Sneaker Industry Statistics

This page presents the latest figures on the sneaker industry, production numbers, market share distribution, as well as projections for the next ten years.

Sneaker market overview

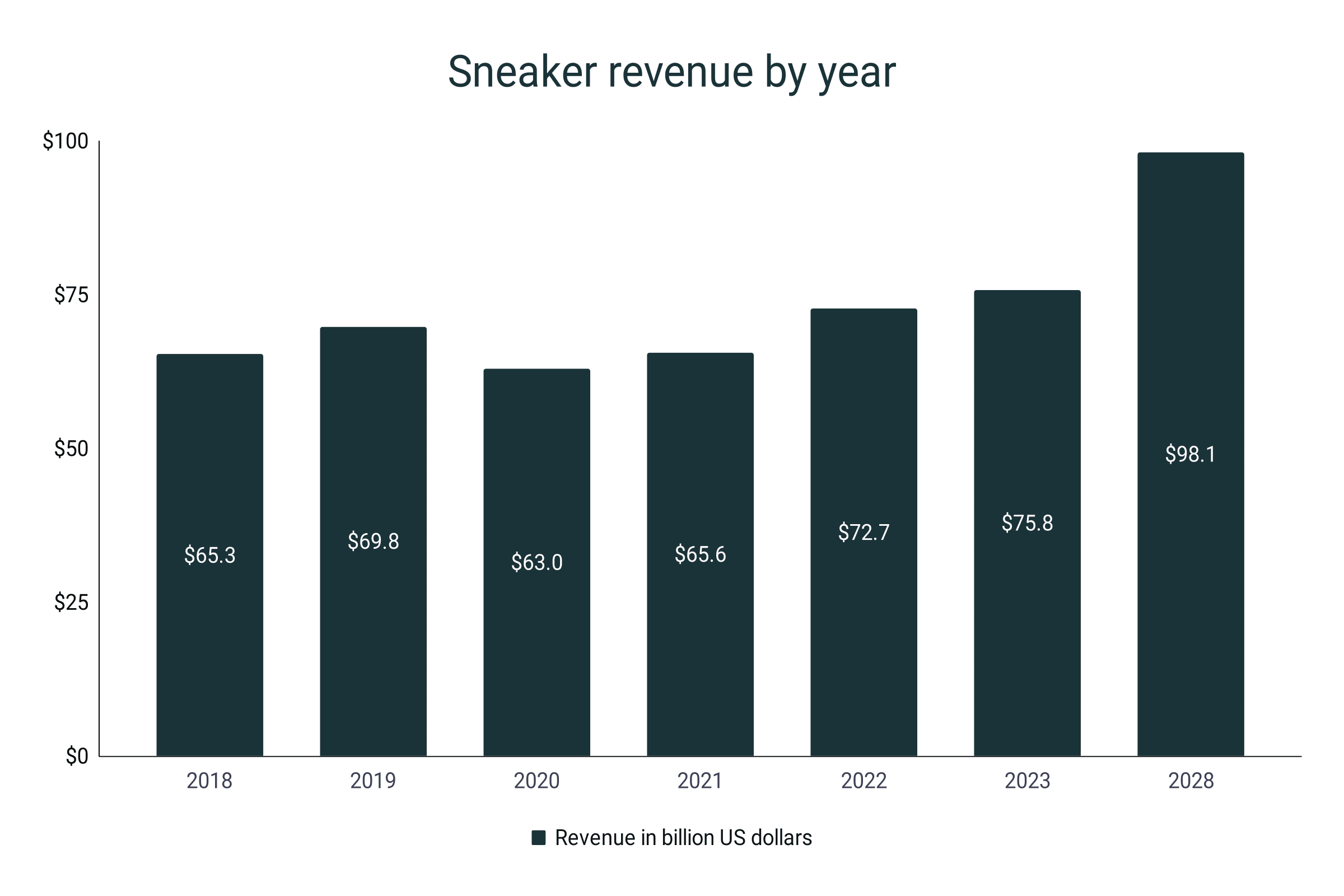

- The global sneaker market will reach a whopping $75.8 billion in revenue in 2023. This will account for 19% of the total footwear sales.

- Sneaker sales will increase by 4.2% compared to the revenue in 2022.

- The revenue from the sneaker industry has grown by 16.1% over the last 5 years.

- Worldwide sneaker revenue is projected to grow at a compound annual growth rate (CAGR) of 5.3% over the next 5 years and is expected to reach $98.1 billion in 2028.

- In 2020, due to the pandemic, sneaker sales dropped by 9.8%. It was the only drop in global sneaker revenue over the past five years.

- With a $22.3 billion expected revenue, the United States remains the top player in the global sneaker market.

- This figure equates to a $9.86 revenue generated per person for 2023.

- With a share of 36.5%, the Asia Pacific ruled the sneaker market in 2021.

- North America snatched the top spot in 2022 with about 30% of the sneaker market. Europe, on the other hand, had a 24% share.

- Over the forecast period of 2023-2029, the women's end-user market will experience a 5.5% compound annual growth.

- With a CAGR of 6.9%, the mid-top segment is the fastest-growing sneaker type market for the same forecast period.

