PUMA business statistics

Top PUMA business statistics

- PUMA SE (PUM) is valued at €16.88 billion

- PUMA generates €5.23 billion of sales each year

- 96% of PUMA products are sourced or manufactured in Asia

- The three-person management board of PUMA, including the CEO, were paid a combined €2.2 million in 2020, less than 5% of the Nike CEO’s total compensation in 2020

- PUMA spend €1 billion per year on marketing and retail expenses

PUMA financial statistics

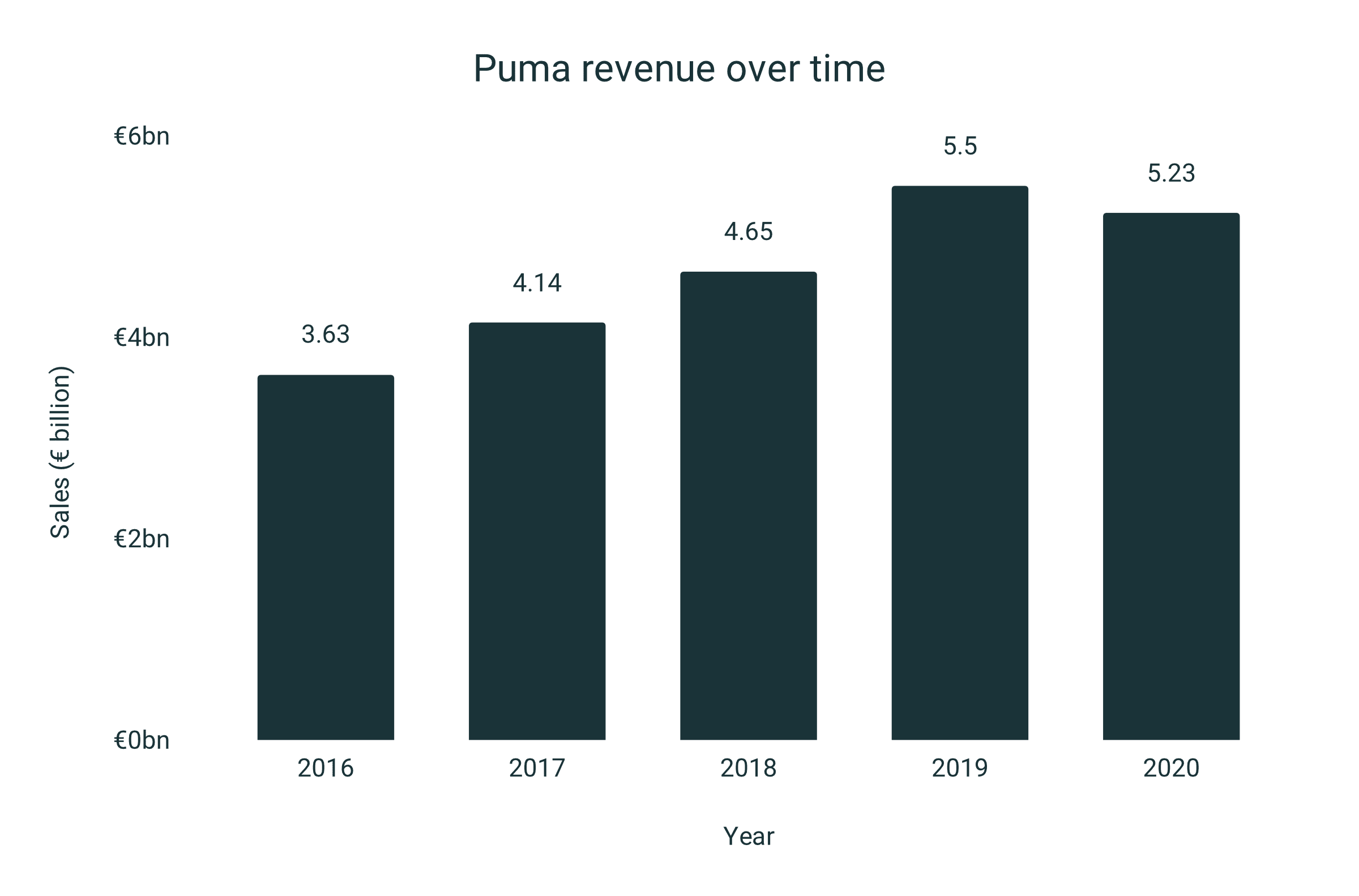

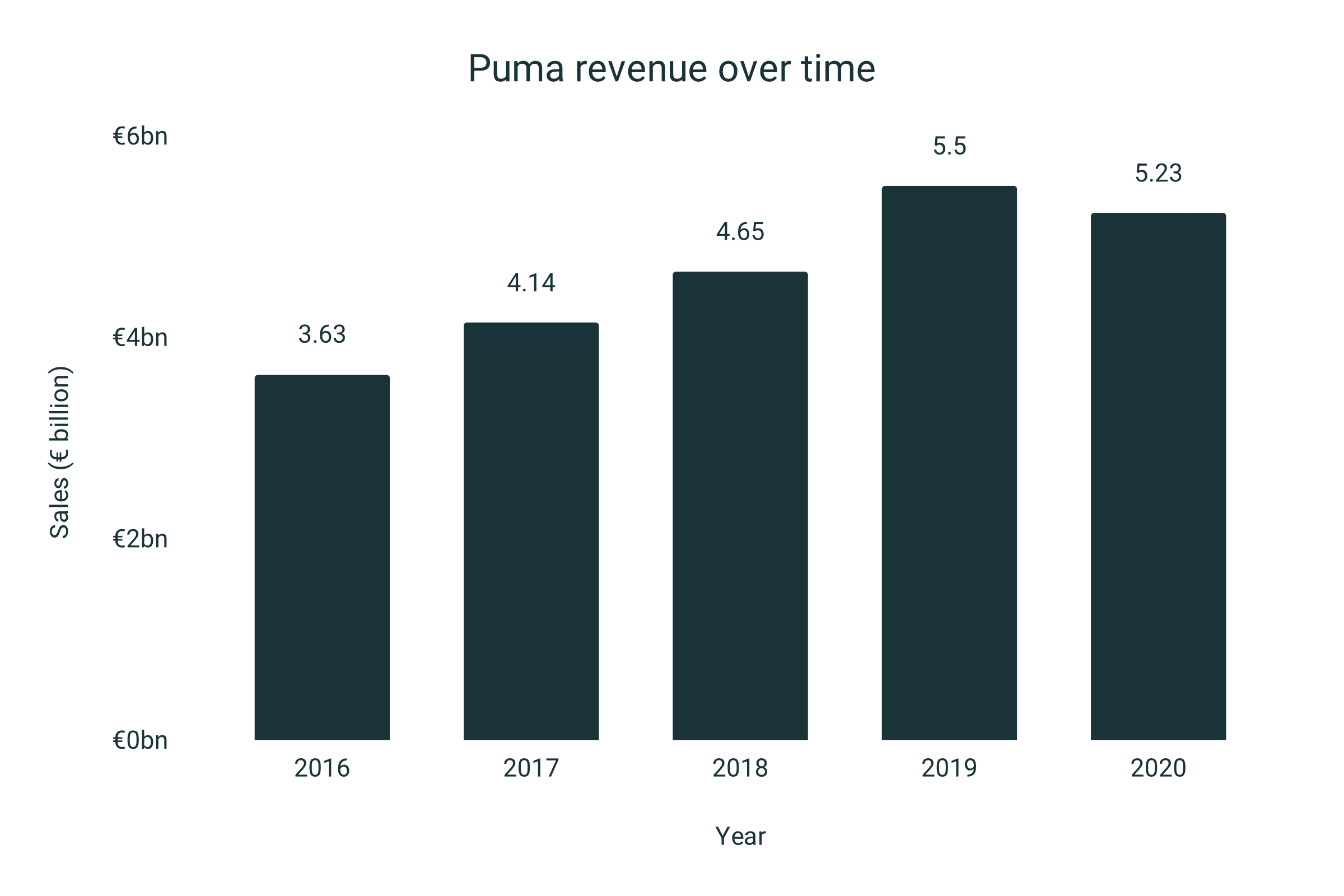

- PUMA’s revenue in 2020 was €5.23 billion

- PUMA’s revenues grew 51.51% from 2016 to 2019 before their growth was interrupted by the pandemic in 2020

- In the 3rd quarter of 2020, PUMA had their best-ever quarter generating sales of €1.58 billion

- PUMA pay €39.2 million in taxes at a rate of 24.2%

PUMA sales by region

- PUMA sold €1.98 billion worth of product in their EMEA region (Europe, Middle East and Africa)

