continue growing to 190.56 billion in 2022.

Projections estimate that the industry will reach a revenue of 434.74 billion by 2028, growing 171.75% from 2021.

Pandemics impact on segments of the fitness industry market

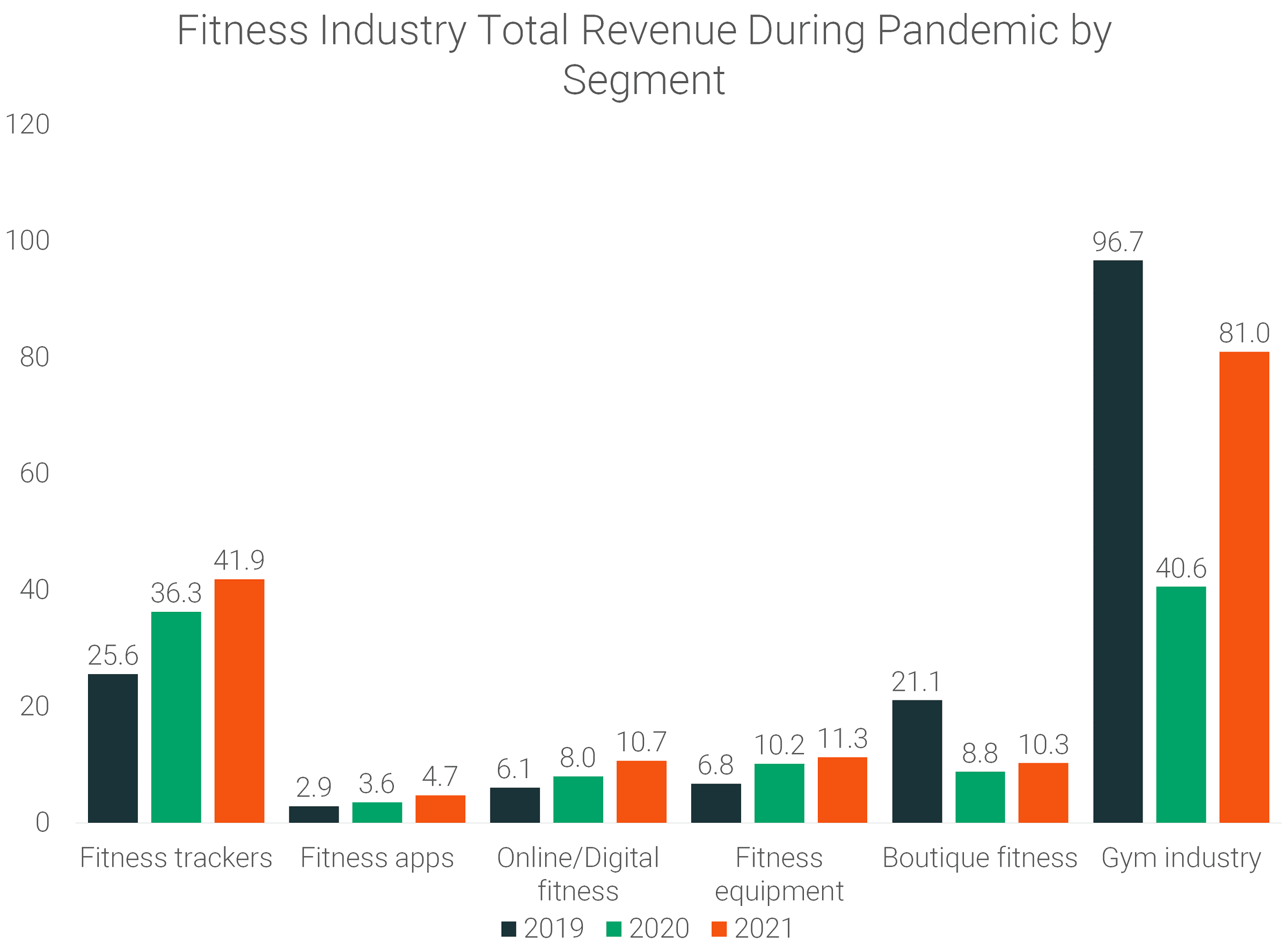