|

Year |

Revenue (in billions) |

Growth |

|

2018 |

$65.3 |

|

|

2019 |

$69.8 |

6.9% |

|

2020 |

$63.0 |

-9.8% |

|

2021 |

$65.6 |

4.2% |

|

2022 |

$72.7 |

10.8% |

|

2023 |

$75.8 |

4.2% |

|

2028 |

$98.1 |

29.5% |

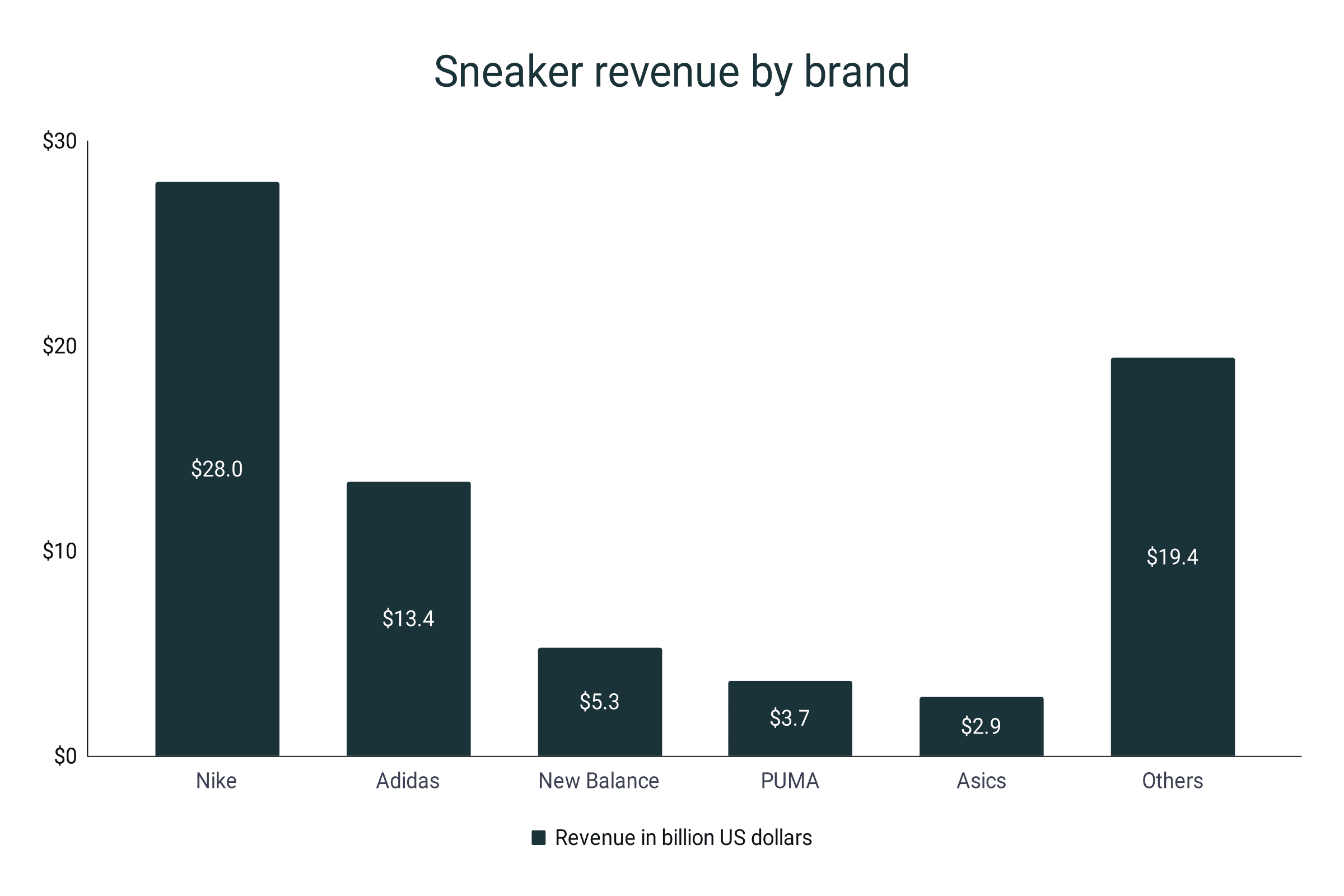

Sneaker revenue by brand

- Data from 2022 reveals that Nike leads in global sneaker revenue with $28 billion.

- Adidas is far second at $13.4 billion, an 18.4% share in the worldwide sneaker market.

- Nike and Adidas combined hold about 57% of the entire sneaker industry.

- Trailing in the third spot for top global sales in 2022 is New Balance with $5.3 billion.

- PUMA ($3.7B), and Asics ($2.9B) complete the top 5 list in fourth and fifth, respectively.

- If we combine the revenues of Adidas, New Balance, PUMA, and Asics in 2022, Nike still outperforms the total share by 3.7%.

- The entire sneaker revenue generated by other companies amounted to $19.4 billion. This is roughly equivalent to a 26.7% market share.