- PUMA generated sales of €1.77 billion in the Americas

- PUMA generated sales of €1.47 billion in the Asia-Pacific region

PUMA sales by channel

- PUMA’s wholesale revenue makes up 72.7% of all sales at €3.8 billion

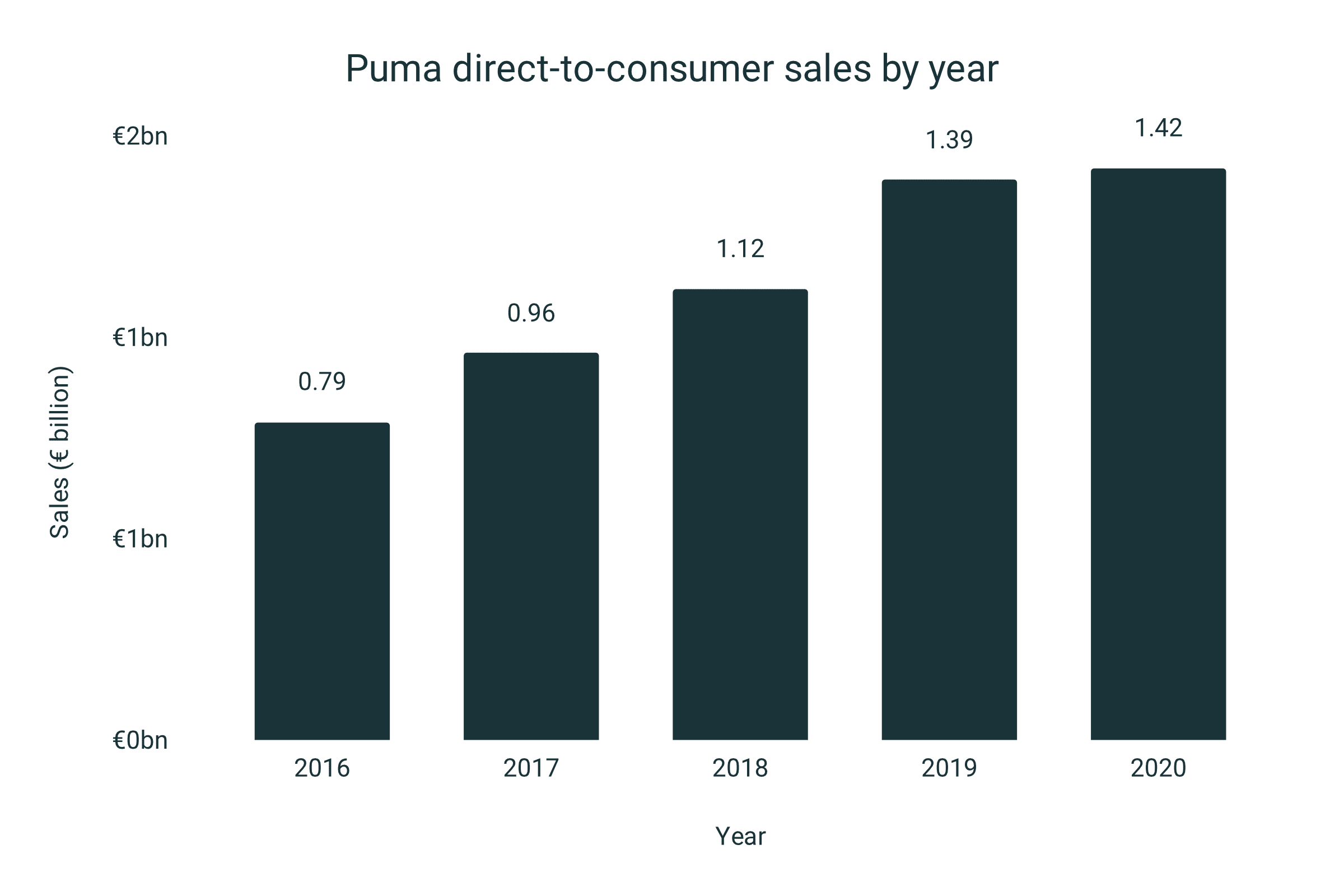

- PUMA’s direct-to-consumer sales make up 27.2% of all sales at €1.42 billion

- Direct to Consumer (Retail stores and e-commerce) increased by 6.4% despite the pandemic and sales at PUMA’s own retail stores declined

- This is due to the PUMA e-commerce business growing by over 60%

- PUMA’s direct-to-consumer sales have almost doubled since 2016, growing by 97.2%

- PUMA’s licencing income from ââroyalties and commissions decreased by 36% to €16.1 million

