Sneaker Resale Statistics

This report includes the latest facts, figures, and future projections on the sneaker resale industry.

Top sneaker resale statistics

- By the end of 2023, the entire sneaker resale industry will accumulate $11.5 billion in revenue, equivalent to 15.3% of the primary sneaker market.

- The used sneaker market will enjoy a compound annual growth rate of 16.4%, reaching $53.2 billion in total sales to cap 2032.

- The United States will continue as the major player in global secondary sneaker sales by ending 2023 with a $2 billion total revenue.

- Air Jordan and Nike dominate the sneaker resale market with a 71.3% combined market share in 2020.

- Adidas experienced a 27,800% growth in its secondary sneaker sales between 2014 and 2020.

- In 2020, online marketplaces are the most used channel for reselling trainers, raking up 50% of all transactions and a $3 billion revenue.

- The women's sneaker resale segment experienced a 41.1% spike from 1.6% in 2014 to 42.7% in 2022.

- The majority of secondary sneaker shoppers belong to the millennial age group (27-42), taking up approximately 80% of sneaker resale purchases.

- Balenciaga trainers are the most expensive trainers to resale with an average price tag of $699. Vans is the cheapest at $121.

- StockX will stay as the top sneaker resale platform with a $540.9 million revenue by 2023.

- Fight Club, on the other hand, is the fastest-growing reselling site after registering a 494% increase in annual sales in 2021.

- To date, Michael Jordan’s 1998 NBA Finals Air Jordan 13 is the most expensive sneaker ever to be resold. It fetched $2.2 million in an April 2023 Sotheby auction.

Sneaker resale market overview

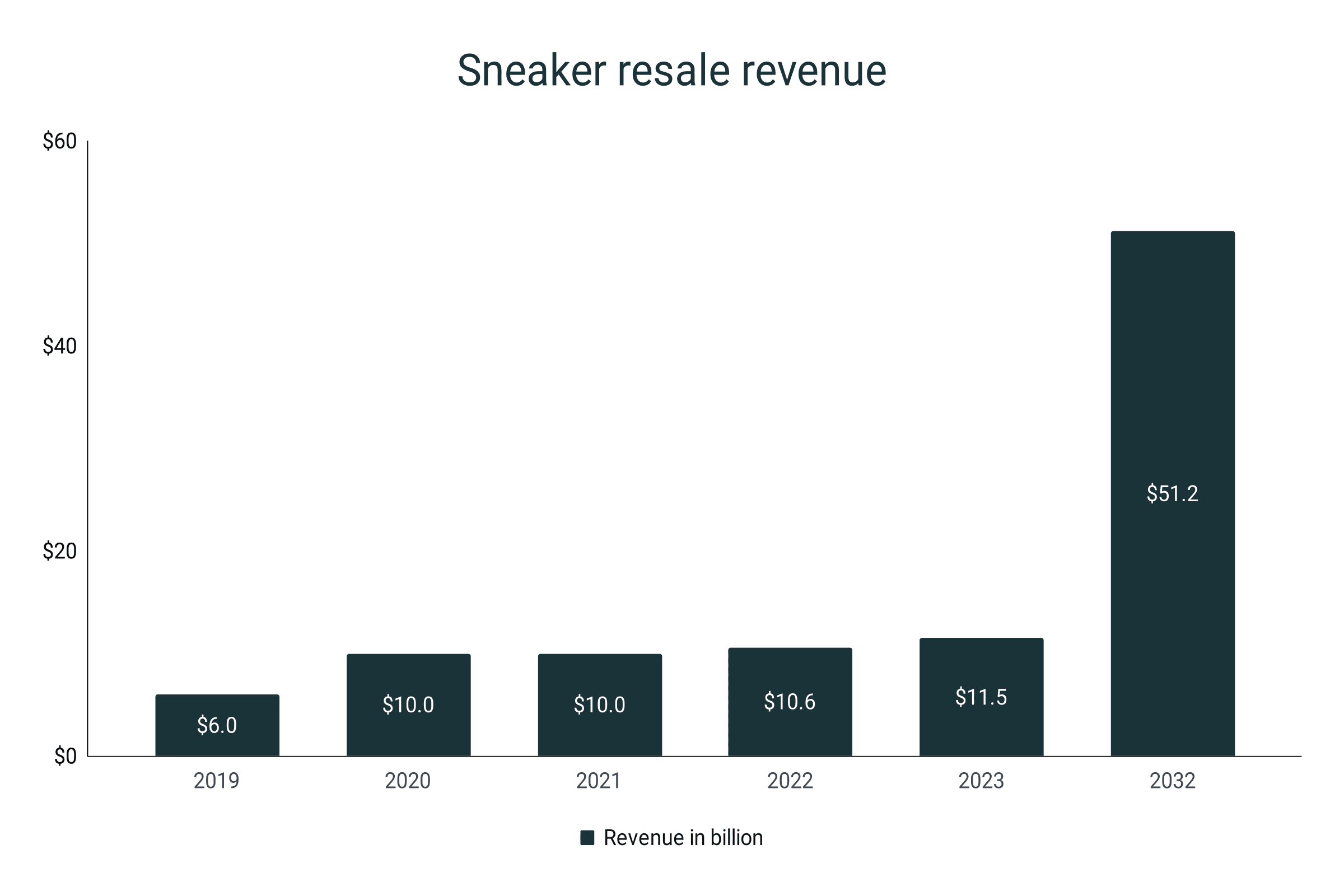

- The entire sneaker resale market is expected to cross the $11.5 billion mark by the end of 2023.

- In 2023, the used sneaker market will rise by 8.55% compared to the $10.6 billion revenue in the previous year.

- As of 2022, the secondhand sneaker market is equivalent to 14.6% of the global sneaker industry. By 2023 it will be relatively 15.3% of the primary sneaker market.

- The sneaker resale market is approximately 6% of the global secondhand apparel and resale industry which is valued at $177 billion in 2022.

- By 2032, the secondary sneaker revenue is projected to reach $51.2 billion, signifying a 16.4% CAGR.

- With a 10-year gap between 2022 and 2032, the sneaker resale market is projected to register a whopping 401.9% growth.

- In the United States, the total secondary sneaker market is expected to generate $2 billion worth of sales by the end of 2023.

- The US secondhand sneaker industry is also projected to balloon by $30 billion in 2030 with a 47.2% CAGR.

- The used sneaker industry in the US is expected to register a 1,400% growth by the end of 2030.

Sneaker resale revenue by year

|

Year |

Revenue in billion |

|

2019 |

$6 |

|

2020 |

$10 |

|

2021 |

$10 |

|

2022 |

$10.6 |

|

2023 |

$11.5 |

|

2032 |

$51.2 |

Sneaker resale revenue by region

- In the United States, the sneaker resale value is $2 billion in 2019, taking up more than a third of the entire reselling market in North America.

- By the end of 2023, the United States will rake up another $2 billion in revenue in the secondhand sneaker market.

- This will be equivalent to a 17.4% US share of the global sneaker resale revenue of 2023.

- China, on the other hand, reportedly reached $1 billion in secondary sneaker sales in 2019.