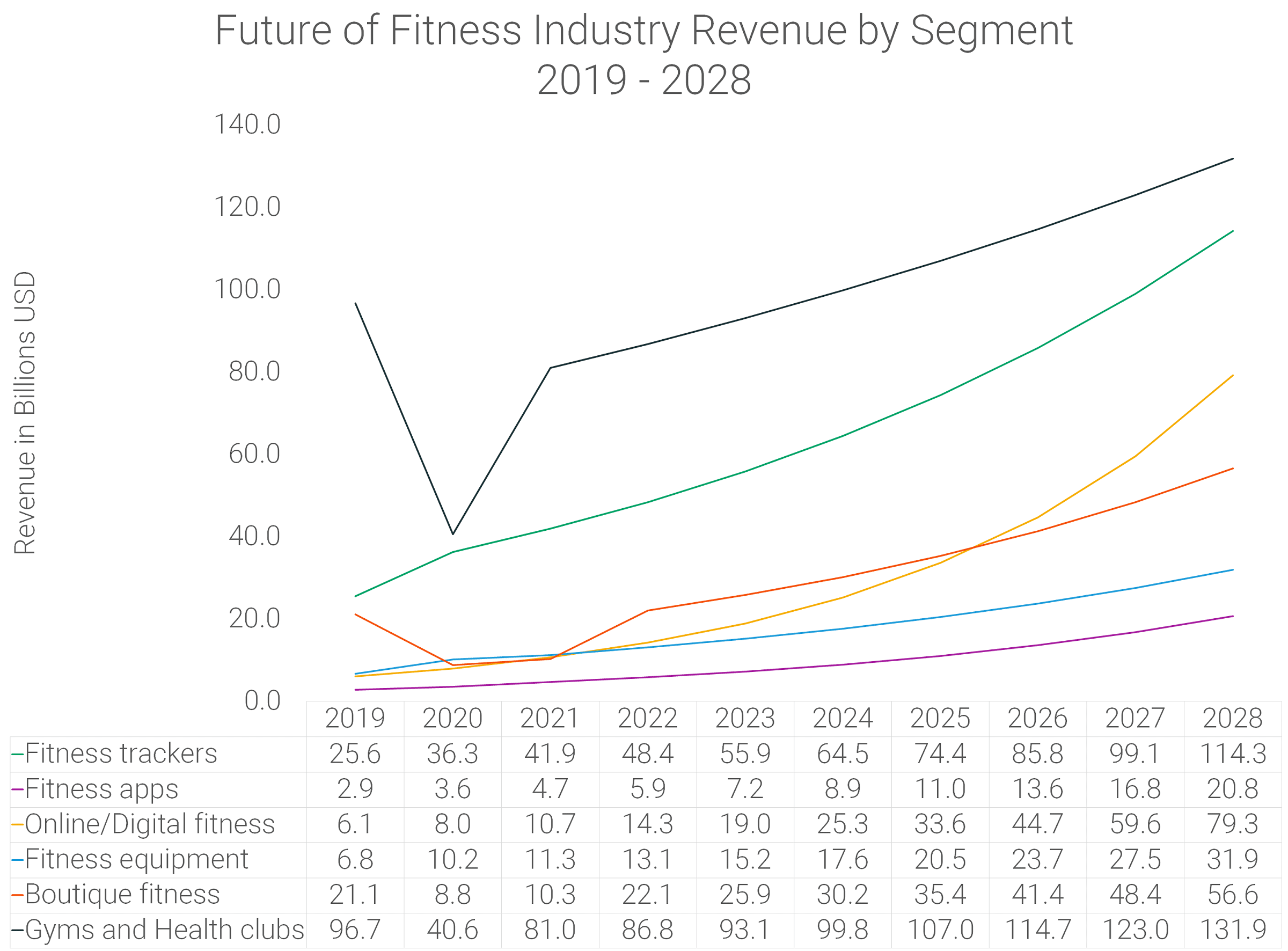

With the gym industry’s greater than 50% decline in revenue in 2020, it was the first time that gyms didn’t make up more than half of the fitness industry’s revenue. That’s because the other segments combined for 54.03% of the total market revenue.

