Puma Shoes Statistics

This report is a compilation of various qualitative data about the past, present, and future of the PUMA shoe brand.

Top PUMA shoe statistics

- The revenue of PUMA’s footwear products amounted to $4.6 billion in 2022.

- PUMA’s revenue from shoes experienced continuous growth from 2014-2022. If the trend continues, the company will reach $6.2 in footwear revenues by 2030.

- As of 2022, the global shoe market share of PUMA is 1.2%.

- Meanwhile, in the United States, the company holds 4% of the athletic shoe segment.

- PUMA is the fourth most popular basketball shoe brand in the NBA, averaging 3.4% for the past five seasons.

- In the global athletic footwear market, PUMA maintains a 2.1% share. In trainers, the shoe brand secured a 5.1% cut.

- 35 million pairs of PUMA shoes are produced annually.

- In 2022, 44% of the company’s leather materials were sourced from USA.

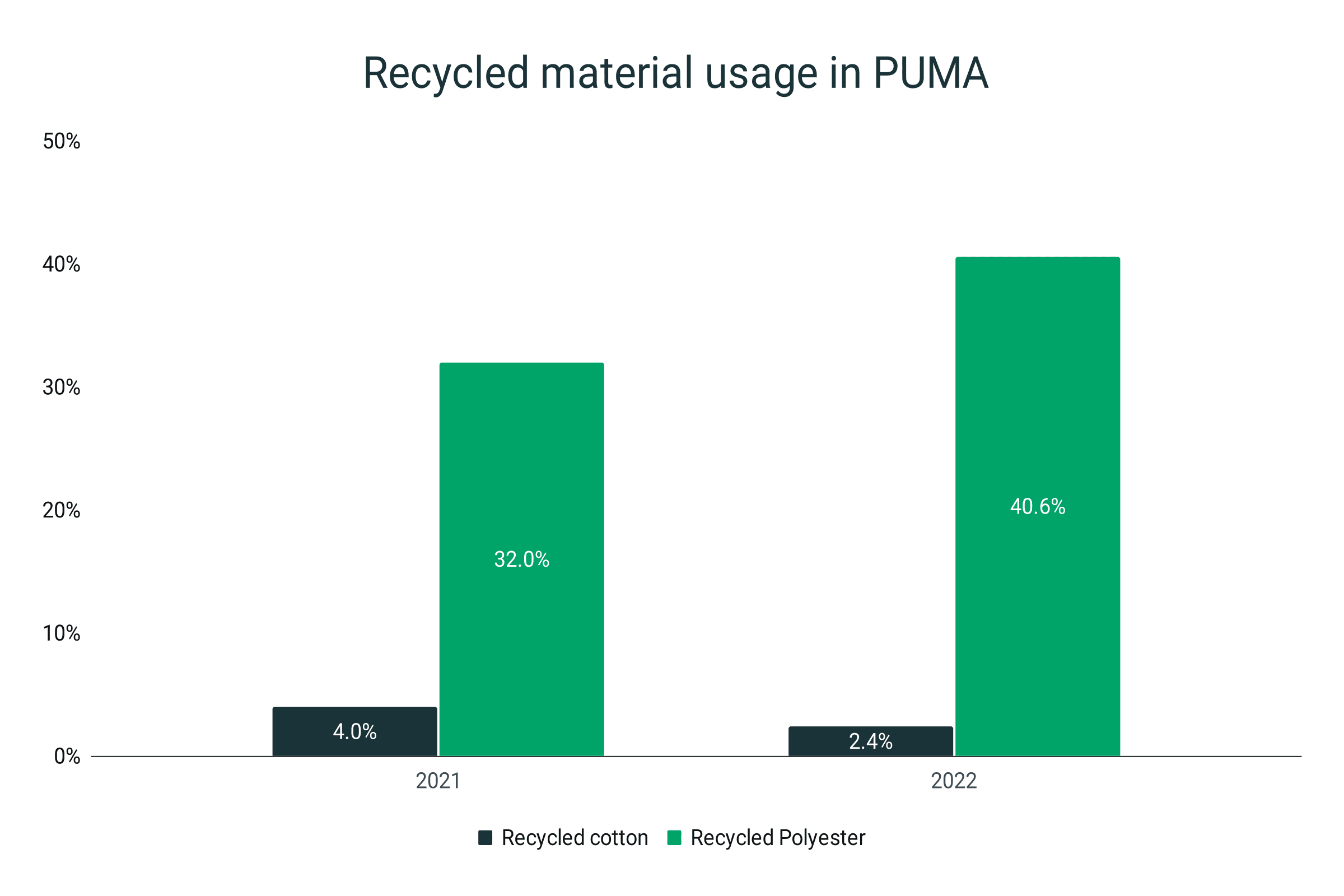

- The company uses 40.6% recycled polyester and 2.4% recycled cotton in its manufacturing process.

- 61% of the company’s shoes manufactured in 2022 used one or more sustainable components. The company’s target is to reach 90% by 2025.

- The average price of a PUMA footwear product is $95.3.

- PUMA basketball shoes ($120.7) and training shoes ($81.4) are the most and least expensive in terms of mean prices.