- The combined US and China sneaker resale market took up 28.3% of the global secondhand sneaker revenues in 2019.

- Mathematical models predict that the US used sneaker industry alone will generate $6 billion by the end of 2025, prompting the country to stay ahead of its competitors.

- According to StockX, 6 out of the 10 fastest-growing sneaker resale markets were from Europe. These countries are France, Italy, the United Kingdom, Spain, Germany, and the Netherlands.

- France experienced a 281% increase in buyer gross merchandise value (GMV) in 2019. Meanwhile, Italy showed an 830% rise in seller GMV in the same year.

- Germany also reported a +274% growth in the number of sneaker resellers in 2019.

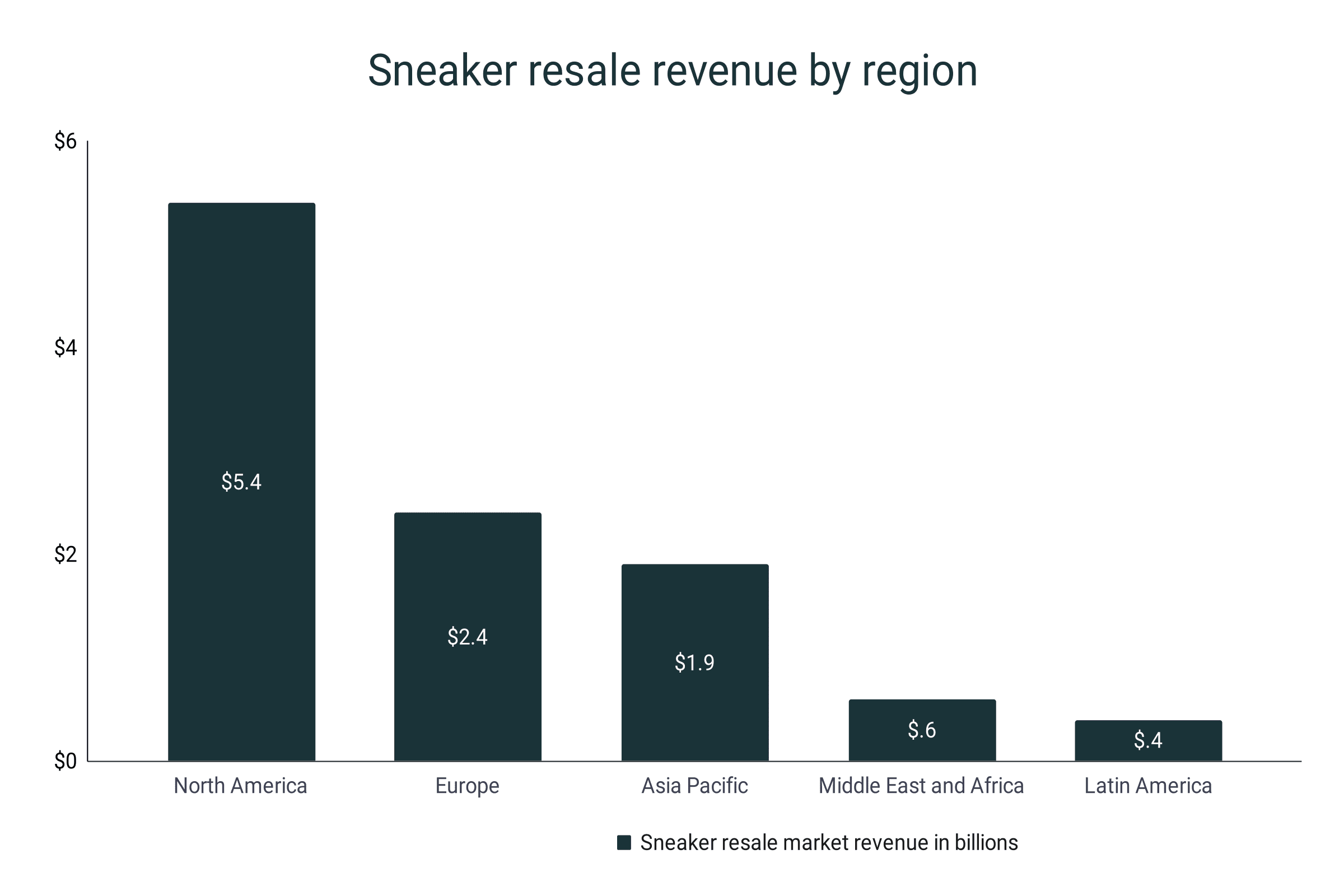

- In 2022, North America tallied $5.4 billion in revenue from secondhand trainers.

- It is followed by Europe and Asia Pacific with $2.4 billion and $1.9 billion, respectively.

- The combined revenues of the Middle East, Africa, and Latin America in sneaker reselling totaled $1 billion.

- In terms of market share, North America occupied 50.5% of the sneaker reselling industry in 2022.

- Europe trails at 22.7% market share in 2022.

- China-led Asia Pacific region took 17.5% of the entire secondary sneaker market.

- During this time, South Korea is the second fastest-growing resale market, registering a 210% increase in Nike sales.

- Middle East and Africa have a 5.6% of the 2022 sneaker resale industry. Qatar shone with a +1,486% Adidas sales.

- Latin America had the least share with 3.7%.