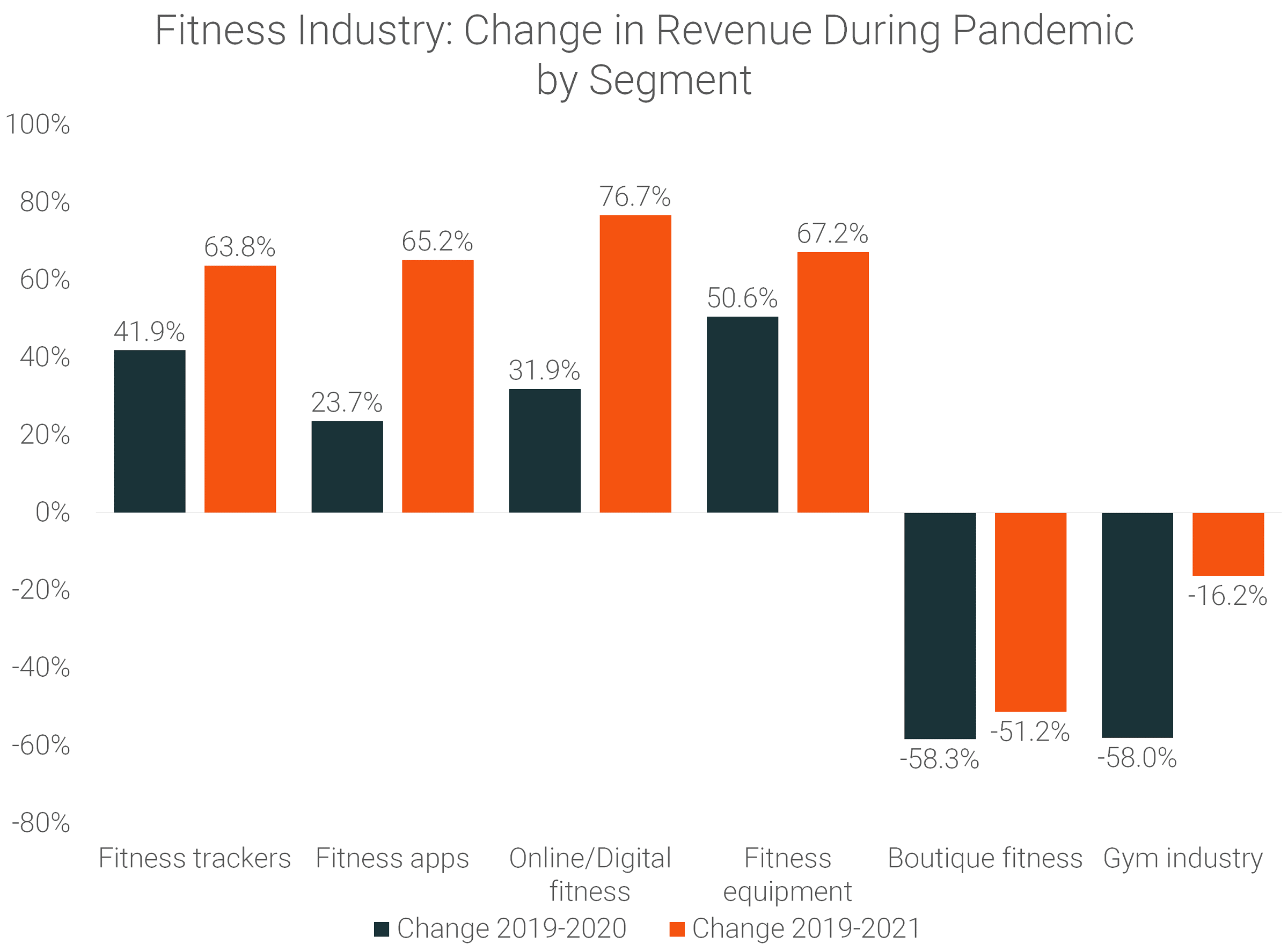

The fitness equipment industry saw the greatest growth during the first year of the pandemic - increasing 50.6% from 6.8 billion in 2019 to 10.2 billion in 2020.

While the industry with the greatest growth over the course of the entire pandemic is the online/digital fitness industry. Supplying on-demand, live-streamed, and pre-recorded fitness content online exploded by 76.7% from 6.1 billion in 2019 to 10.7 billion by the end of 2021.

The other segments experiencing growth were wearable fitness trackers (up 63.8% from 2019 - 2021) and fitness apps (up 65.2% from 2019 - 2021).

Meanwhile, the boutique fitness industry has experienced the greatest decline, dropping 58.3% in 2020 and still down 51.2% by the end of 2021.