PUMA sales by product

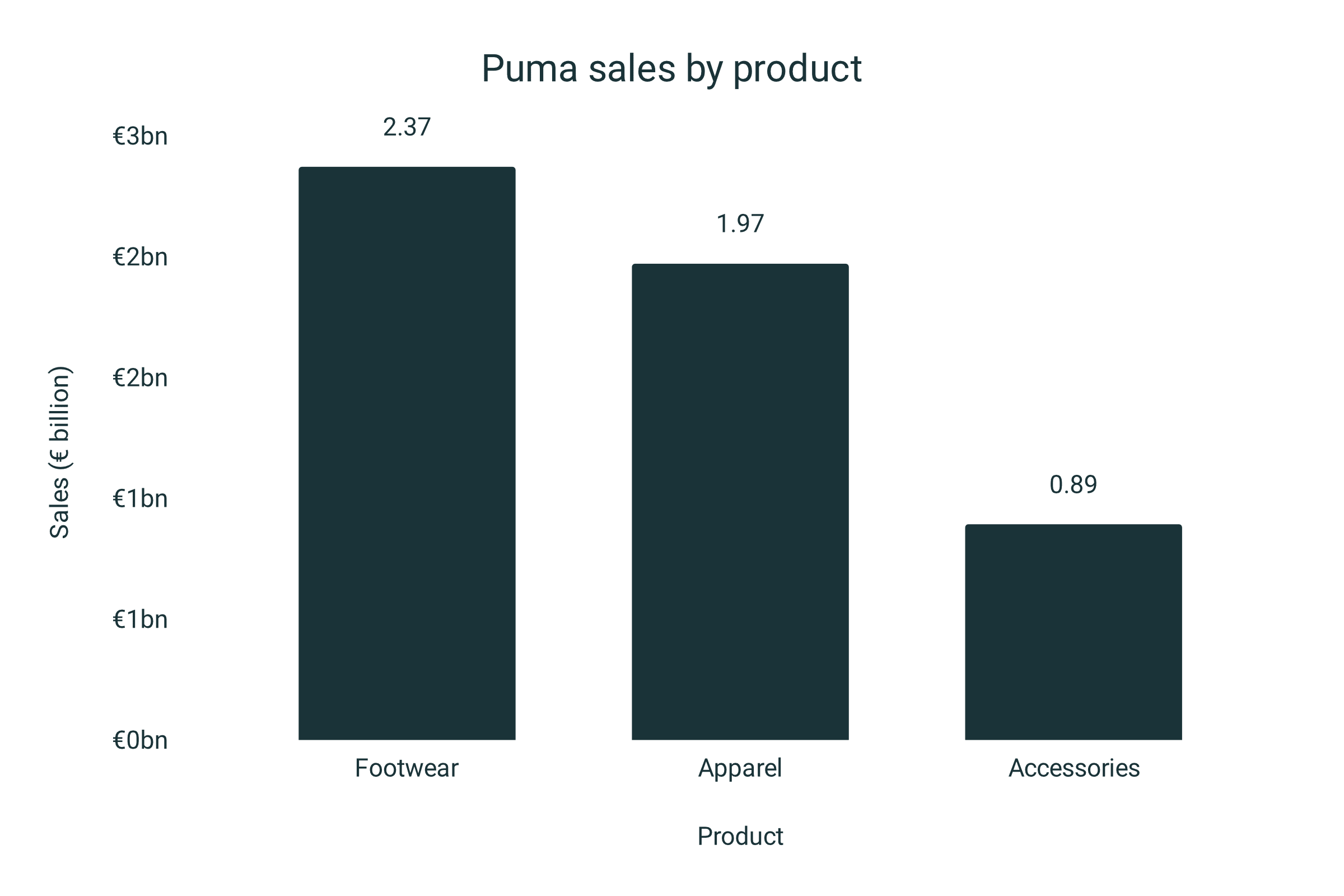

- Footwear makes up 45.2% of PUMA sales at €2.37 billion

- Apparel makes up 37.7% of PUMA sales at €1.97 billion

- Sales of PUMA accessories total €892 million

Covid-19’s impact on PUMA

- At the start of the pandemic, PUMA secured total credit lines of €1.8 billion

- €900 million of this was from KfW, the German state bank

- PUMA worked to protect suppliers, employee jobs, and wholesale retail partners

- Retail partners were offered delayed deliveries and extended payment terms