Sneaker resale revenue by region in 2022

|

Region |

Sneaker resale market revenue in billions |

Market share |

|

North America |

$5.4 |

50.5% |

|

Europe |

$2.4 |

22.7% |

|

Asia Pacific |

$1.9 |

17.5% |

|

Middle East and Africa |

$0.6 |

5.6% |

|

Latin America |

$0.4 |

3.7% |

Sneaker resale revenue by brand

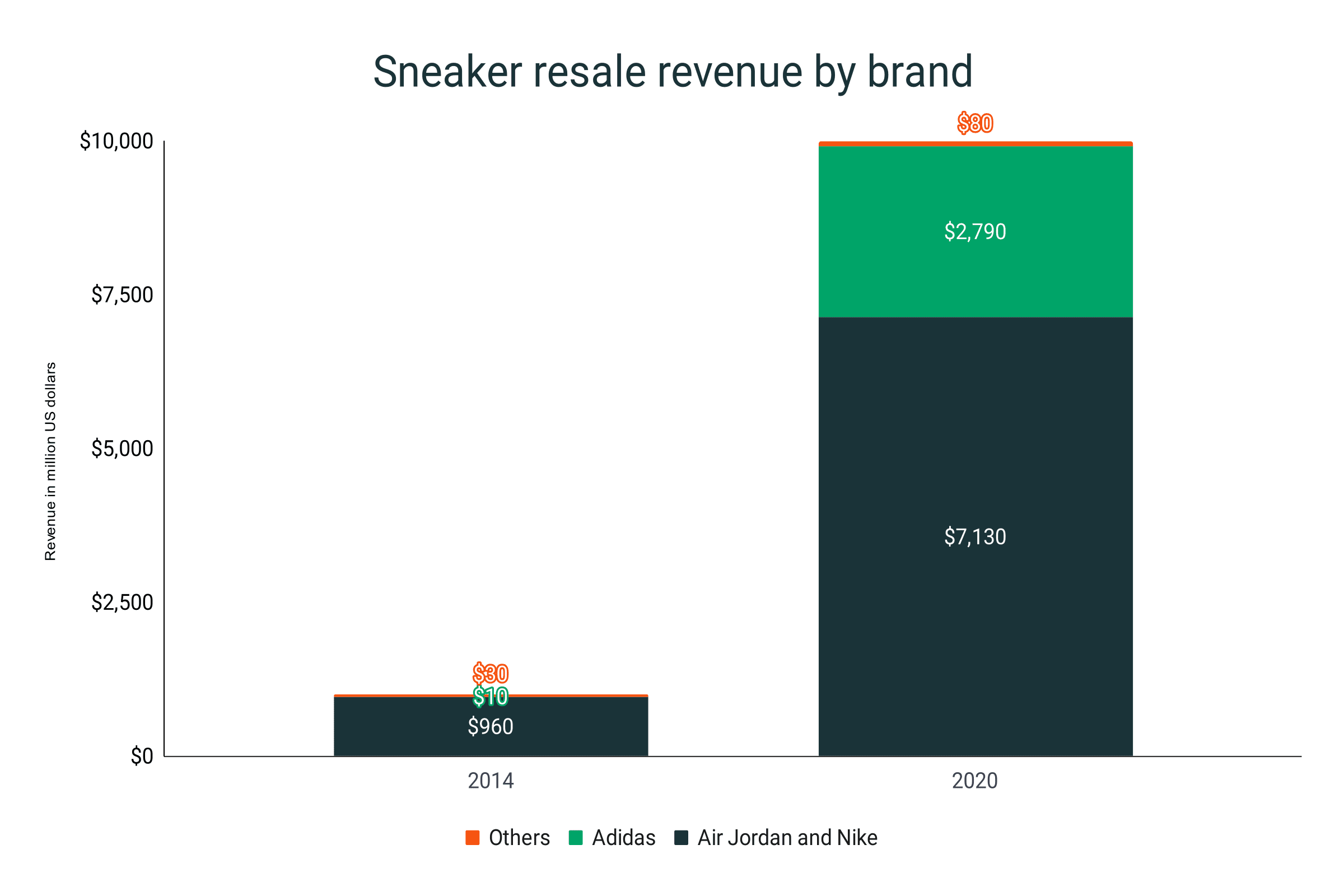

- Figures from 2020 secondary sneaker revenues show that the combined sales from Air Jordan and Nike amounted to $7.1 billion.

- Compared to the sales accumulated in 2014, the revenue has increased by a whopping 642.7%.

- This is also equal to a compound annual growth rate of 39.7%.

- Adidas is the second biggest sneaker resale brand with $2.8 billion in revenues.

- From 2014-2020, the company has grown its secondary market by a staggering 27,800%.

- Based on the calculation, the CAGR of Adidas resale is 155.6%. If this trend continues, Adidas will rake in $4.7 billion in secondhand sneaker revenues by the end of 2023.

- In 2020, the combined used sneaker revenues of all other shoe companies amounted to $80 million.

- This is equivalent to a 166.7% increase from 2014 to 2020.

Sneaker resale revenue by brand

|

Brand |

2014 |

2020 |

|

Air Jordan and Nike |

$960 million |

$7,130 million |

|

Adidas |

$10 million |

$2,790 million |

|

Others |

$30 million |

$80 million |

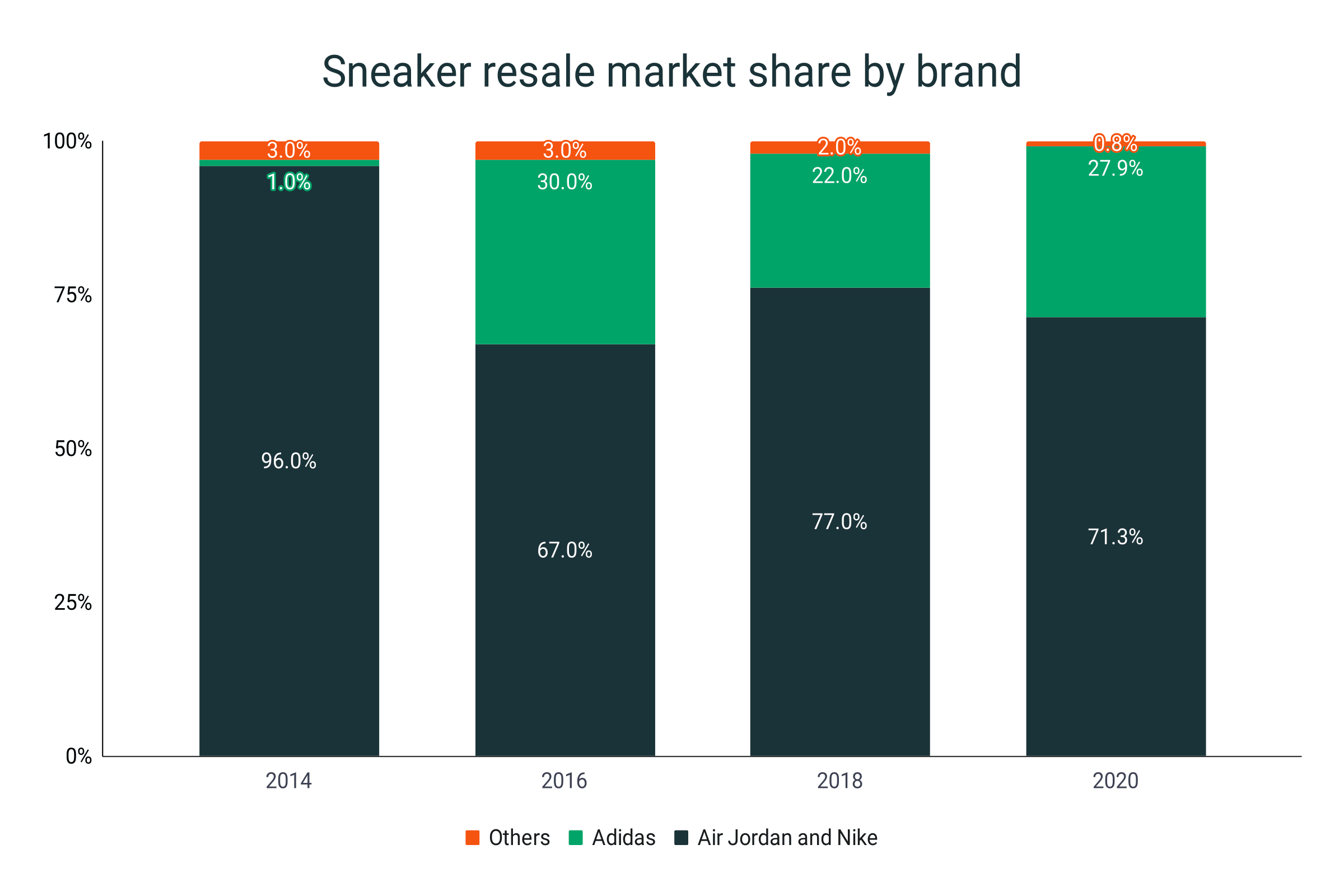

- Nike and Air Jordan comprise the majority of the resale market with a 71.3% share in 2020.