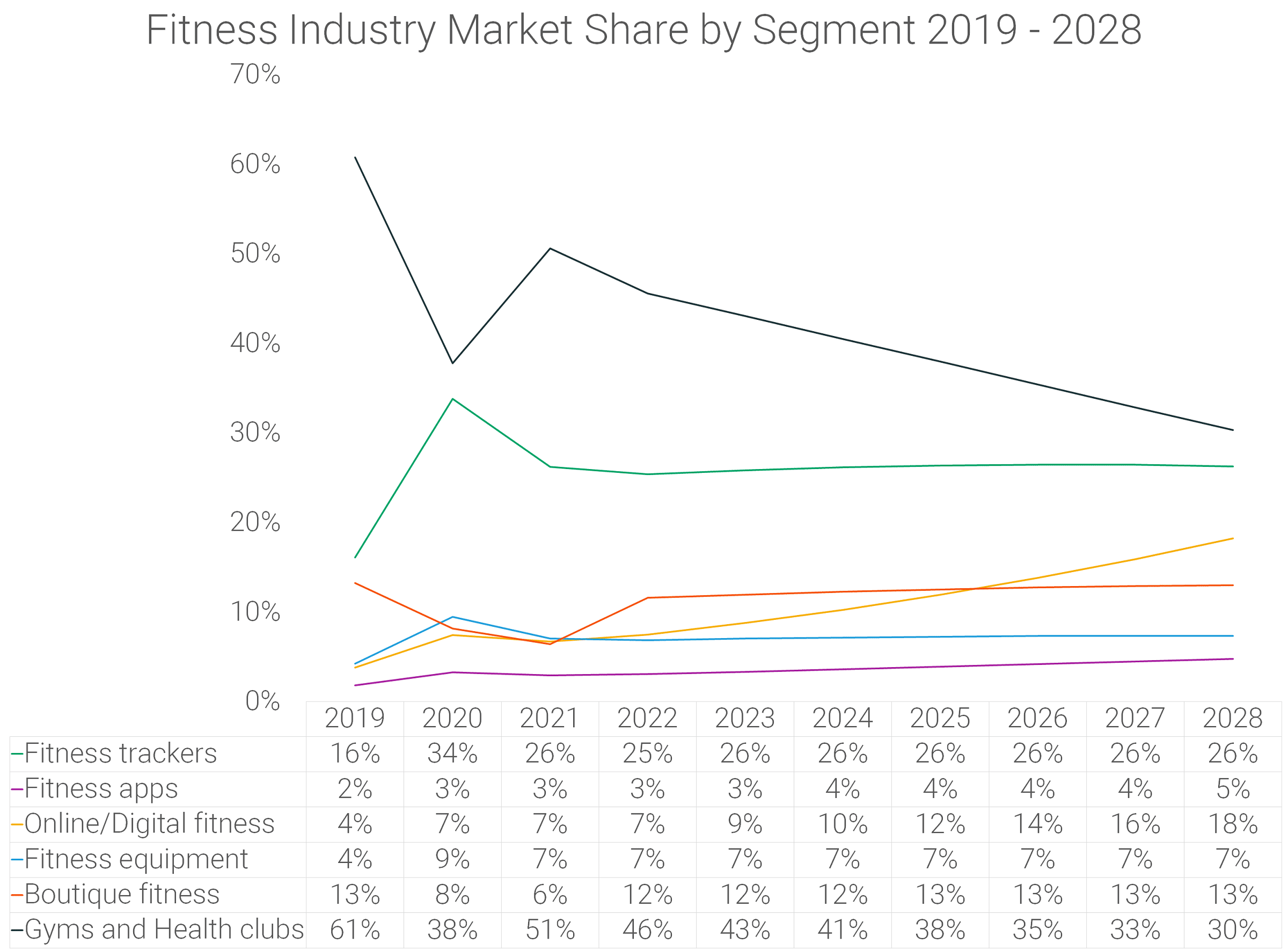

Future of the fitness industry by segment 2019 - 2028

The gym industry has long been the major pillar of the fitness industry, accounting for 61% of the industry’s revenue as of 2019 (96.7 billion in revenue).

With other segments in the industry experiencing growth, it is expected that the gym industry will only account for 30% of the fitness industry’s revenue by 2028 (131.9 billion in revenue).

The two major segments taking up more of the market share are:

- Fitness trackers - Expected to go from 16% market share in 2019 (25.6 billion in revenue) to 26% in 2028 (114.3 billion in revenue)

- Online/digital fitness - Expected to go from 4% market share in 2019 (6.1 billion in revenue) to 18% market share in 2028 (79.3 billion in revenue)

The two segments with the lowest market shares in 2021 and 2028 are:

- Fitness apps - Expected to go from 3% market share in 2021 (4.7 billion) to 5% in 2028 (20.8 billion)

- Fitness equipment - Expected to go from 7% market share in 2021 (11.3 billion) to 7% in 2028 (31.9 billion)