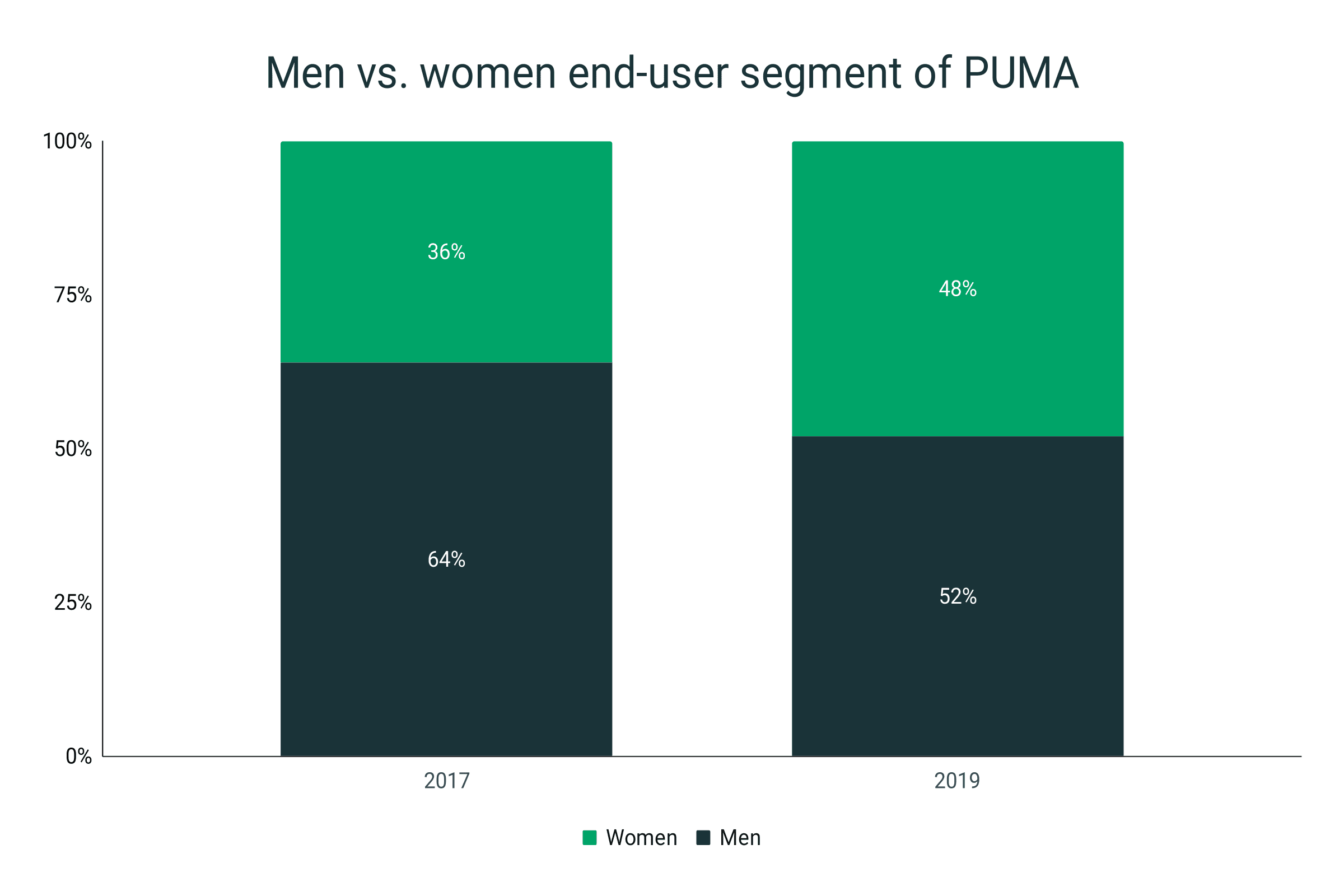

- In 2019, PUMA was able to expand their women's end-user segment to 48% compared to a 36% share in 2017.

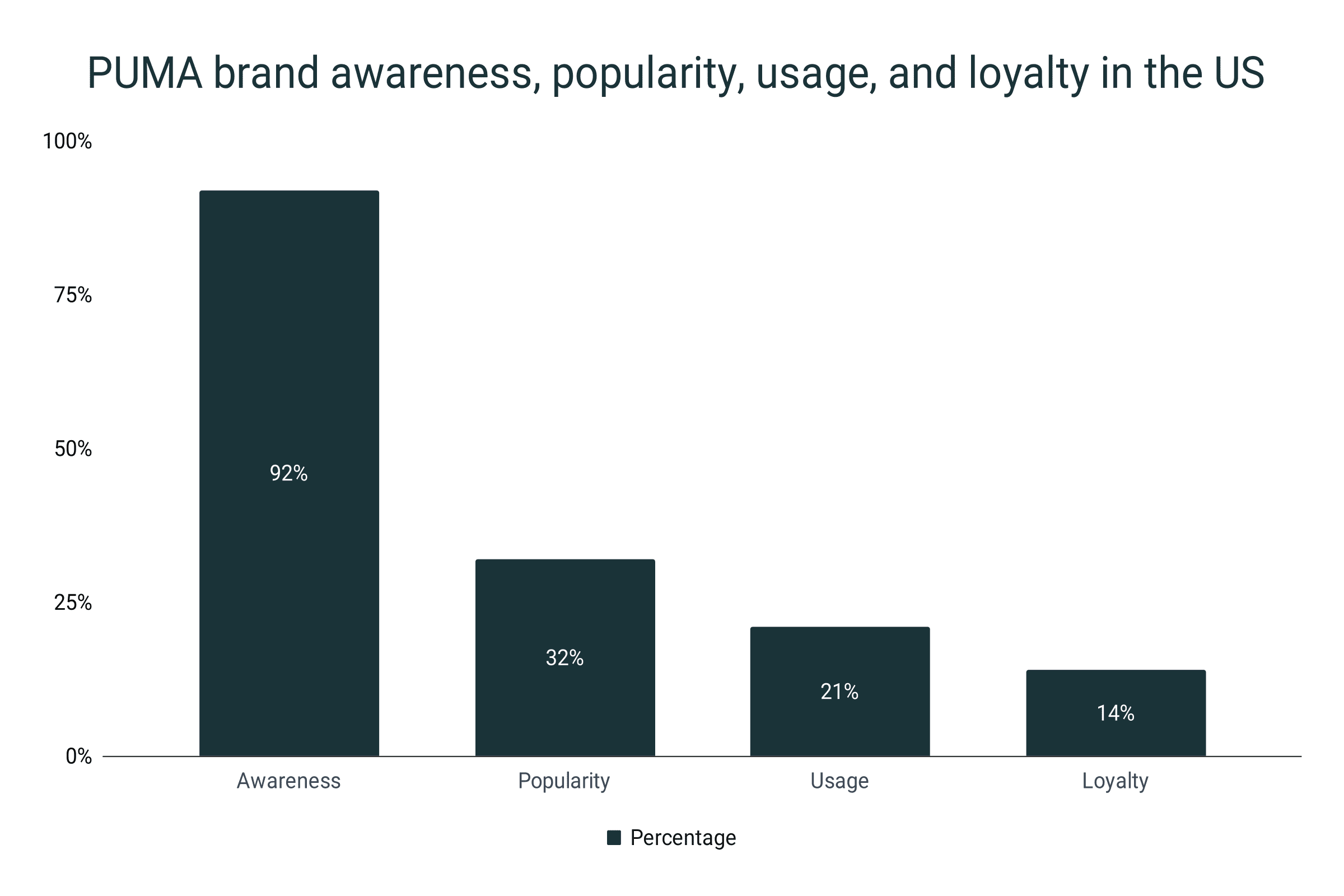

- About 21% of the American consumer population wears PUMA but only 14% are loyal to the brand.