- This is a 5.7% dip compared to the 77% performance in 2018.

- Back in 2014, Nike and Air Jordan is 96% of the entire sneaker resale industry. This means their share has gone down by 24.7% by the end of 2020.

- Adidas capped 2020 with a 27.9% sneaker resale portion.

- A 5.9% increase from its 2018’s 22% market share.

- Adidas recorded its biggest slice in 2016, registering 30% of the entire secondhand sneaker market.

- Comparing the figures from 2014 to 2020, Adidas has grown its secondary sneaker market share by 26.9%.

- From 2014-2018, other sneaker brands are at a steady 2-3% share of the resale market. The figure dropped to 0.8% in 2020.

Sneaker resale market share by brand

|

Year |

Air Jordan and Nike |

Adidas |

Others |

|

2014 |

96% |

1% |

3% |

|

2016 |

67% |

30% |

3% |

|

2018 |

77% |

22% |

2% |

|

2020 |

71.3% |

27.9% |

0.8% |

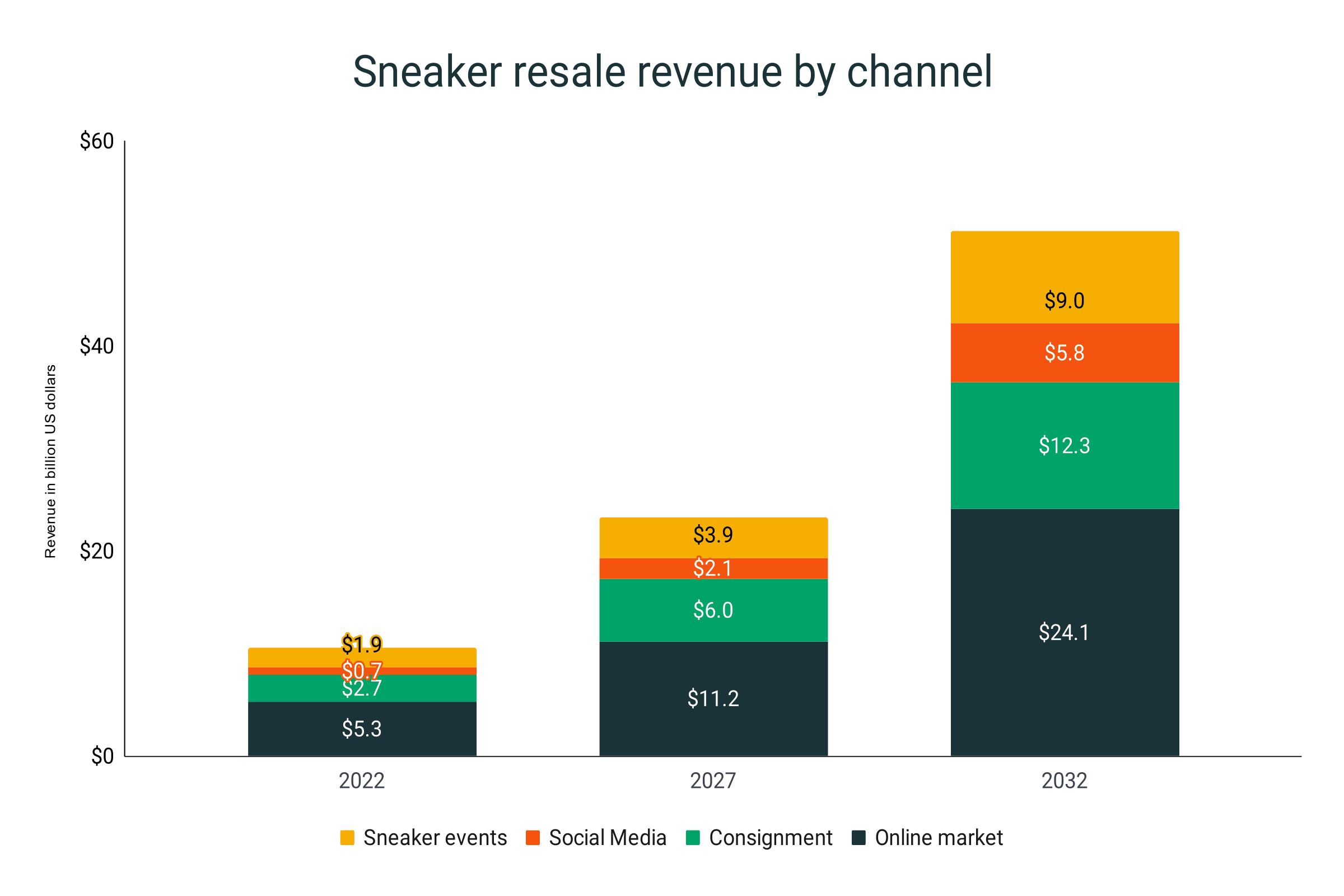

Sneaker resale channels

- Data on the 2020 secondary sneaker market reveals that online marketplaces take up 50% of the total revenues, amounting to $3 billion in revenues.

- This figure is expected to increase to $6.3 billion by 2027 and $12.9 billion by 2031.

- From 2022-2032, revenues from selling used trainers through online sites will experience a 330% growth.

- Consignments are the source of 25% of the entire secondhand sneaker revenues in 2022.

- By mathematical models, the entire revenue through resale consignments will be $3.4 billion by 2027.

- With $1.1 billion in sales, sneaker events cut an 18.3% slice of the secondary sneaker market.

- It is estimated to grow to $4.8 billion by 2032 but will only be occupying a 17.5% market share.

- Social media as a sneaker resale channel takes the least market share of 6.67% in 2020.

- Projections say that the total sales of used trainers through social media outlets will reach $1.2 billion in 2027 and $3.1 billion in 2032.