Sneaker revenue by brand

|

Brand |

Revenue (in billions) |

Share in percent |

|

Nike |

$28.0 |

38.5% |

|

Adidas |

$13.4 |

18.4% |

|

New Balance |

$5.3 |

7.3% |

|

PUMA |

$3.7 |

5.1% |

|

Asics |

$2.9 |

4.0% |

|

Others |

$19.4 |

26.7% |

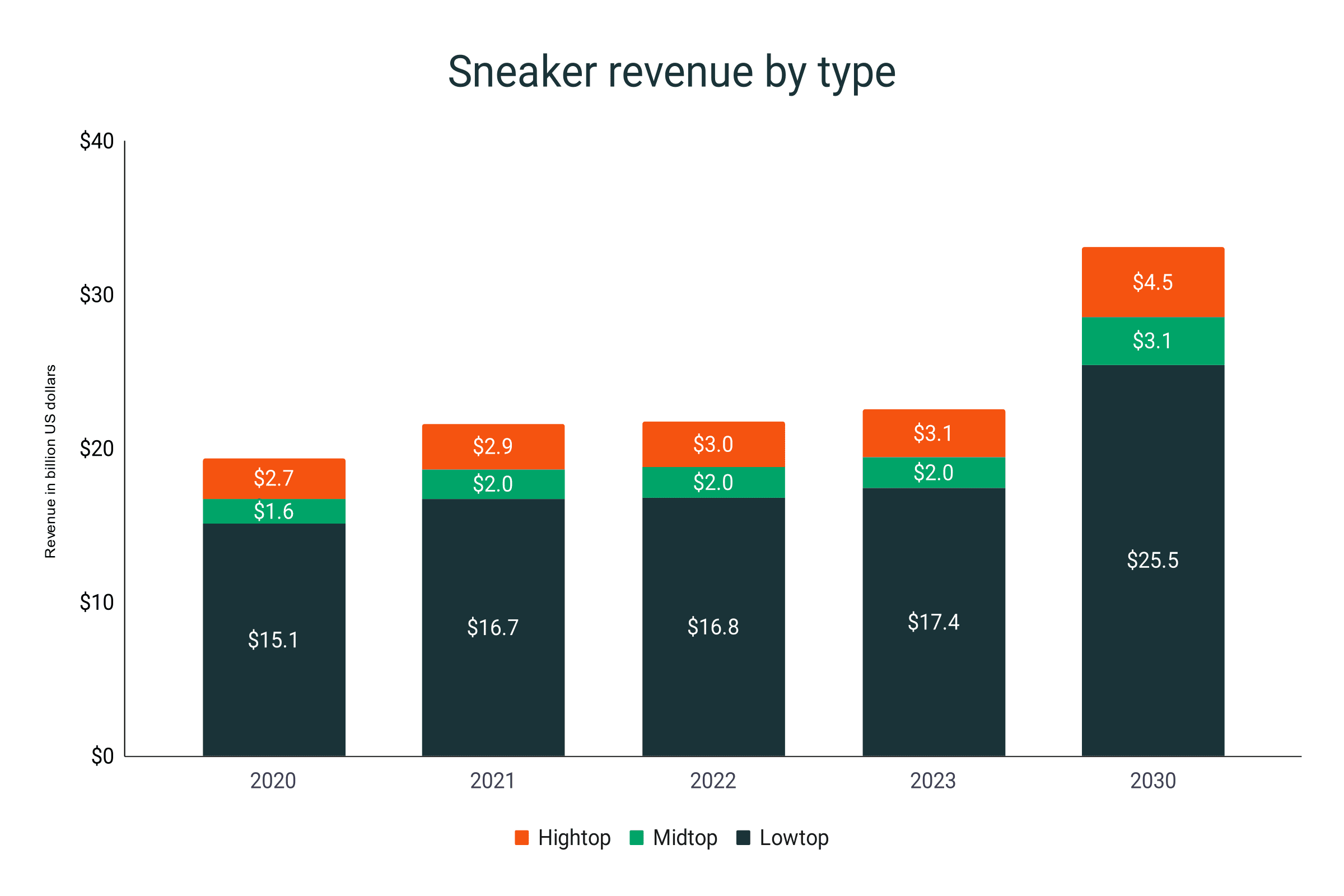

Sneaker revenue by type

- Low-top trainers will continue to be the bulk of the global sneaker market. It is expected to amass a total of $17.4 billion in revenues by the end of 2023.

- The ow-top market share will also reach 77.3% share.

- Between 2022 and 2023, the low-top sneaker market will grow by 3.7%.

- Mathematical models estimate that revenues from low-top trainers will reach $25.5 billion in 2030.

- High-top sneaker market will be a far second at 13.8% share to cap 2023. Mid-top trainers share will settle at 8.9%.

- By 2030, the high-top revenue will amount to $4.5 billion. Meanwhile, mid-top sales will total $3.1 billion approximately.

- However, in terms of total market share, the high-top sneaker market will drop by 0.07% between 2023-2030.

- Mid-top market will enjoy a 0.36% share increase in the same forecast period.

- The CAGR for the mid-top sneaker segment over 2020-2030 is 2.9%.

Sneaker revenue by type (in billion US dollars)

|

Year |

Hightop |

Midtop |

Lowtop |

|

2020 |

$2.7 |

$1.6 |

$15.1 |

|

2021 |

$2.9 |

$2.0 |

$16.7 |

|

2022 |

$3.0 |

$2.0 |

$16.8 |

|

2023 |

$3.1 |

$2.0 |

$17.4 |

|

2030 |

$4.5 |

$3.1 |

$25.5 |

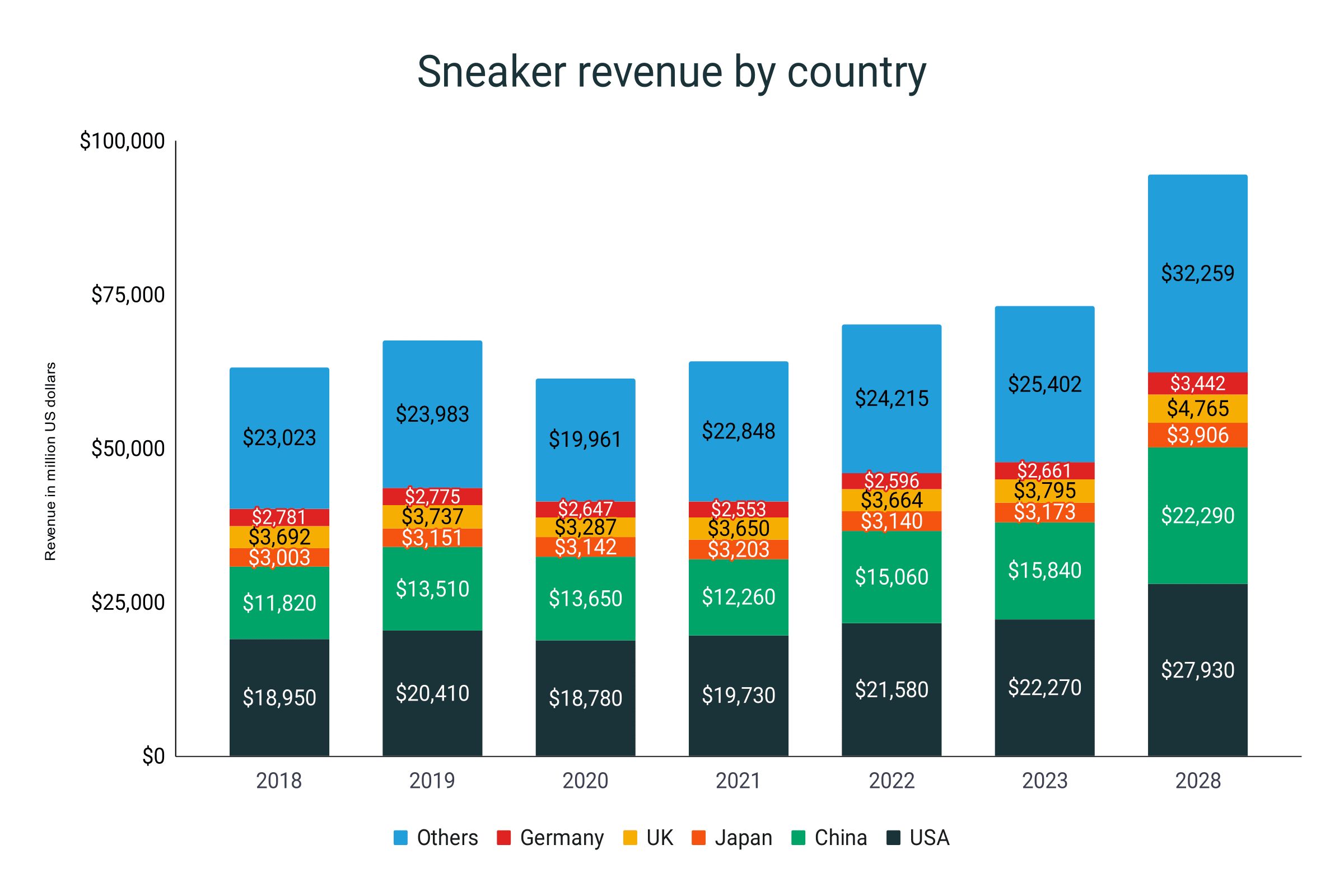

Sneaker revenue by country

- The United States will lead the 2023 sneaker market with a $22.3 billion revenue.