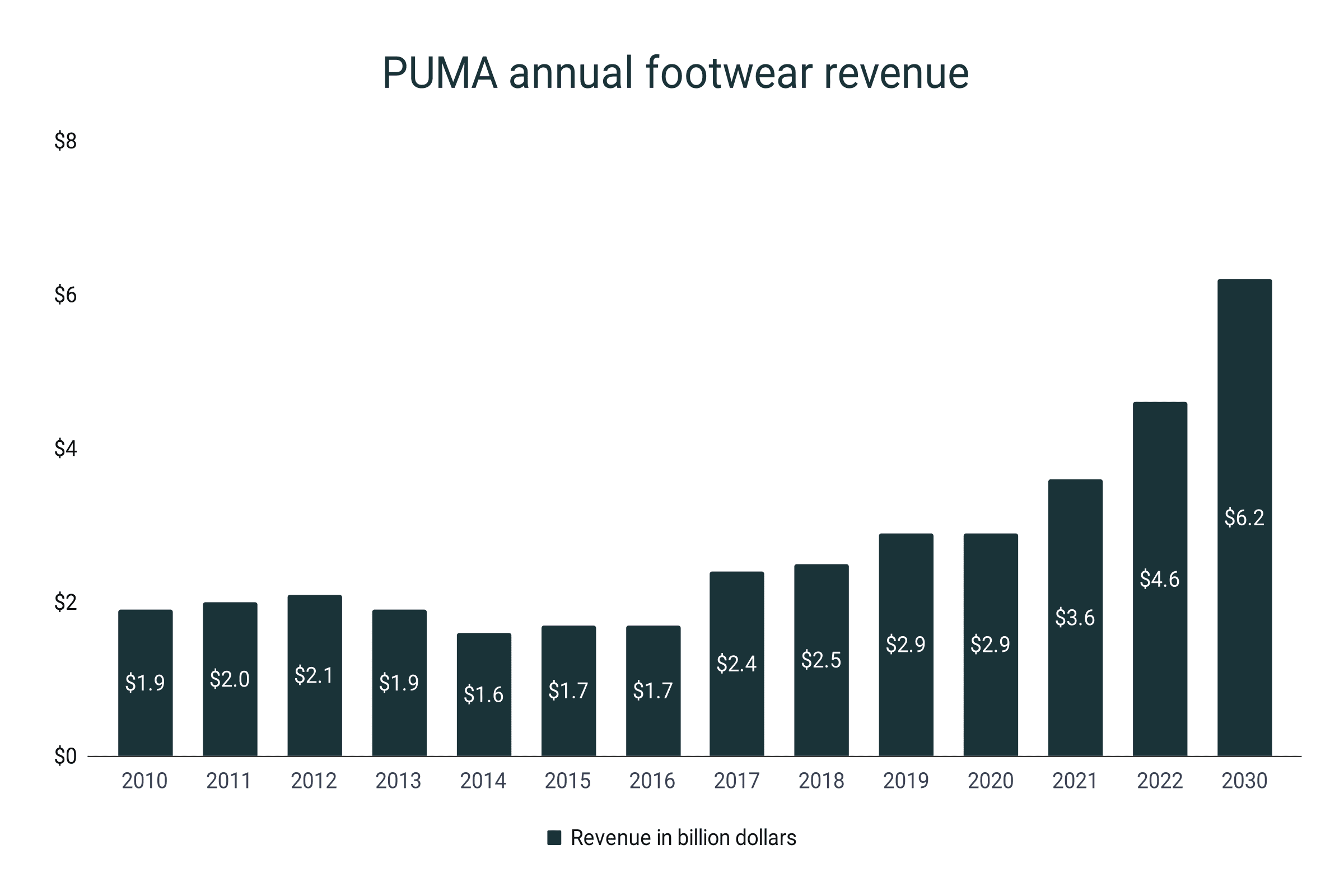

PUMA shoe revenue

- PUMA closed the 2022 fiscal year with a strong $4.6 billion revenue in its footwear segment.

- The previous year, it scored $3.6 billion in revenues. The year-on-year growth is 28.8% from 2021 to 2022.

- Interestingly, PUMA was able to sustain its output despite the pandemic. From 2019 to 2020, the shoe brand generated $2.9 billion in revenues (plus: a 1.7% growth!).

- Since 2014, PUMA has seen an upward trajectory in its total shoe revenue. From $1.6 billion in 2014, it has ballooned by 187.5% in 2022.

- The greatest jump happened between 2016-17. From a $1.7 billion output, the shoe company pumped a $2.4 billion total, equivalent to a 40.9% increase.

- However, during the 2013 and 2014 fiscal years, PUMA’s shoe revenue experienced consecutive 10.9% and 17% losses, respectively.

- In 2010, the brand’s revenue from its footwear segment amounted to $1.9 billion. Thus, it experienced a whopping 142.1%

- This is equivalent to a compound annual growth rate of 7.6%.

- If the trend continues, PUMA will breach the $6 billion point by 2030.