Sneaker resale by channel

| Year |

Online market |

Consignment |

Social Media |

Sneaker events |

|

2022 |

$5.3 |

$2.7 |

$0.7 |

$1.9 |

|

2027 |

$11.2 |

$6.0 |

$2.1 |

$3.9 |

|

2032 |

$24.1 |

$12.3 |

$5.8 |

$9.0 |

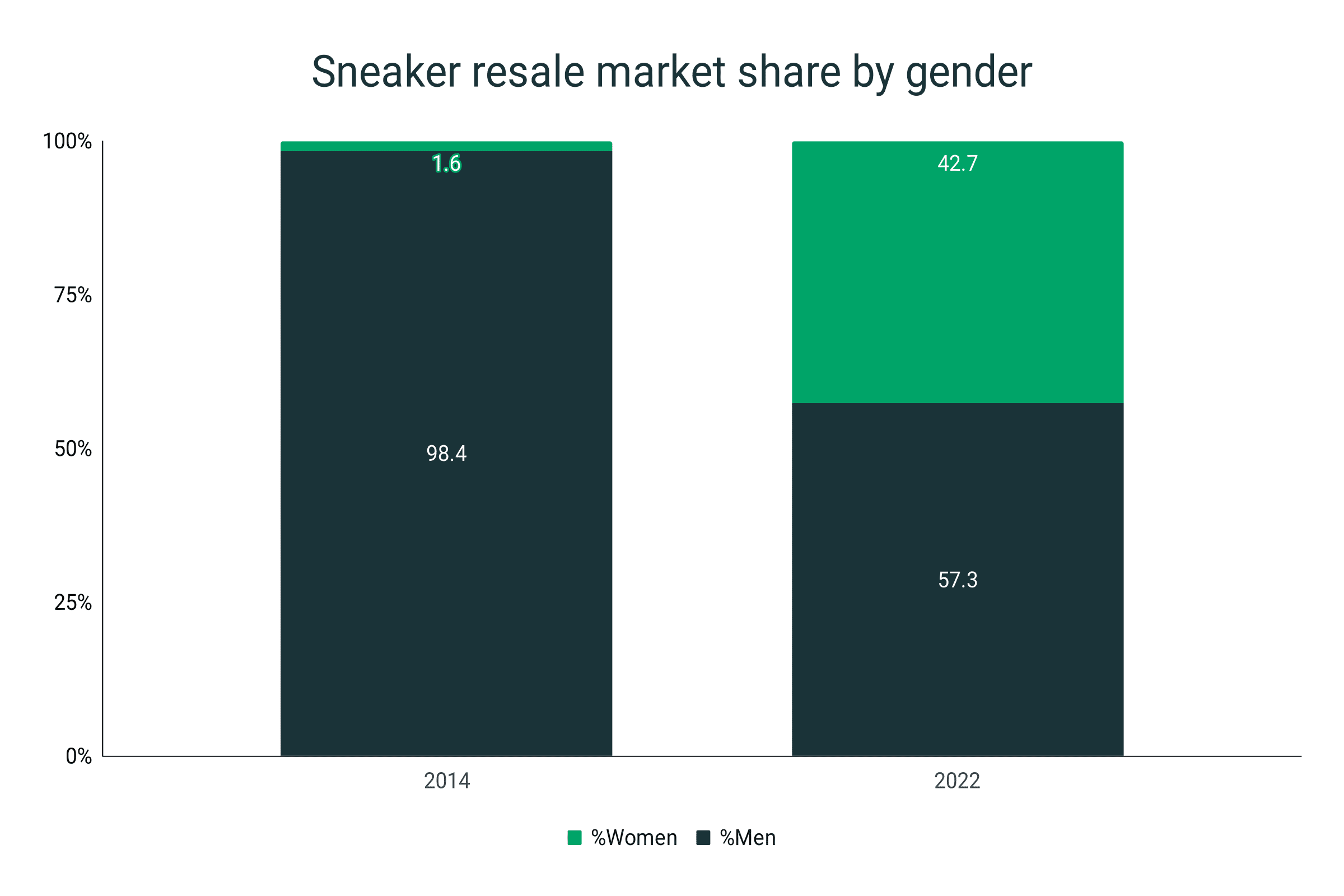

Sneaker resale consumer profile

- The used sneaker market in 2022 is dominated by men with a 57.1% share.

- Consequently, the women’s market portion is 42.2%.

- Back in 2014, the resale market is 98.4% for men generating $984 million in revenue.

- Meaning, between 2014 and 2022, the percentage of men in the sneaker market decreased by 41.1%.

- Meanwhile, the women end-user segment has grown by 41.1%.

- According to StockX, the current women’s resale is 1500 times greater than when the company started in 2015.

- Back in 2014, the women-generated sneaker resale revenue is worth $16 million.

Sneaker resale by gender

|

Year |

%Men |

%Women |

|

2014 |

98.4 |

1.6 |

|

2022 |

57.3 |

42.7 |

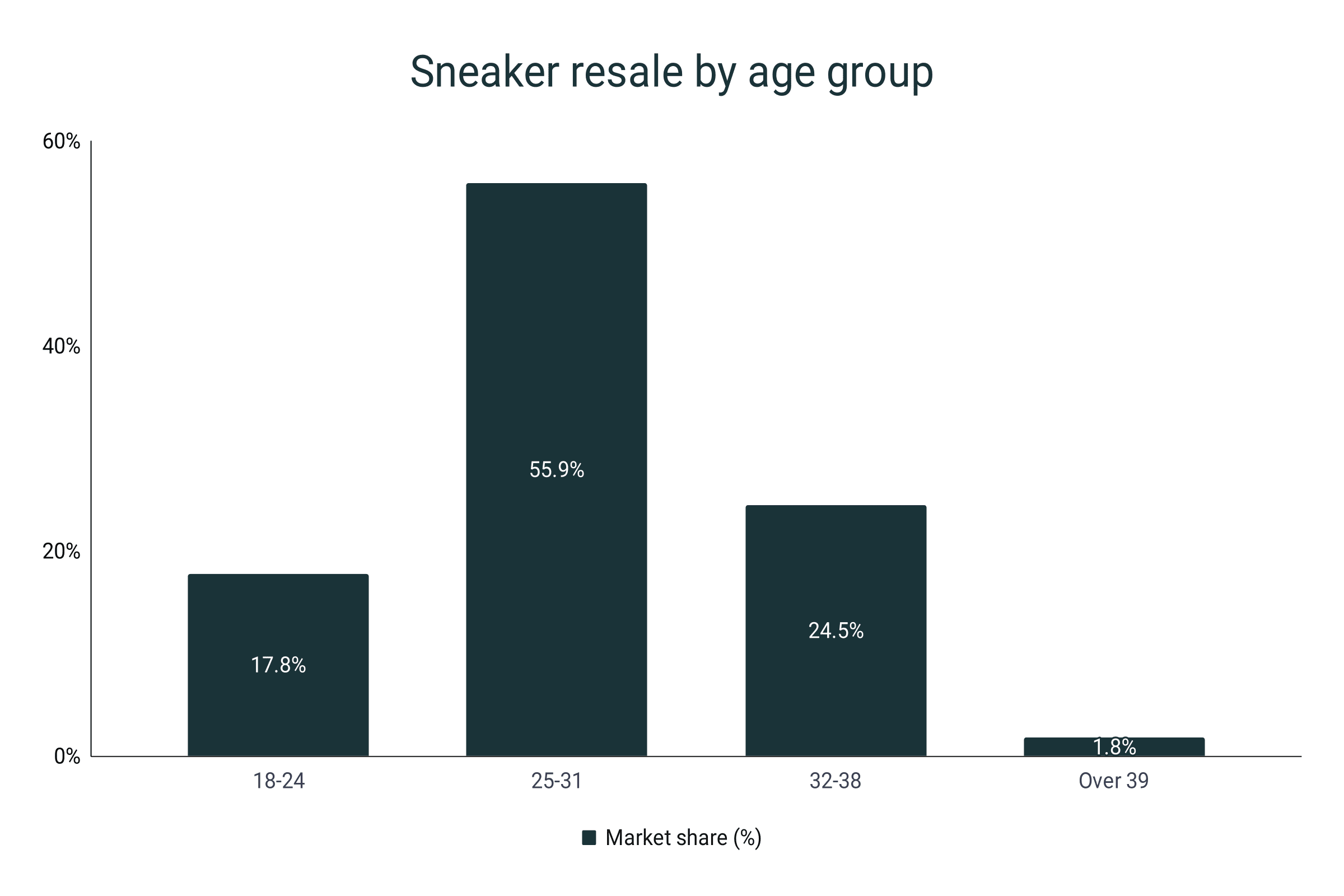

- In terms of age, about 55.9% of secondhand sneaker consumers are in the 25-31 age group.