- The US will be way ahead by about $6.5 billion of the $15.8 billion sales of China.

- During the 2018-2023 period, US sneaker sales will register a 14.9% growth.

- By estimates, the United States sneaker revenue will balloon to $27.9 billion by the end of 2028, equivalent to a 25.4% increase compared to figures in 2023.

- In 2020, during the COVID-19 pandemic, all sneaker markets saw a decrease in sales except for China which managed to increase its revenue by 1.5% from 2019 to 2020.

- By the end of 2028, mathematical models approximate China’s sneaker sales to reach $22.3 billion, joining the United States in the 20-billion-dollar industry mark.

- China is forecasted to be the fastest-growing sneaker market. It is expected to increase its 2023 figures by 40.7% by 2028.

- The United Kingdom is the third biggest sneaker market in 2022 raking up $3.7 billion.

- Great Britain is projected to tally $3.8 billion by 2023, signifying a 2.7% increase. This is the lowest growth seen among the market players of the world.

- Japan, Germany, and India will trail as the fourth, fifth, and sixth biggest sneaker markets by 2023 with $3.2, $2.7, and $2.6 billion in revenues.

- During the 2018-2023 period, India exhibited the greatest revenue increase with 23.1%.

- Among the top markets, Germany is the only one which showed signs of slowing down after registering a 4.5% dip from 2018 and 2023 total sales.

- The rest of the countries of the world combined will total $25.4 billion in revenue in 2023.

Sneaker Revenue by country (in billion US dollars)

|

Year |

USA |

China |

Japan |

UK |

Germany |

India |

Others |

|

2018 |

$19.0 |

$11.8 |

$3.0 |

$3.7 |

$2.8 |

$2.0 |

$23.0 |

|

2019 |

$20.4 |

$13.5 |

$3.2 |

$3.7 |

$2.8 |

$2.3 |

$24.0 |

|

2020 |

$18.8 |

$13.7 |

$3.1 |

$3.3 |

$2.6 |

$1.5 |

$20.0 |

|

2021 |

$19.7 |

$12.3 |

$3.2 |

$3.7 |

$2.6 |

$1.4 |

$22.8 |

|

2022 |

$21.6 |

$15.1 |

$3.1 |

$3.7 |

$2.6 |

$2.5 |

$24.2 |

|

2023 |

$22.3 |

$15.8 |

$3.2 |

$3.8 |

$2.7 |

$2.6 |

$25.4 |

|

2028 |

$27.9 |

$22.3 |

$3.9 |

$4.8 |

$3.4 |

$3.5 |

$32.3 |

|

Growth 2018-2023 |

14.9% |

25.4% |

5.4% |

2.7% |

-4.5% |

23.1% |

9.4% |

|

Growth 2023-2028 |

25.4% |

40.7% |

23.1% |

25.6% |

29.3% |

35.0% |

27.0% |

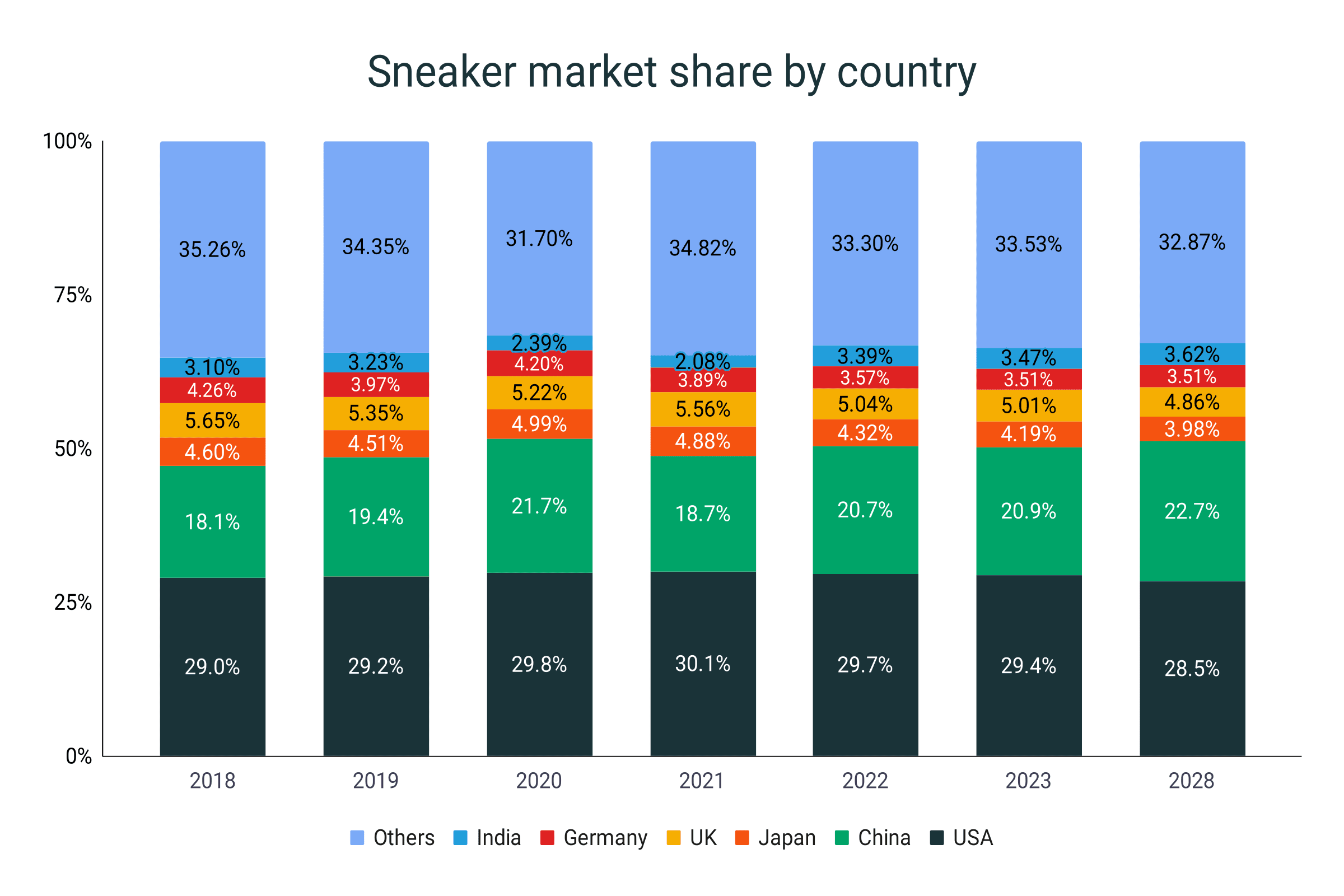

- With a 29.4% share, the United States will dominate the sneaker market in 2023.