PUMA annual footwear revenue

|

Year |

Revenue in billion dollars |

Growth |

|

2010 |

$1.9 |

|

|

2011 |

$2.0 |

5.3% |

|

2012 |

$2.1 |

6.0% |

|

2013 |

$1.9 |

-10.9% |

|

2014 |

$1.6 |

-17.0% |

|

2015 |

$1.7 |

5.8% |

|

2016 |

$1.7 |

3.6% |

|

2017 |

$2.4 |

40.9% |

|

2018 |

$2.5 |

3.7% |

|

2019 |

$2.9 |

14.4% |

|

2020 |

$2.9 |

1.7% |

|

2021 |

$3.6 |

23.0% |

|

2022 |

$4.6 |

28.8% |

|

2030* |

$6.2 |

34.8% |

*projected

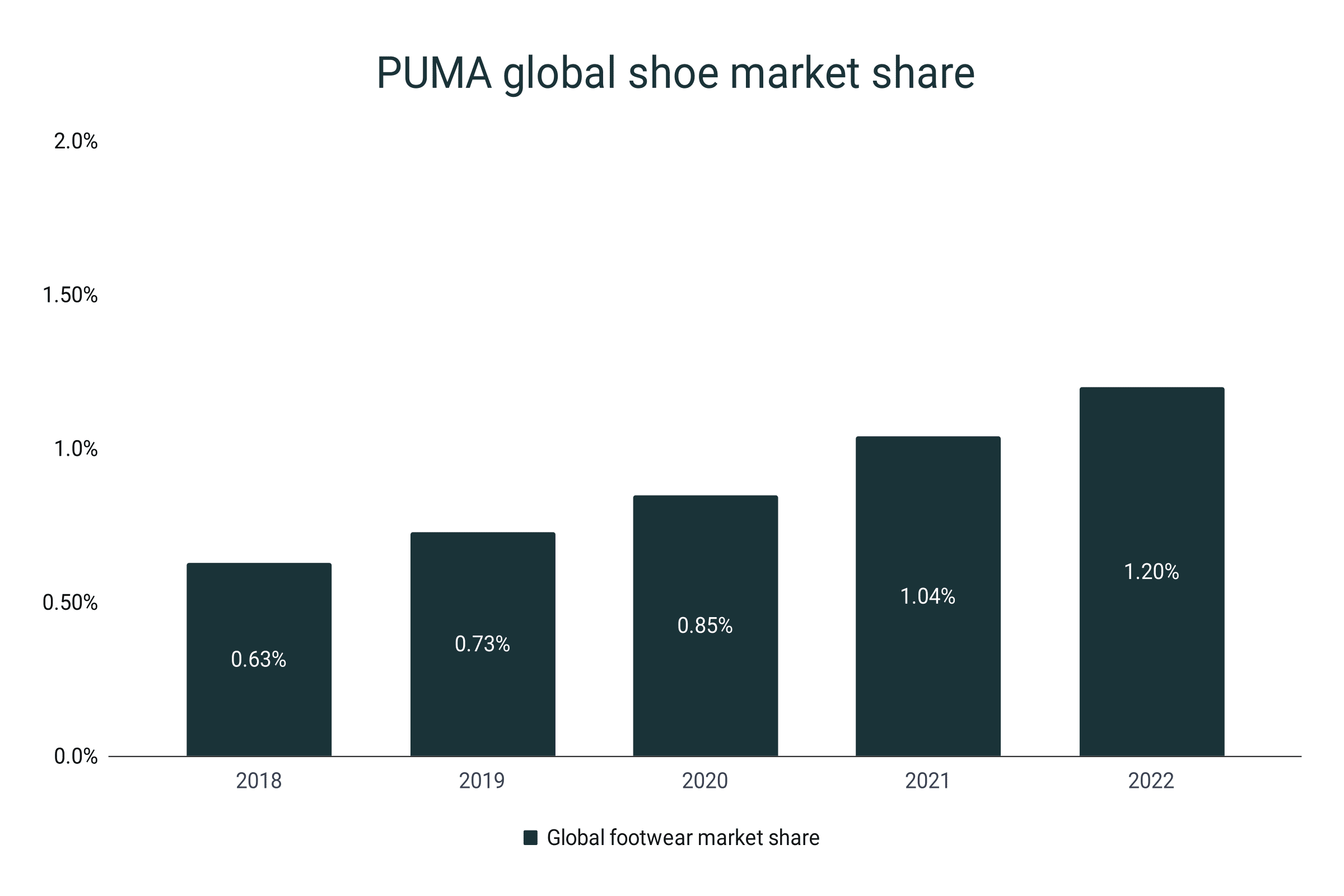

PUMA shoe market share

- As of 2022, PUMA held a 1.2% portion of the global footwear market.

- It is higher compared to the 1.04% showing in 2021.

- For the past five years, PUMA has enjoyed an increase in its global shoe market presence. From 0.63% in 2018, it has almost doubled its market share in 2022.

PUMA global shoe market share

|

Year |

Global footwear market share |

|

2018 |

0.63% |

|

2019 |

0.73% |

|

2020 |

0.85% |

|

2021 |

1.04% |

|

2022 |

1.20% |

- In the sneaker department, PUMA is one of the top market players with a 5.1% share.

- PUMA sports shoes also hold about 2.1% of the global athletic footwear market.

- The shoe brand also scored a 2% share in the running shoe market.

- Meanwhile, for the American football shoes, PUMA holds a 7% portion.

- Additionally, 10.9% of athletes are wearing the shoe brand’s American football cleats.

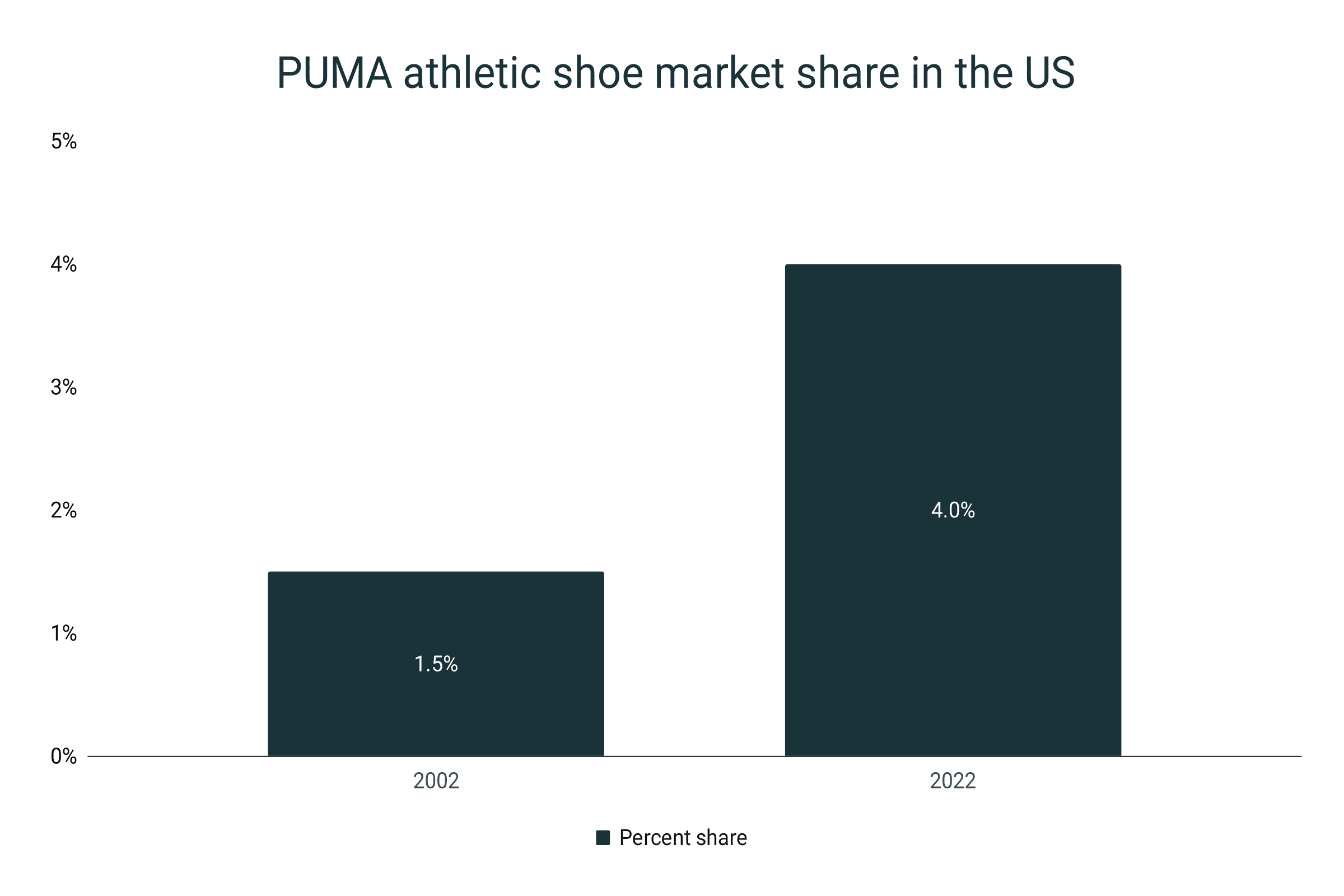

- In the United States, PUMA took a 4% portion of the athletic shoe market.