- The 32-38 age group recorded a 24.5% share while ages 18-24 have a 17.8% share of the used sneaker market.

- Ages 39 and up accounted for 1.8% of the resale consumers.

- The majority of secondary sneaker shoppers belong to the millennial age group (27-42), taking up approximately 80% of the market.

- This is reflected in a report by thredUp, noting that 35% of millennial consumers prefer thrift shopping due to environmental reasons.

- Of the Gen Z (ages 9-24) population, 33% of the Gen Z men consider themselves “sneakerheads.” For Gen Z women, the figure is 26%.

Sneaker resale by age group

|

Age |

Market share (%) |

|

18-24 |

17.8 |

|

25-31 |

55.9 |

|

32-38 |

24.5 |

|

Over 39 |

1.8 |

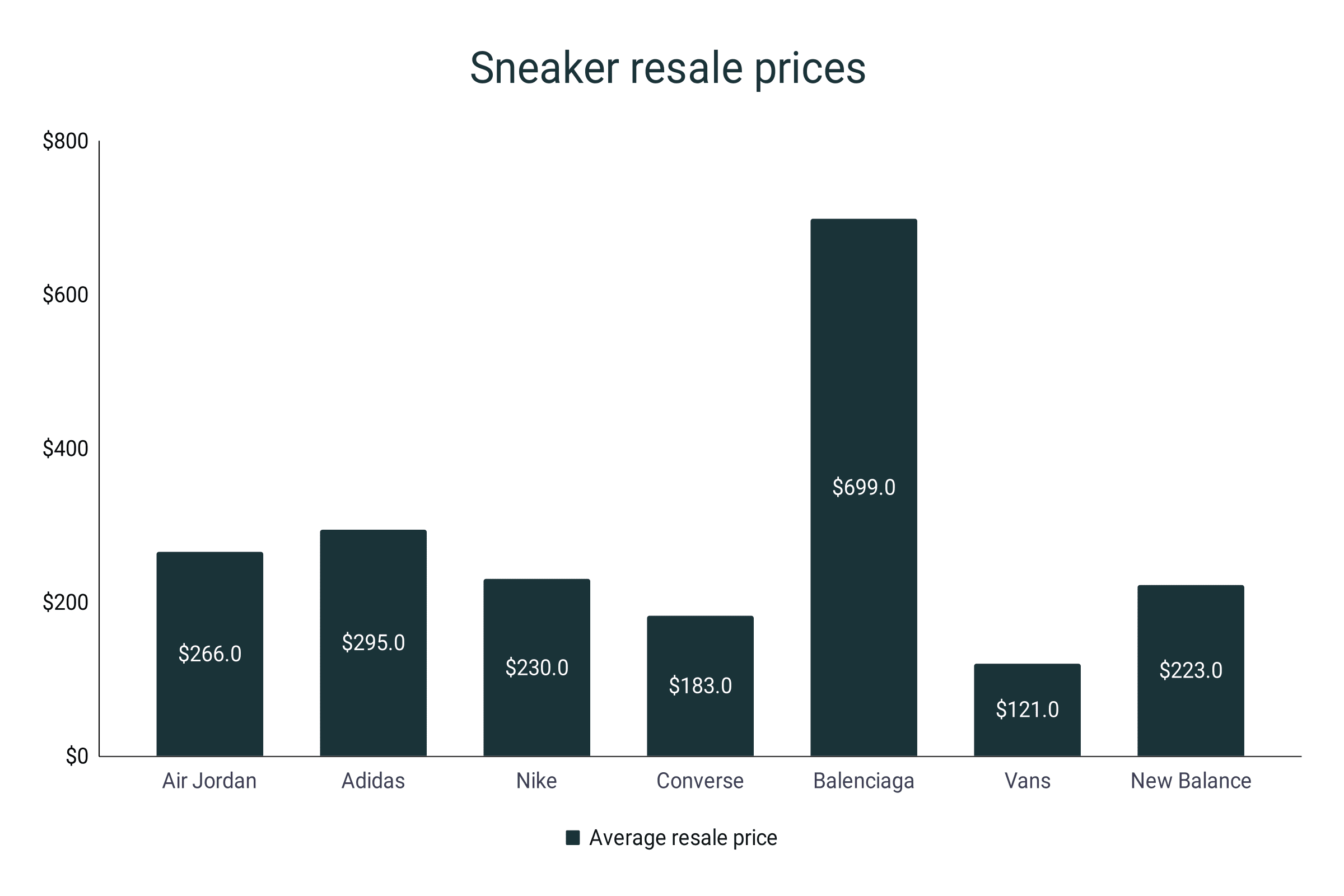

Sneaker resale prices

- Balenciaga trainers with a $699 price tag are the most expensive in terms of average reselling price.

- Adidas is the next with an average resale price of $295.

- In the third and fourth spots are Air Jordan and Nike with $266 and $230, respectively.

- Secondary New Balance trainers, on the other hand, have a mean cost of approximately $223.

- Vans and Converse, relatively, have the cheapest reselling price at $121 and $183, respectively.