- However, this is a 0.3% dip from the 29.7$ share in 2022.

- Continuing this trend, the market share of US trainers will drop to 28.5% by 2028.

- In 2022, the US and China combined sneaker market accounted for 50.4% of the global revenue. By 2023, it will slightly dip to 50.3% combined share.

- At the peak of the COVID-19 pandemic in 2020, China enjoyed a 2.4% increase in its global sneaker market share.

- In the same year, Japan enjoyed a 0.5% rise while the US also managed to improve their own market potion by 0.6% each in 2020.

- Projection models show that by 2028, China will take a 22.7% sneaker market share.

- The United Kingdom, on the other hand, will enjoy a 5% market portion by the end of 2023. Japan will closely follow with a 4.2% share.

- By 2028, India will overtake Germany as the fifth biggest sneaker market with a 3.6% share compared to the latter’s 3.5%.

- Japan, the UK, and Germany will suffer a decrease in the overall sneaker market share from 2018 to 2023 with 0.4%, 0.7%, and 0.8% drops, respectively.

- India will enjoy a 0.5% gain from 2018 to 2028.

- In 2018, the rest of the countries of the world took up 35.3% of the entire sneaker market. By 2023, it will be 33.5%.

- According to projections, the combined sneaker market share of the rest of the world will continue to drop to 32.9% in 2028.

Sneaker market share by country

|

Year |

USA |

China |

Japan |

UK |

Germany |

India |

Others |

|

2018 |

29.0% |

18.1% |

4.6% |

5.7% |

4.3% |

3.1% |

35.3% |

|

2019 |

29.2% |

19.3% |

4.5% |

5.4% |

4.0% |

3.2% |

34.3% |

|

2020 |

29.8% |

21.7% |

5.0% |

5.2% |

4.2% |

2.4% |

31.7% |

|

2021 |

30.1% |

18.7% |

4.9% |

5.6% |

3.9% |

2.1% |

34.8% |

|

2022 |

29.7% |

20.7% |

4.3% |

5.0% |

3.6% |

3.4% |

33.3% |

|

2023 |

29.4% |

20.9% |

4.2% |

5.0% |

3.5% |

3.5% |

33.5% |

|

2028 |

28.5% |

22.7% |

4.0% |

4.9% |

3.5% |

3.6% |

32.9% |

Sneaker revenue per capita

- As of 2023, the average revenue per capita of the sneaker industry is $9.9.

- This represents a 3.2% growth compared to the $9.6 recorded in 2022.

- Over the past five years, the mean revenue per capita has risen by 10.5%.

- It is projected that the growth rate will catapult by 24.24% in 2028, reaching an average of $12.3 in revenue per capita.

- Notably, during the peak of the COVID-19 pandemic in 2020, the data experienced a significant drop of 10.7%.

Revenue per capita by year

|

Year |

Revenue per capita (in US dollars) |

Growth |

|

2018 |

$8.9 |

|

|

2019 |

$9.4 |

5.8% |

|

2020 |

$8.4 |

-10.7% |

|

2021 |

$8.7 |

3.2% |

|

2022 |

$9.6 |

9.8% |

|

2023 |

$9.9 |

3.2% |

|

2028 |

$12.3 |

24.2% |

Sneaker production statistics

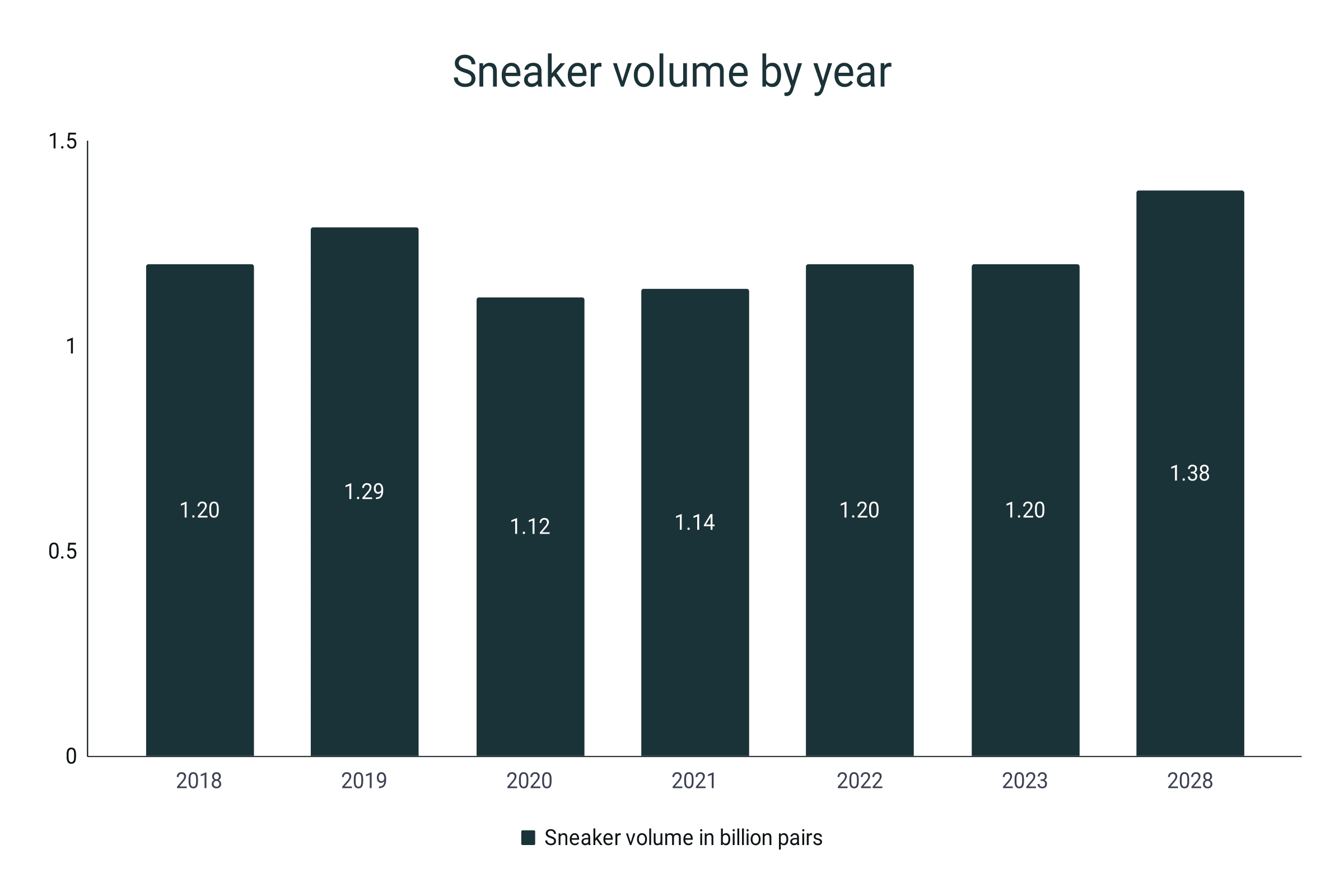

- About 1.2 billion pairs of trainers will be produced in 2023, matching the numbers recorded in 2022 and 2018.