- Back in 2002, the brand’s market share was only 1.5%.

- Meaning, PUMA was able to widen its presence by 166.7% in two decades.

- The growth in the American footwear market is attributed to the expansion efforts of the German company to the United States. In 2021, they opened their 150,000-square-foot North American headquarters located at Assembly Row in Somerville, Massachusetts.

PUMA athletic shoe market share in the US

|

Year |

Percent share |

|

2002 |

1.5% |

|

2022 |

4% |

PUMA basketball shoe statistics

- PUMA’s basketball shoe sales took up about 27% of the brand’s entire footwear sales.

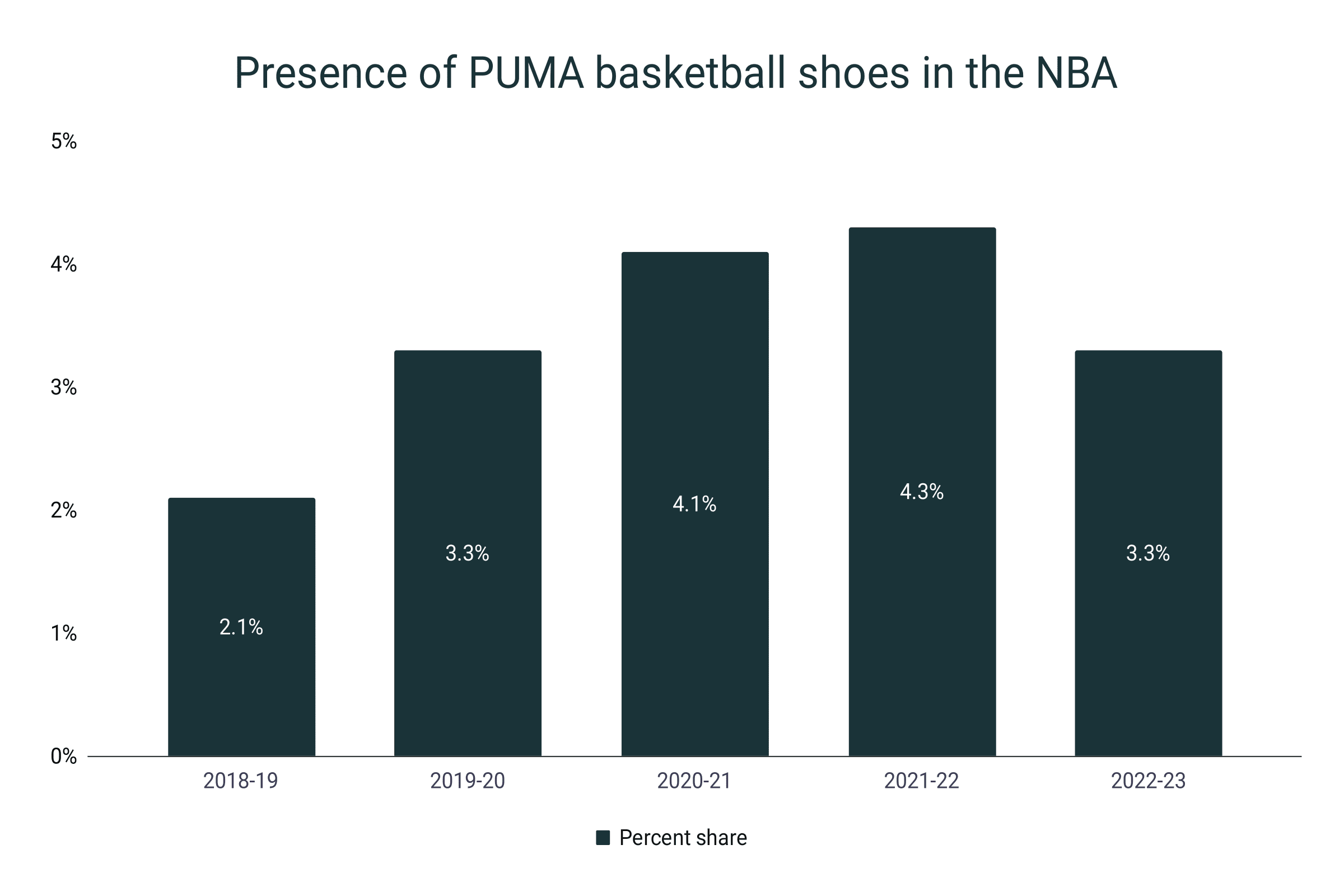

- Consequently, PUMA is the fourth biggest player in the National Basketball Association (NBA). Over the past five seasons, PUMA has averaged a 3.4% share.

- The company enjoyed a 3.3% share in the 2022-23 NBA season.

- The year prior, in 2021, PUMA registered its highest showing with a 4.3% portion of all NBA players.

- In the 2018-19 season, the brand’s share was at 2.1%. Compared to the brand’s current performance, its NBA presence enjoyed a 57.1% increase.

- PUMA Clyde All-Pro and Clyde Hardwood are two of the most popular choices among players. The All-Pro was worn by 10 players during the 2020-21 season. On the other hand, Hardwood was sported by 12 players during the 2019-20 NBA season.

Presence of PUMA basketball shoes in the NBA

|

Season |

Percent share |

|

2018-19 |

2.1% |

|

2019-20 |

3.3% |

|

2020-21 |

4.1% |

|

2021-22 |

4.3% |

|

2022-23 |

3.3% |

|

Ave. (2018-2023) |

3.4% |

PUMA shoe production

- PUMA reportedly produces 100,000 pairs of shoes per day.

- That is equivalent to more than 35 million pairs in a year.

- On average, a PUMA shoe weighs 8.3 oz (235.3g).

- According to PUMA, nearly 50% of its golf shoes are manufactured in China and Vietnam.

- Additionally, about 5.5% of all PUMA shoes in the USA are imported from Vietnam.