Average sneaker resale prices

|

Brand |

Average resale price |

|

Air Jordan |

$266 |

|

Adidas |

$295 |

|

Nike |

$230 |

|

Converse |

$183 |

|

Balenciaga |

$699 |

|

Vans |

$121 |

|

New Balance |

$223 |

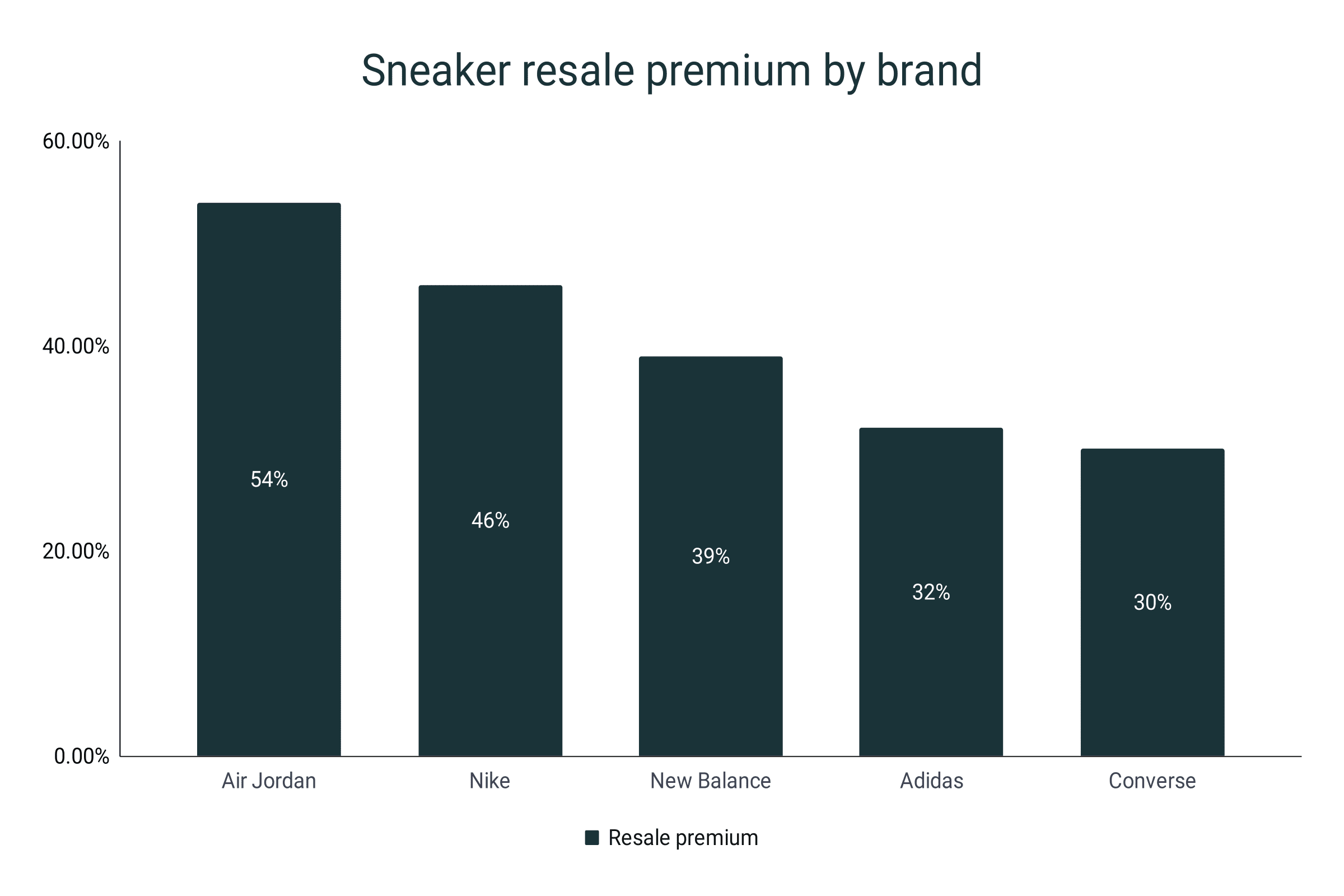

- In terms of resale premium or the percent of markup from the retail price, Air Jordan leads the pack with an average of 54%. This means that a Jordan DNA shoe, for example, which has a retail price of $100 will sell at $154 on resale sites.

- Nike, which accounted for 50% of all resold trainers on StockX in 2020, registered an average premium of 46%.

- Adidas and Converse resold trainers, on the other hand, have an average of 32% and 30% markup, respectively.

- The New Balance, which showed an average annual resale value growth of 61%, has a price premium of 39% on average.

Sneaker resale premium by brand

|

Brand |

Resale premium |

|

Air Jordan |

54% |

|

Nike |

46% |

|

New Balance |

39% |

|

Adidas |

32% |

|

Converse |

30% |

- Air Jordan 1 is the most resold sneaker at $260 and has a market share of 23%.

- On average, the retail value of Jordan 1 trainers is $140. Meaning, it generates an 85.7% premium when resold.

- In Japan, Jordan 1 Retro High OG Defiant SB LA to Chicago is the most bought secondary sneaker. It sells for $391 on average, 50.4% more than the mean reselling price of Air Jordan worldwide.

- The Adidas Yeezy 350 is the second most bought second-hand sneaker globally, accumulating an 18% share of the entire resale market.

- When resold, it costs 27.3% more than its mean retail price of $220.

- In China, 10,000+ pairs of Yeezy Boost 350 V2 Clay were resold in 2019 alone.

- The Nike Air Force 1 holds a 6% cut of the entire sneaker resale market. On average, it costs $274 in resale value.

- Compared to the $120 retail price, Air Force 1 kicks earn a 128.3% premium on average on resale.