- Suppliers were asked to slow down production but not to cancel orders

- PUMA held more inventory in warehouses

- Less than 1% of all orders from suppliers were cancelled

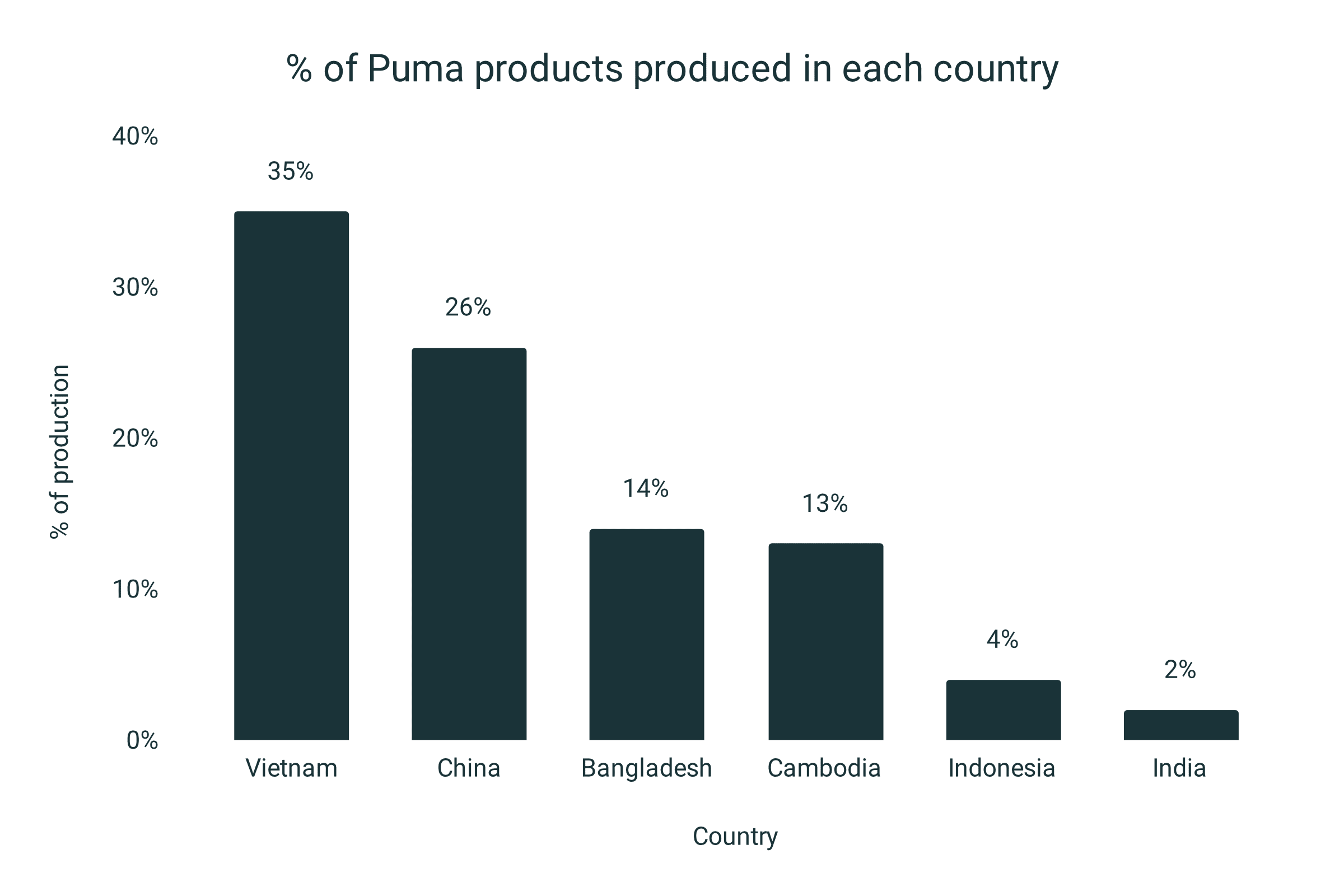

PUMA manufacturing and distribution

- PUMA outsources almost all of its production to 139 independent suppliers

- These suppliers are in 31 countries around the world

- 96% of PUMA products are sourced or manufactured in Asia

- 6 countries are responsible for 94% of all production

- Vietnam - 35%

- China - 26%

- Bangladesh - 14%

- Cambodia - 13%

- Indonesia - 4%

PUMA Sustainability

- 100% of the cotton used in PUMA products is “more sustainable”

- PUMA uses 650 tonnes of plastic shopping bags each year

- 400 tonnes in store

- 250 tonnes in product packaging

- Only 4.9% of these plastic bags contain recycled materials

- 81% of PUMA apparel contains at least 50% “more sustainable” material

- This compares to 47% of accessories and 24% of footwear being made of more than 50% more sustainable materials