- This number is almost twice the amount of trainers globally manufactured in 2012.

- The sneaker volume per capita by the end of 2023 will be 0.16 pairs.

- At the height of the pandemic in 2020, the bulk of trainers manufactured worldwide dropped to 1.12 billion pairs.

- This is a 13.2% dip compared to the 1.29 billion worldwide total in 2019, the highest in the last six years.

- As the world exits the pandemic in 2022, the figures rose by 5.26%.

- Furthermore, mathematical models predict that by 2026, the global production volume will amount to 1.31 billion pairs.

- The numbers will continue to rise, reaching 1.38 billion in 2028, translating to a 0.17 average sneaker pair per person.

Sneaker volume by year

|

Year |

Volume (in billion pairs) |

Volume per capita (in pairs) |

|

2018 |

1.20 |

0.16 |

|

2019 |

1.29 |

0.17 |

|

2020 |

1.12 |

0.15 |

|

2021 |

1.14 |

0.15 |

|

2022 |

1.20 |

0.16 |

|

2023 |

1.20 |

0.16 |

|

2028 |

1.38 |

0.17 |

Sneaker consumption by category

- In 2022, the women’s sneaker market accounted for $27 billion in revenues. It has more than doubled its value in 2016.

- Women’s sneaker segment in 2021 raked up $24.21 billion, a 36.9% share of the market.

- Women’s sneaker revenues have increased by 11.5% from 2021 to 2022.

- The women end-user share has grown from 20% in 2014 to 37.1% in 2022. A 17.1% difference over the span of nine years.

- It is expected to grow to $51.7 billion in 2032 with a CAGR of 6.7%.

- With $5.45 billion in sales, the kids’ sneaker segment accounted for an 8.3% share.

- Meanwhile, the men’s sneaker segment in 2021 amounted to $36 billion in revenue.

- This is equal to a 54.8% share of the entire sneaker sales in the same year.

Sneaker revenue by category in 2021

|

Channel |

Revenue (in billions of US$) |

Share in % |

|

Men |

35.95 |

54.8 |

|

Women |

24.21 |

36.9 |

|

Kids |

5.45 |

8.3 |

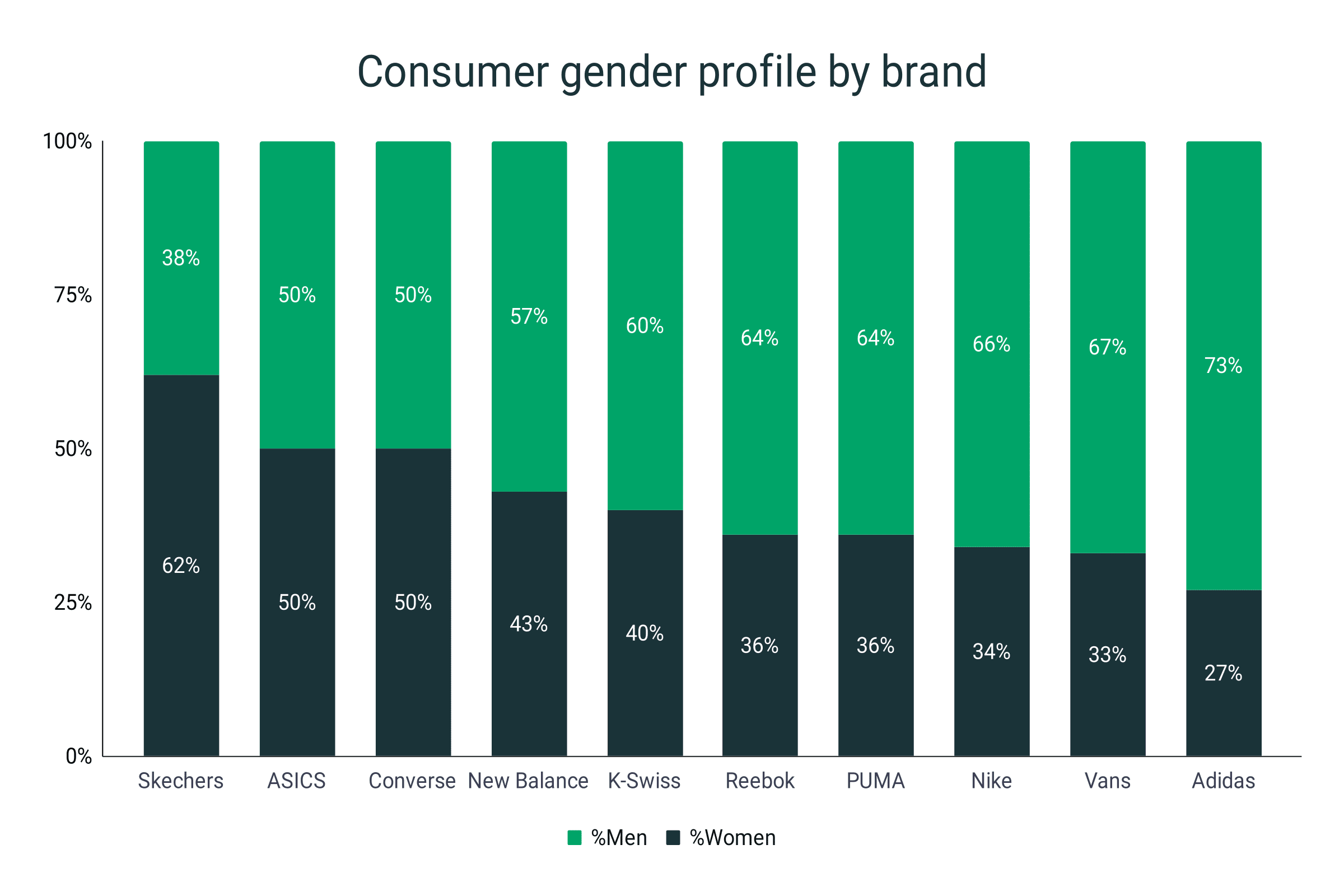

- Skechers is the only women-dominated sneaker brand in 2021. According to data, 62% of its shoppers are women.