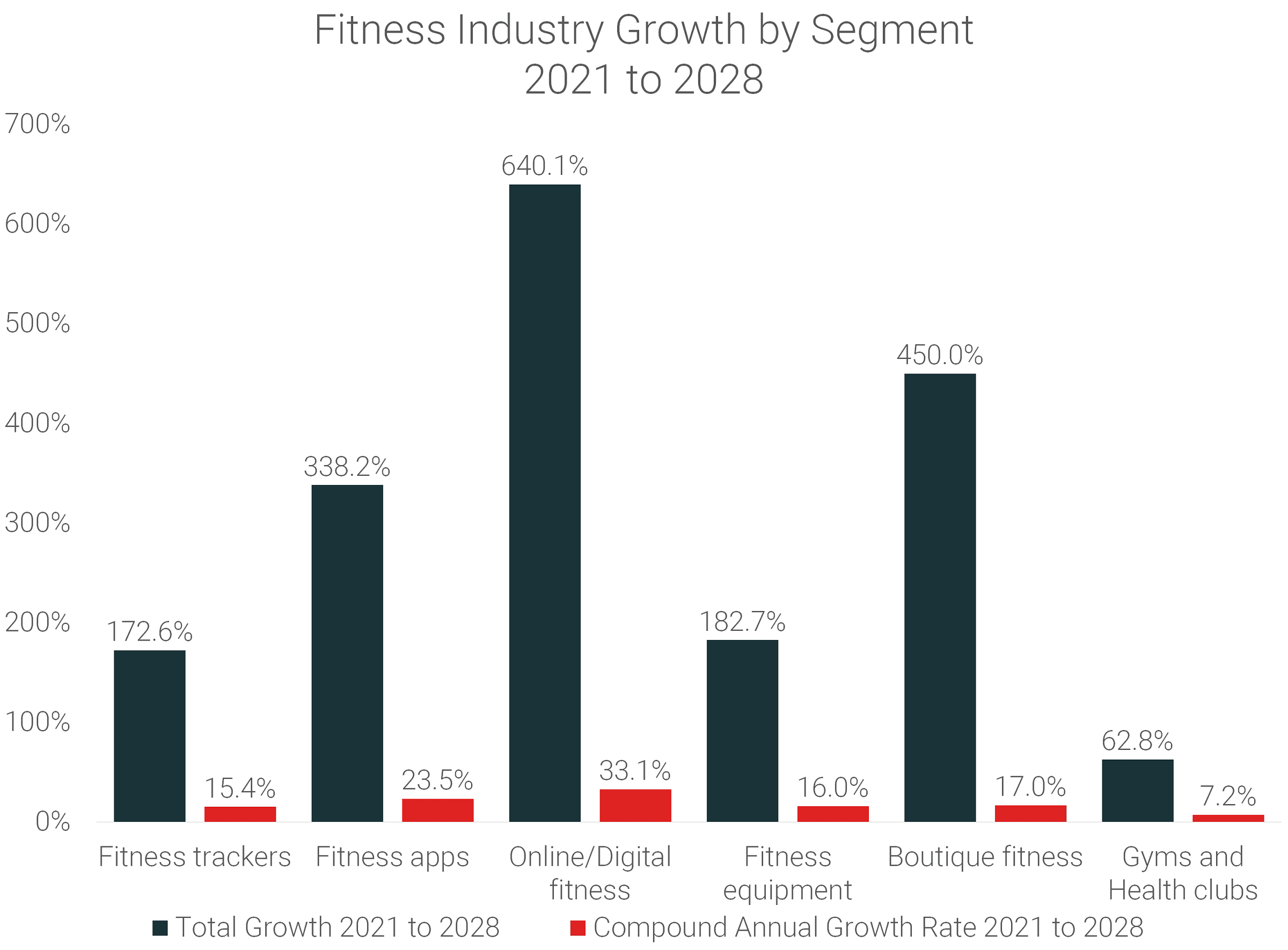

Fitness industry growth 2021 to 2028

The fastest-growing segment in the fitness industry is the online/digital fitness industry. Revenue generated around delivering live-streamed, on-demand, and pre-recorded fitness content is expected to grow 33.1% each year, for a total growth of 640.1% from 2021 to 2028.

Fitness apps have the second-highest CAGR (compound annual growth rate) at 23.5%, expecting to grow 338.2% over the 7 year period.

Meanwhile, the segment expecting the second-highest overall growth over the 7 year period is boutique fitness, expecting to grow 450% from 2021 to 2028.

Conclusion

The COVID-19 pandemic has directly affected the fitness industry in 2020 as many gyms and fitness centres were forced to shut down operations to reduce the spread of the virus. The fitness industry suffered a huge decline in revenue, but is expected to start to recover in 2021 and the succeeding years as people put more emphasis on their health and well-being.

About RunRepeat

RunRepeat hosts an extensive collection of athletic shoe reviews. Here, you can find unbiased shoe reviews, so you won’t have to spend too much time deciding whether a pair of shoes is the right fit for you. We ensure they are unbiased by a) buying shoes with our own money b) testing the shoes ourselves c) cutting the shoes in half in the lab and showcasing the results of all the lab tests we do.

Aside from our collection of running shoes, trainers, and trainers, you can also check out our shoe guides to learn more about the different types of shoes and their unique features.

Use of content

- If you want to know more about the fitness industry statistics, you are more than welcome to reach out to Nick Rizzo at nick@runrepeat.com. He’s also available to do interviews.

- Feel free to use data found in this article on any online publication. We only request that you link back to this original source.