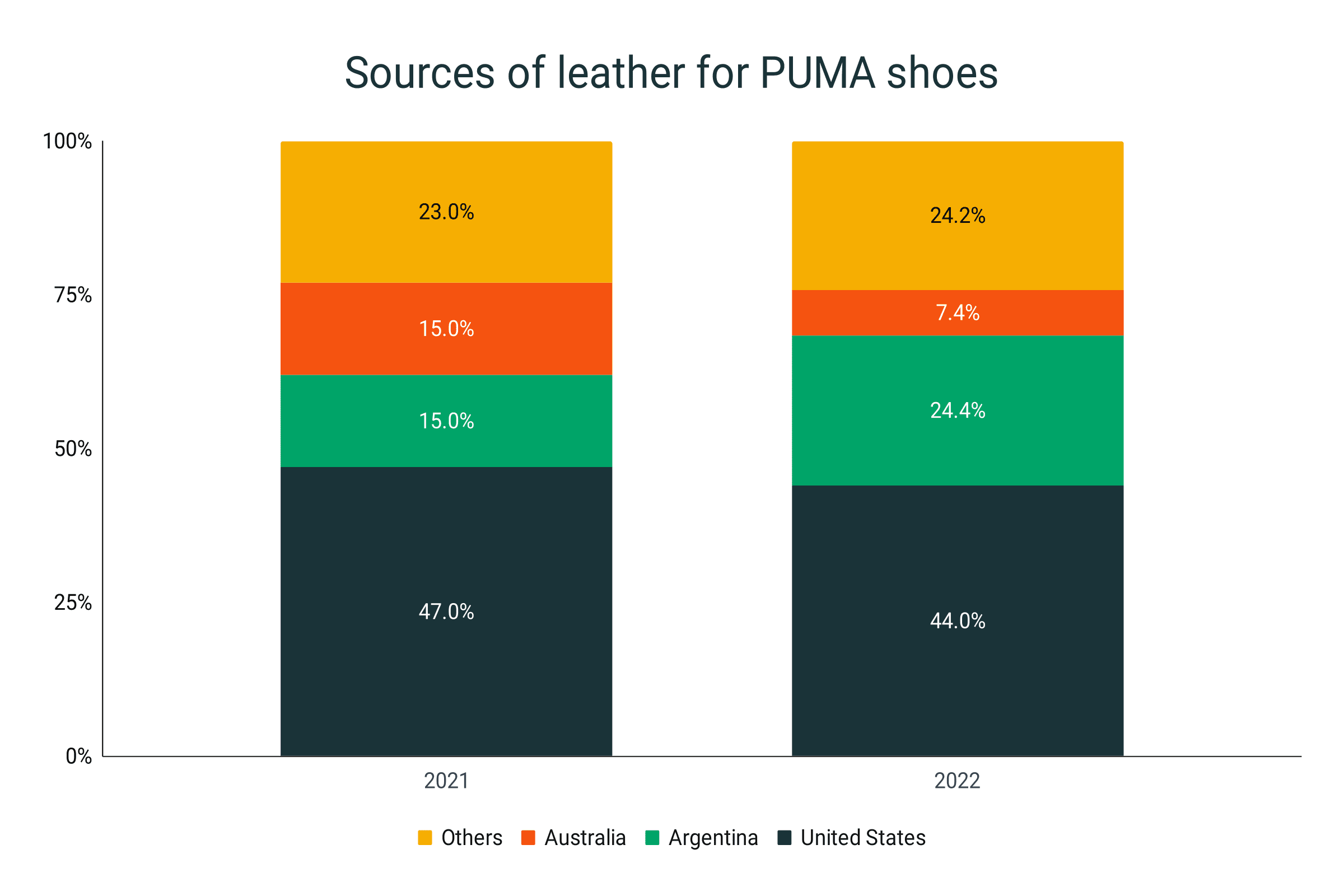

- However, in terms of raw materials, the United States is the primary source of leather for PUMA. The company sourced 44% of its leather from the country in 2022.

- In 2021, 47% was from the US.

- Argentina is the second main source of leather with 24.4% in 2022 and 15% in 2021.

- The third biggest supplier of leather is Australia with 7.4% and 15% in 2022 and 2021, respectively.