- ASICS and Converse reported an equal number of men and women sneaker consumers in the same year.

- Additionally, Reebok and PUMA reported that 36% of their consumers are women while 65% are male.

- Adidas showed the biggest disparity between men and women buyers in 2021. Seventy-three percent of the consumers are men, outnumbering the women by 46%.

Men's and women's sneaker consumption by brand in 2021

|

Brand |

%Women |

%Men |

|

Skechers |

62 |

38 |

|

ASICS |

50 |

50 |

|

Converse |

50 |

50 |

|

New Balance |

43 |

57 |

|

K-Swiss |

40 |

60 |

|

Reebok |

36 |

64 |

|

PUMA |

36 |

64 |

|

Nike |

34 |

66 |

|

Vans |

33 |

67 |

|

Adidas |

27 |

73 |

Sneaker revenue by sales channel

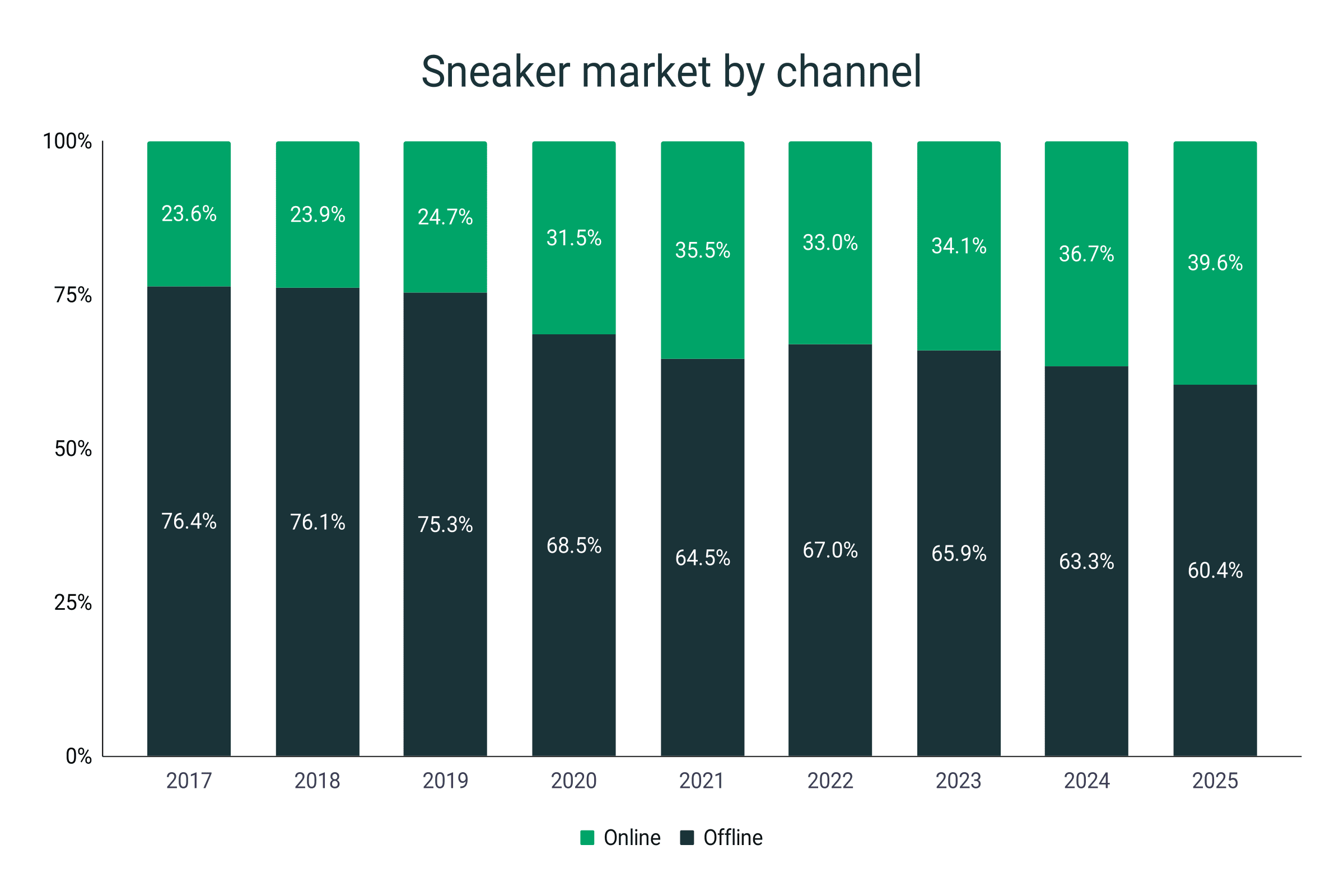

- In the sneaker segment, offline transaction revenue by the end of 2023 will tally 65.9% of the total sales. This is equivalent to about $50 billion.

- Meanwhile, the online market share will reach 34.1% or roughly $25.8 billion.

- There has been a 1.1% drop from the 67% offline market share tallied in 2022.

- In contrast to the 76.4% share in 2017, the total decline in offline market revenue has amounted to 10.5% as of 2023.

- In 2021, the lowest offline-to-online share difference was recorded at 29%. This means that the offline market exceeded the e-commerce share by more than $19 billion.

- Consequently, the highest e-commerce market share rose to a record-breaking 35.5% in the same year.

- According to estimates, the online sneaker market will continue to grow by as much as 39.6% by 2025, leaving a 60.4-percent portion to the offline market.

- In the U.S. today, 25% of current sneaker purchases are from online retailers.