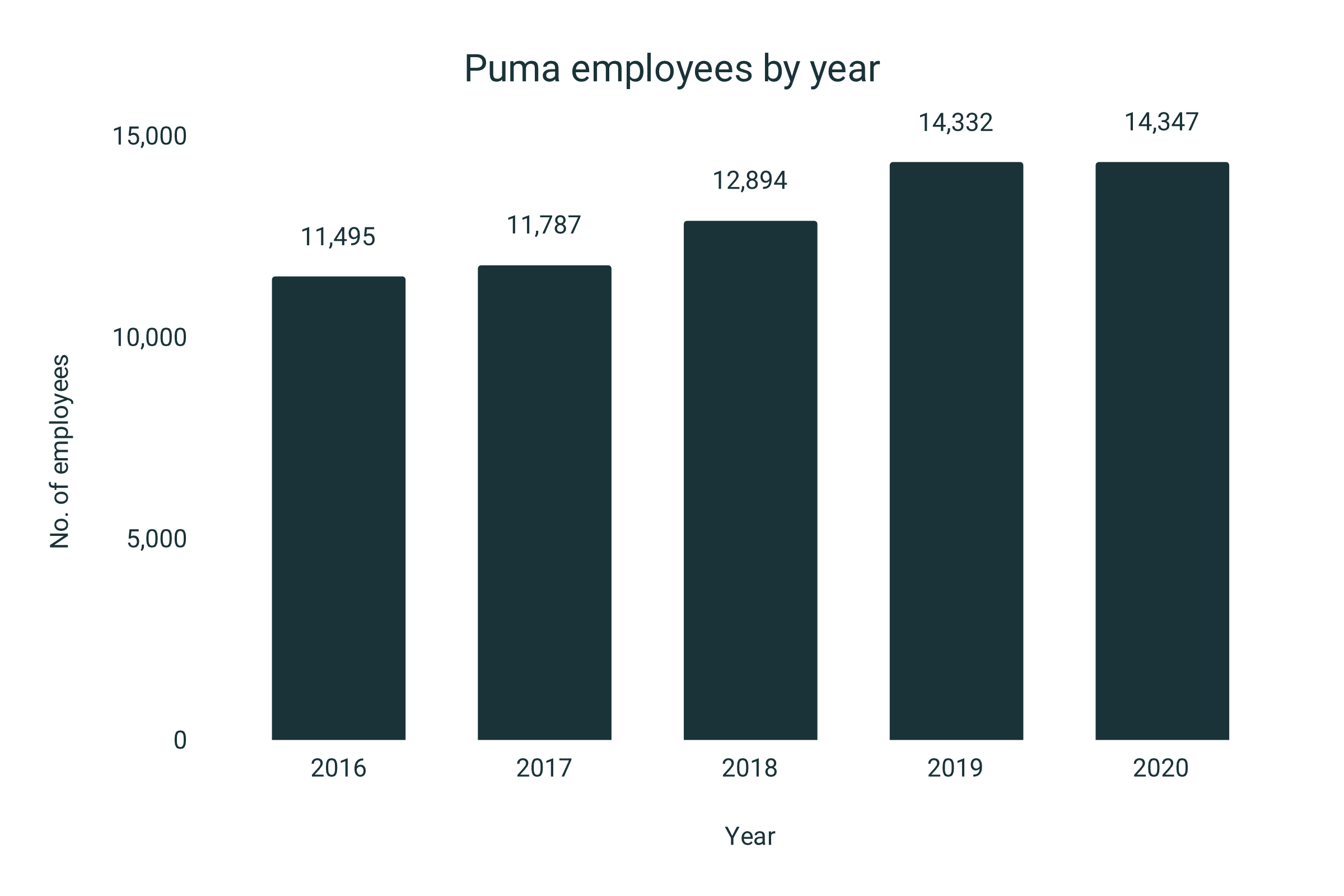

PUMA employee statistics

- PUMA has 14,347 employees

- PUMA spends €441.9 million wages and salaries each year

- The average salary for a PUMA employee is €30,743

- There is a 50% to 50% male-to-female ratio of employees across all locations in which PUMA operate

- 29% of PUMA employees are covered by a collective bargaining agreement

|

Department |

No. of Employees |

|

Marketing, retail and sales |

10,761 |

|

R&D |

1,049 |

|

Administration |

2,564 |

- The entire PUMA management board (3 members) were paid €2.2 million - working out at approximately €733,000 each if split equally

- This is less than 5% of the Nike CEO’s total compensation in 2020