Sources of leather for PUMA shoes

|

Year |

United States |

Argentina |

Australia |

Others |

|

2021 |

47% |

15% |

15% |

23% |

|

2022 |

44% |

24.4% |

7.4% |

24.2% |

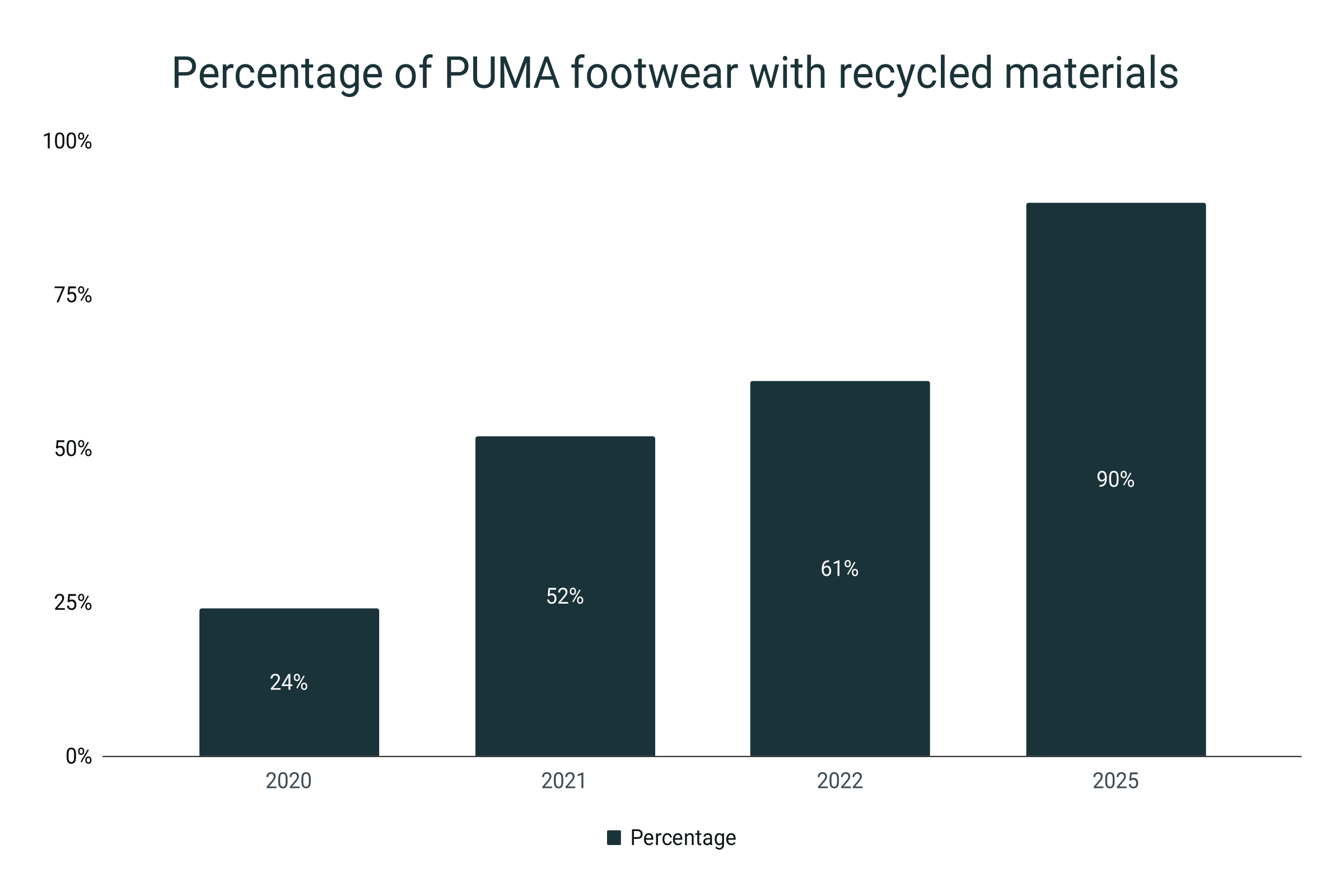

PUMA shoe sustainability

- 61% of PUMA footwear in 2022 was manufactured with a sustainable and/or recycled component.

- This is a significant increase from the 52% figure in 2021.

- In 2020, only 24% of the shoes produced by PUMA have sustainable materials.

- The company targets that by 2025, at least 90% of its footwear products will be manufactured with sustainable and recycled materials.

Percentage of PUMA footwear with recycled materials

|

Year |

Percentage |

|

2020 |

24% |

|

2021 |

52% |

|

2022 |

61% |

|

2025* |

90% |

*Company target

- As of 2022, PUMA was able to increase its utilisation of recycled polyester to 40.6%. Previously, it marked a 32% usage in 2021.

- For recycled cotton, however, the company dropped to a 2.4% utilisation.

- In 2021, the shoe brand used recycled cotton for 4% of its products.

- The drop is attributed to the company’s switching back to conventional cotton in 2022. It accounted for 93.7% of the cotton the company used.

Recycled material usage in PUMA

|

2021 |

2022 |

|

|

Recycled cotton |

4% |

2.4% |

|

Recycled Polyester |

32% |

40.6% |

- PUMA targets to use 100% certified recycled cardboard on its packaging by 2025.

- As of 2021, the company was able to reach 88% utilisation.

- Additionally, PUMA reported that it sourced 99.9% of its leather from LWG-certified tanners.

- The company also achieved 100% reliance on RDS-certified down feathers in 2020.

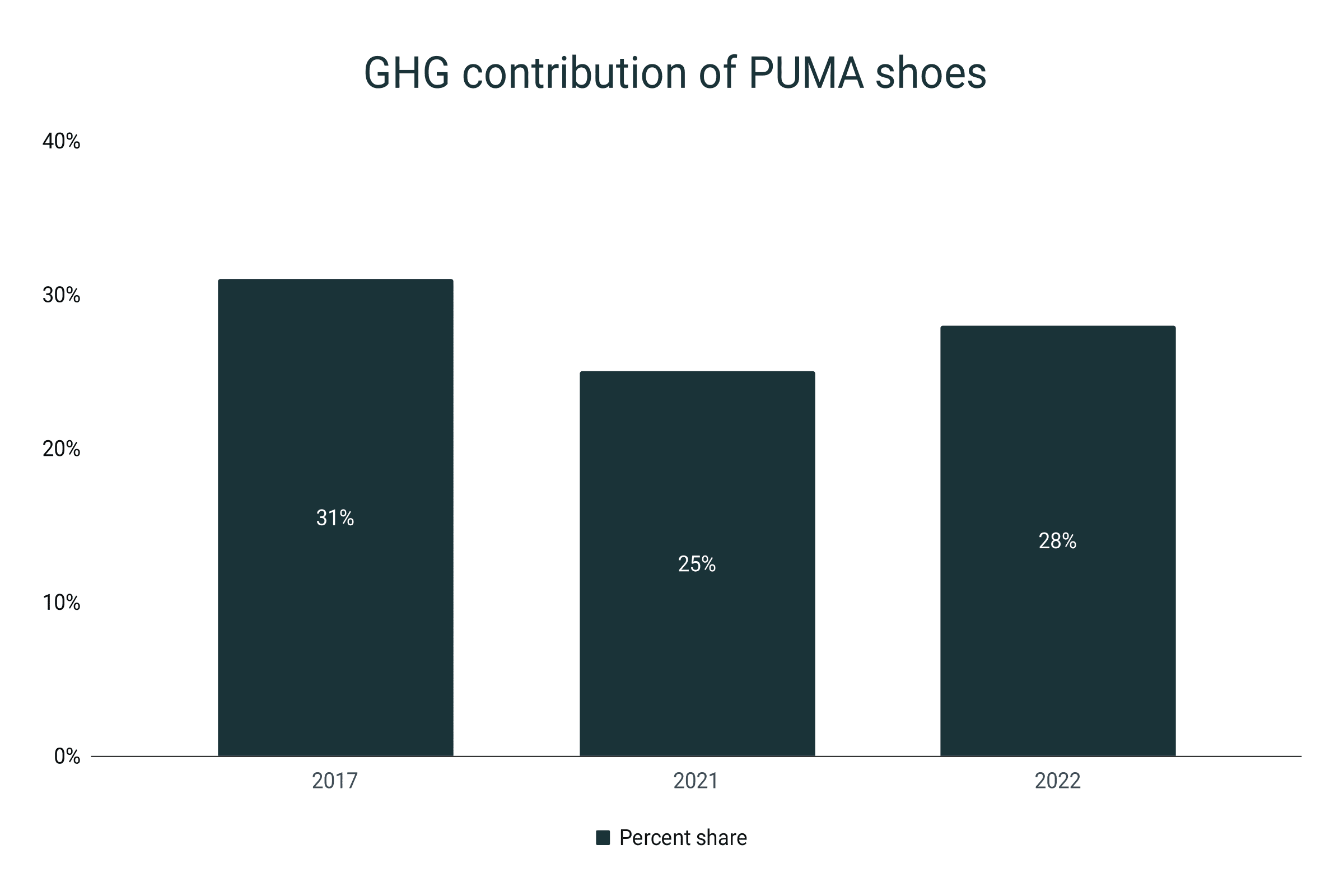

- In terms of greenhouse gas (GHG) contribution, PUMA recorded that 28% of its emissions are from manufacturing shoes.

- The percent share of the footwear department in the GHG output is about 25%.

- Way back in 2017, 31% of PUMA’s GGHG emissions were due to its footwear segment.