Offline and online market share

|

Year |

Offline (in %) |

Online (in %) |

Difference (in %) |

|

2017 |

76.4 |

23.6 |

52.8 |

|

2018 |

76.1 |

23.9 |

52.2 |

|

2019 |

75.3 |

24.7 |

50.6 |

|

2020 |

68.5 |

31.5 |

37.0 |

|

2021 |

64.5 |

35.5 |

29.0 |

|

2022 |

67 |

33 |

34.0 |

|

2023 |

65.9 |

34.1 |

31.8 |

|

2024 |

63.3 |

36.7 |

26.6 |

|

2025 |

60.4 |

39.6 |

20.8 |

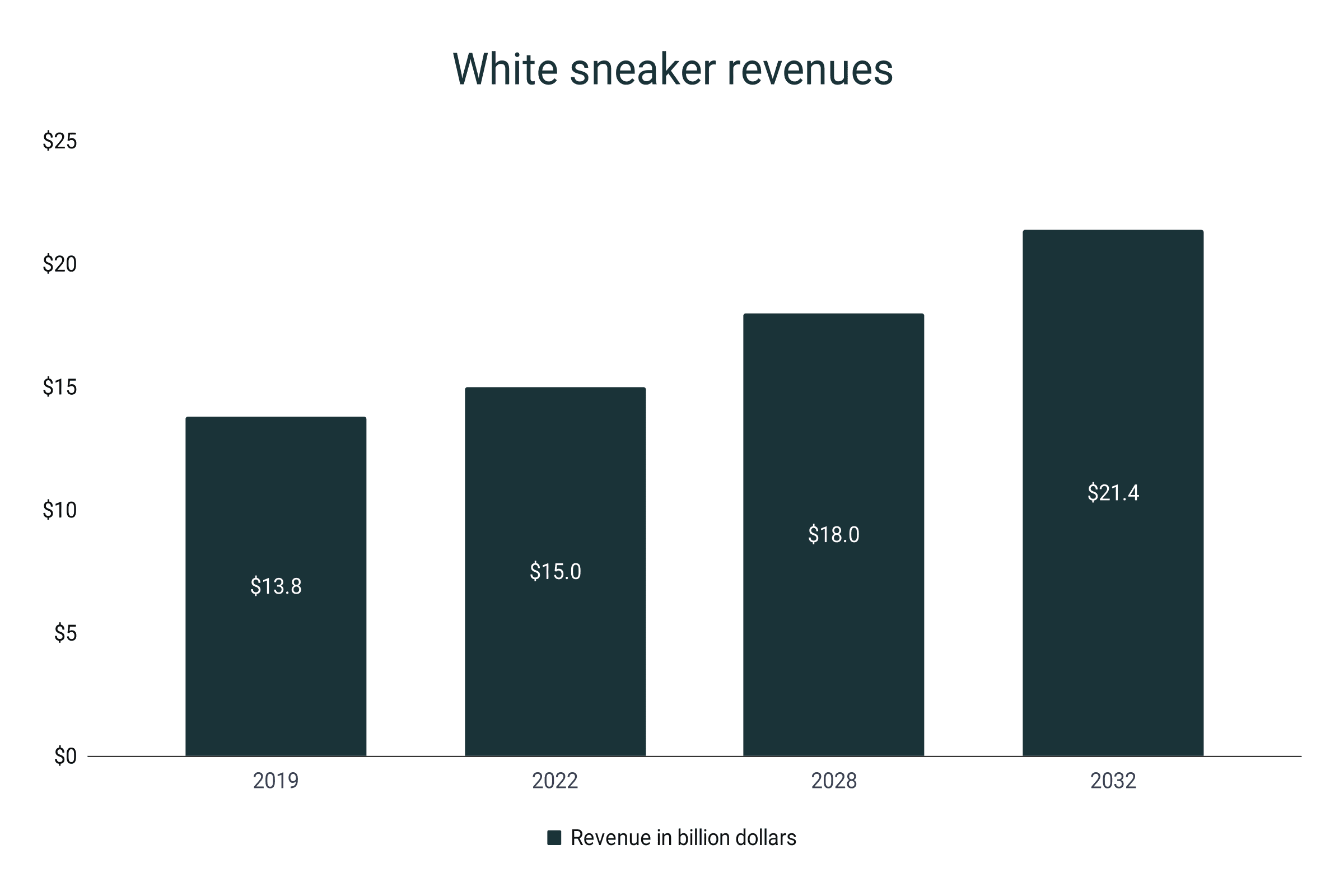

White trainers statistics

- The total revenue from white trainers in 2022 generated $15 billion.

- From its $13.8 billion figure in 2019, the white sneaker market has experienced an 8.7% growth.

- It is projected that in 2028, the white sneaker market will be valued at $18 billion, a 20% increase from its valuation in 2022.

- From 2022 to 2028, the CAGR of the white sneaker industry is 3%.

- Further projection estimates that by 2032 the white sneaker market will breach the 20-billion dollar mark, tallying $21.4 billion in sales.

- This will signify a 42.7% growth from its value in 2022.

- North America holds the biggest chunk of the white sneaker market in 2022 at 28.9%.

- With a market portion of 28.9%, specialty stores are the biggest white sneaker channel.

- Male end-user segment is expected to register a 55.2% share in white sneaker sales by the end of 2032.

White sneaker revenue

|

Year |

Revenue |

Growth |

|

2019 |

$13.8 billion |

|

|

2022 |

$15 billion |

8.7% |

|

2028 |

$18 billion |

20% |

|

2032 |

$21.4 billion |

18.9% |

Sneaker resale market statistics

- As of 2022, the sneaker resale market has skyrocketed into a $10.6 billion global industry, taking 14.6% of the total revenue.

- The resale market has a remarkable 500% increase compared to the $1 billion revenue recorded in 2014.

- Nike dominated the resell market with a 27% share.

- The resale market is expected to reach $27.4 billion in 2032, equivalent to a 16.4% compound annual growth.

- The United States will cap 2023 with a $2 billion revenue from reselling.

- In 2019, the Nike MAG (Plutonium Case) registered a 5,430% increase from an original price of $179 to a jaw-dropping $9,900 reselling price.

Counterfeit sneaker market statistics

- Approximately, counterfeit products account for 2.5% of the total international trade.

- The global counterfeit sneaker market is estimated to be $600 billion in 2023.

- This signifies an 11.11% increase compared to the estimated $450 billion figure in 2020.

- Towards the end of 2023, the counterfeit sneaker market will be 8 times the legitimate sneaker industry.

- At this rate, the counterfeit sneaker market will breach the $1 trillion mark in about 25 years.

- According to the US Customs and Border Protection (CBP), about 14% of all counterfeit products they seized were counterfeit footwear.

- One in four online shoppers have bought and/or received a fake item in 2019 according to a study by Better Business Bureau.

- A survey in 2021 reported that 46% of the study participants admitted to buying fake trainers.

- Another survey of American consumers reveals that 31% of those who received a counterfeit sneaker are dissatisfied. Surprisingly, 69% of the respondents are okay with receiving a fake item.