Greenhouse gas contribution (GHG) of PUMA shoes

|

Year |

Percent share |

|

2017 |

31% |

|

2021 |

25% |

|

2022 |

28% |

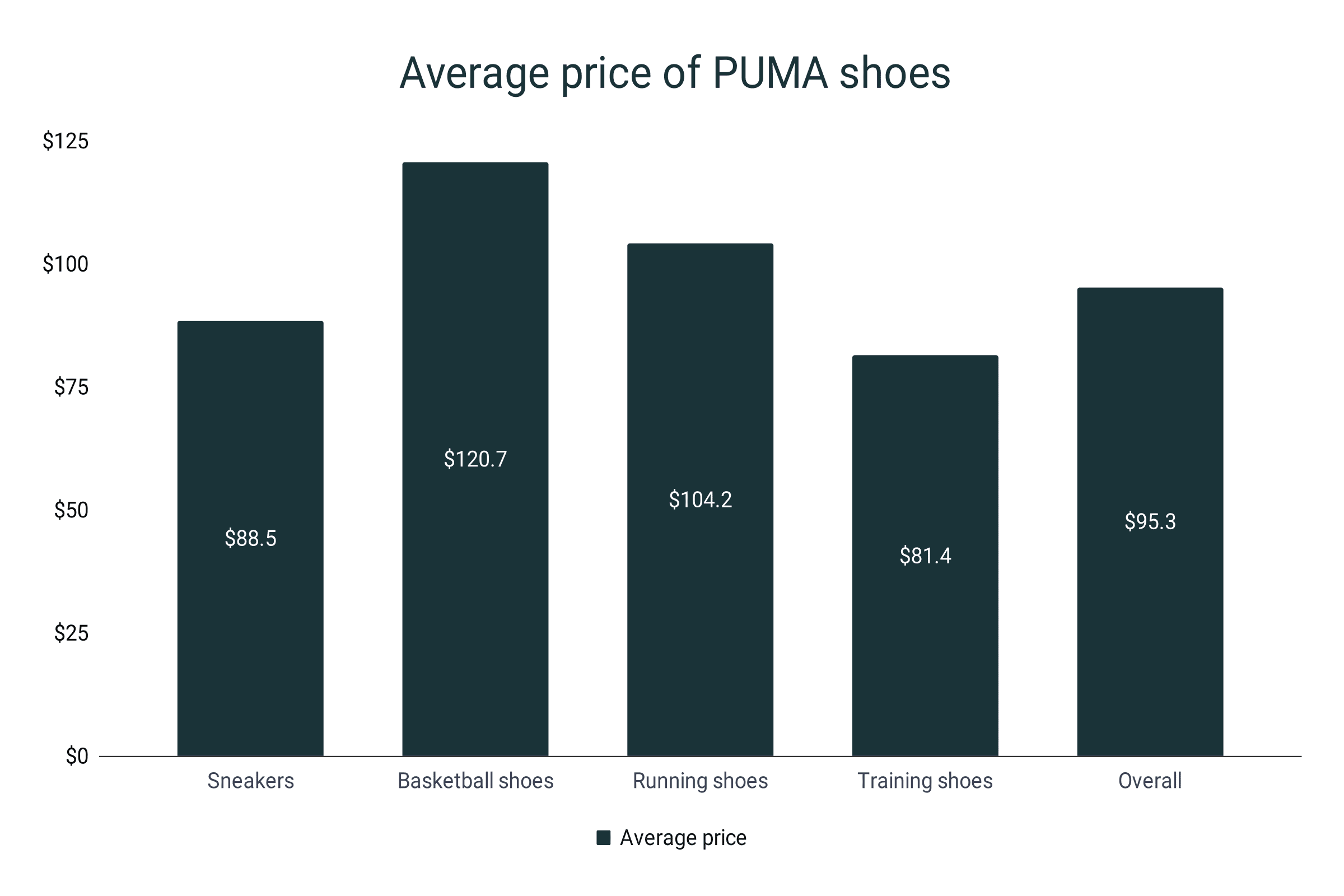

Average PUMA shoe prices in 2023

- Based on the RunRepeat database, the average price of all PUMA footwear products is $95.3.

- Basketball shoes are some of the most expensive PUMA products. They cost about $120.7 a pair.

- The mean price of a PUMA running shoe, on the other hand, is $104.2.

- Below the average line are the trainers and training shoes with price tags of $88.5 and $81.4, respectively.

- Meaning, a PUMA basketball shoe is 26.7% more expensive than the average PUMA shoe.

- Moreover, their training shoes are 14.6% more affordable than the average PUMA kicks.

Average price of PUMA shoes

|

Type |

Average price |

|

Trainers |

$88.5 |

|

Basketball shoes |

$120.7 |

|

Running shoes |

$104.2 |

|

Training shoes |

$81.4 |

|

Overall |

$95.3 |

PUMA shoes’ popularity among consumers

- In 2019, PUMA was able to increase its women user share to 48%.

- Two years ago, the women's market share in PUMA was only 36%.

- Thus, PUMA was able to pump its women end-user segment by 33.3% in just two years.

- Consequently, the men’s end-user segment of the company is still dominant at 64% and 52% for 2017 and 2019, respectively.

Men vs. women end-user segment of PUMA

|

Gender |

2017 |

2019 |

|

Men |

64% |

52% |

|

Women |

36% |

48% |

- Data from 2022 reported that PUMA enjoyed a 92% brand awareness among US shoppers

- In popularity, however, the shoe company fared at 32%.

- 21% of the American population uses PUMA footwear products.

- About 14% are loyal to the brand.

PUMA shoe brand awareness, popularity, usage, and loyalty in the US

|

Parameter |

Percentage |

|

Awareness |

92% |

|

Popularity |

32% |

|

Usage |

21% |

|

Loyalty |

14% |

Sources

https://about.puma.com/en/investor-relations/financial-reports

https://bashabearsbasketball.com/what-percent-of-puma-footwear-sales-are-basketball-shoes/

https://www.slideserve.com/armand-dyer/puma-commercial

https://ivypanda.com/essays/planning-an-integrated-marketing-communications-campaign/

https://www.openpr.com/news/2522197/global-footwear-market-emerging-trends-major-key-players

https://rubbersoles.wordpress.com/tag/market-share/

https://www.nbcnews.com/id/wbna11026473

https://lebasic.com/wp-content/uploads/2016/06/BASIC-ESE_Foul-PLay-Report_2016_Final-1.pdf

https://www.statista.com/statistics/278834/revenue-nike-adidas-puma-footwear-segment/

https://priceonomics.com/how-much-do-shoes-cost-for-men-vs-women/

https://medium.com/@ScrapeHero/most-popular-shoe-brands-on-amazon-94e3c49252ba