Most bought secondary trainers

|

Sneaker |

Market share |

Ave. retail Price |

Ave. resale price |

Premium |

|

Jordan 1 |

23% |

$140 |

$260 |

85.7% |

|

Yeezy 350 |

18% |

$220 |

$280 |

27.3% |

|

Air Force 1 |

6% |

$120 |

$274 |

128.3% |

Sneaker resale platforms

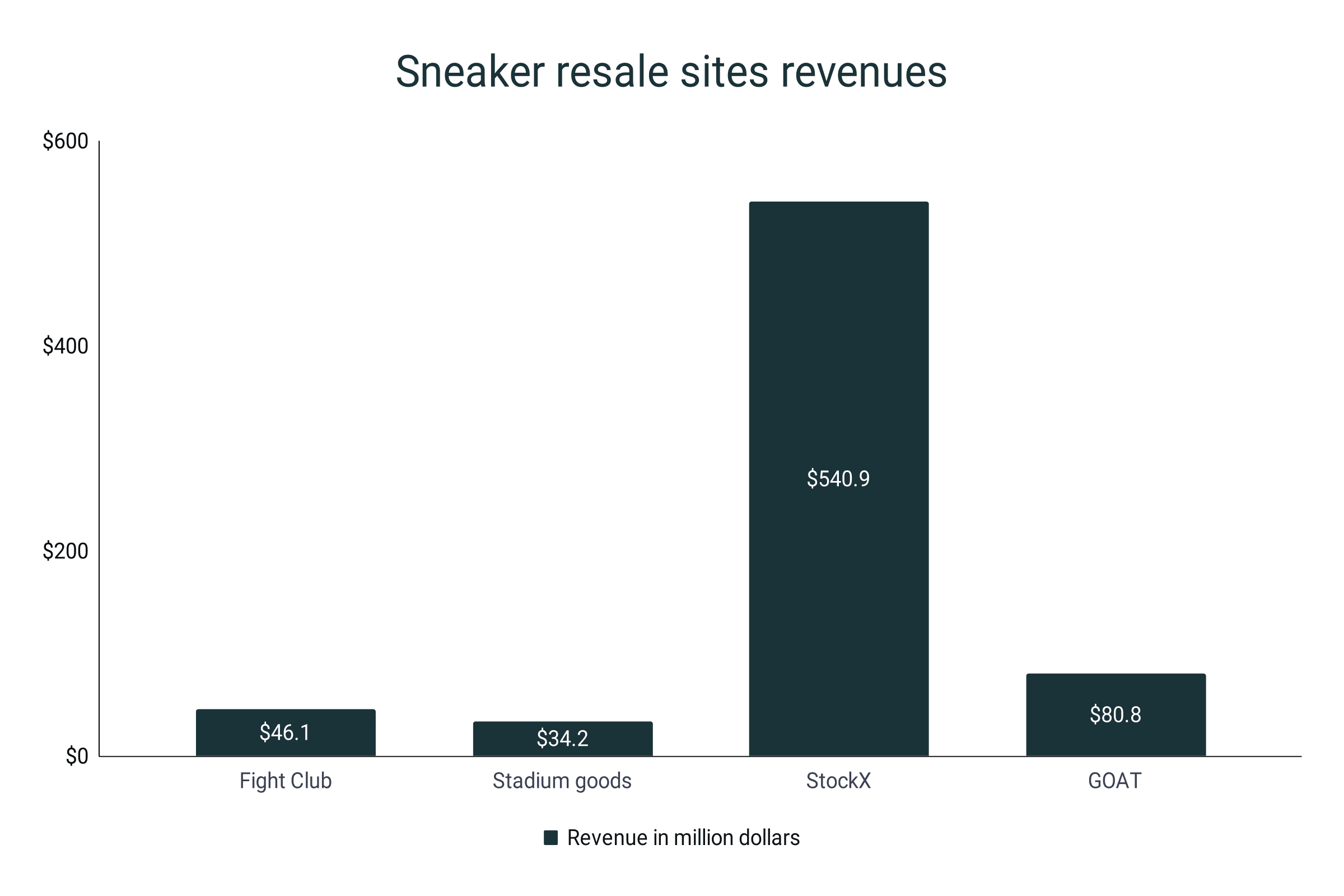

- According to reports, StockX will lead the online sneaker resale market with $540.9 million.

- GOAT will total $80.8 million in revenues by the end of 2023.

- Fight Club and Stadium Goods will reach $46.1 million and $34.2 million in revenues, respectively.

- In terms of company value, StockX is estimated to be worth $3.8 billion before 2023 ends.

- With a $3.7 billion net worth, GOAT is the second biggest sneaker resale company.

- Fight Club will see a $250 million valuation by the end of 2023.

- Stadium Goods was bought for $250 million by FarFetch in 2018.

Sneaker resale sites revenue (2023)

|

Resale site |

Revenue (in $ million) |

Valuation (in $ million) |

|

Fight Club |

$46.1 |

$250 |

|

Stadium goods |

$34.2 |

$250* |

|

StockX |

$540.9 |

$3,800 |

|

GOAT |

$80.8 |

$3,700 |

*valuation before the acquisition by FarFetch in 2018.

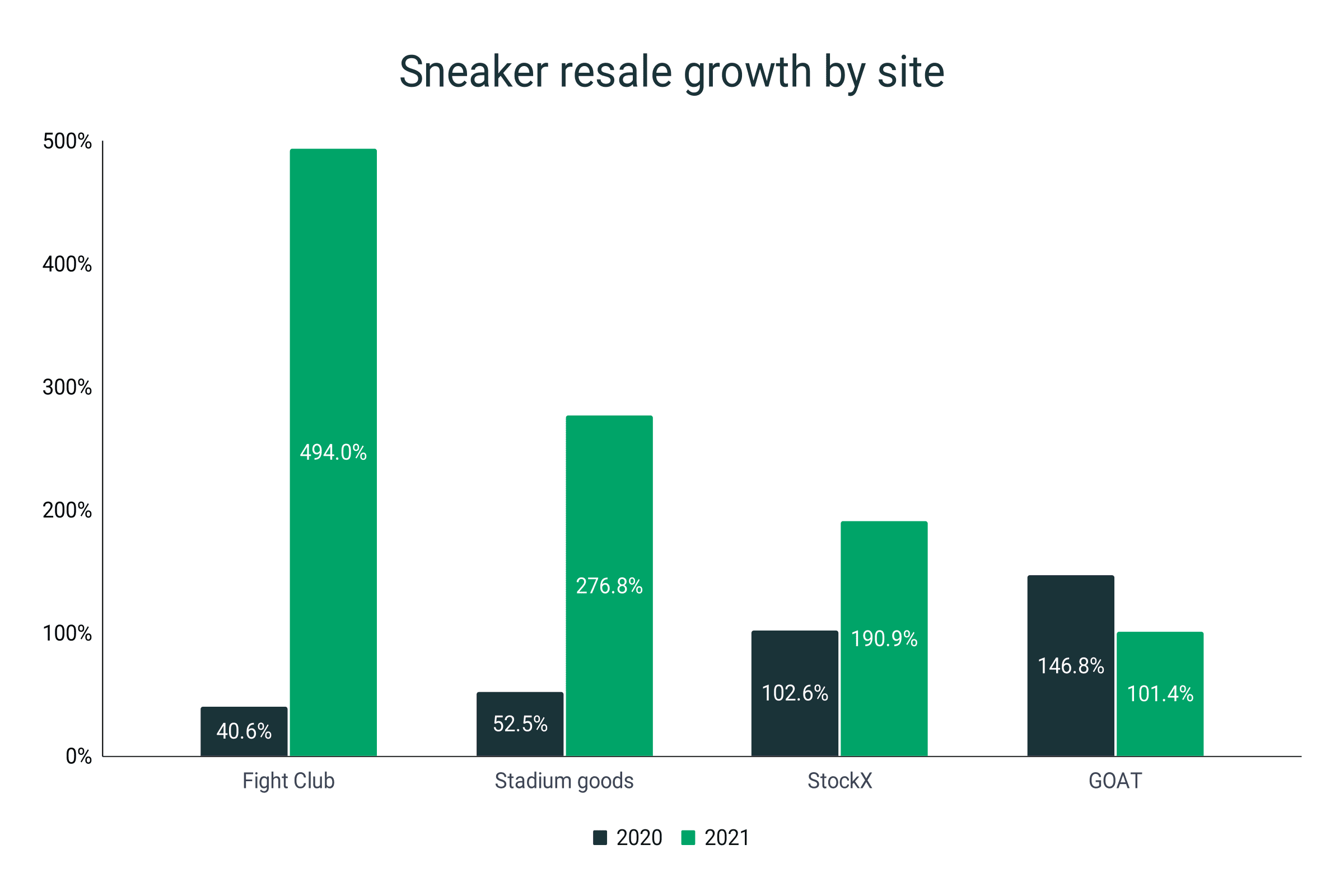

- In 2021, Fight Club experienced a 494% one-year sales increase compared to its sales by the end of 2020.

- Previously, it scored a 40.6% one-year growth in sales.

- With a 453.4% difference, Fight Club became the fastest-growing reselling platform in 2021.

- Stadium Goods registered the second-highest on-year sales growth in 2021 with a 276.8% rise.

- StockX remains to grab a steady third spot in terms of yearly sales growth. It reported a 190.9% and 102.6% increase in 2021 and 2020, respectively.

- Meanwhile, GOAT suffered an 86.8% dip in its sales growth from 2020 to 2021.

Sneaker resale site sales growth

|

Resale site |

2020 |

2021 |

|

Fight Club |

40.6% |

494% |

|

Stadium goods |

52.5% |

276.8% |

|

StockX |

102.6% |

190.9% |

|

GOAT |

146.8% |

101.4% |

Most expensive trainers on the resale market

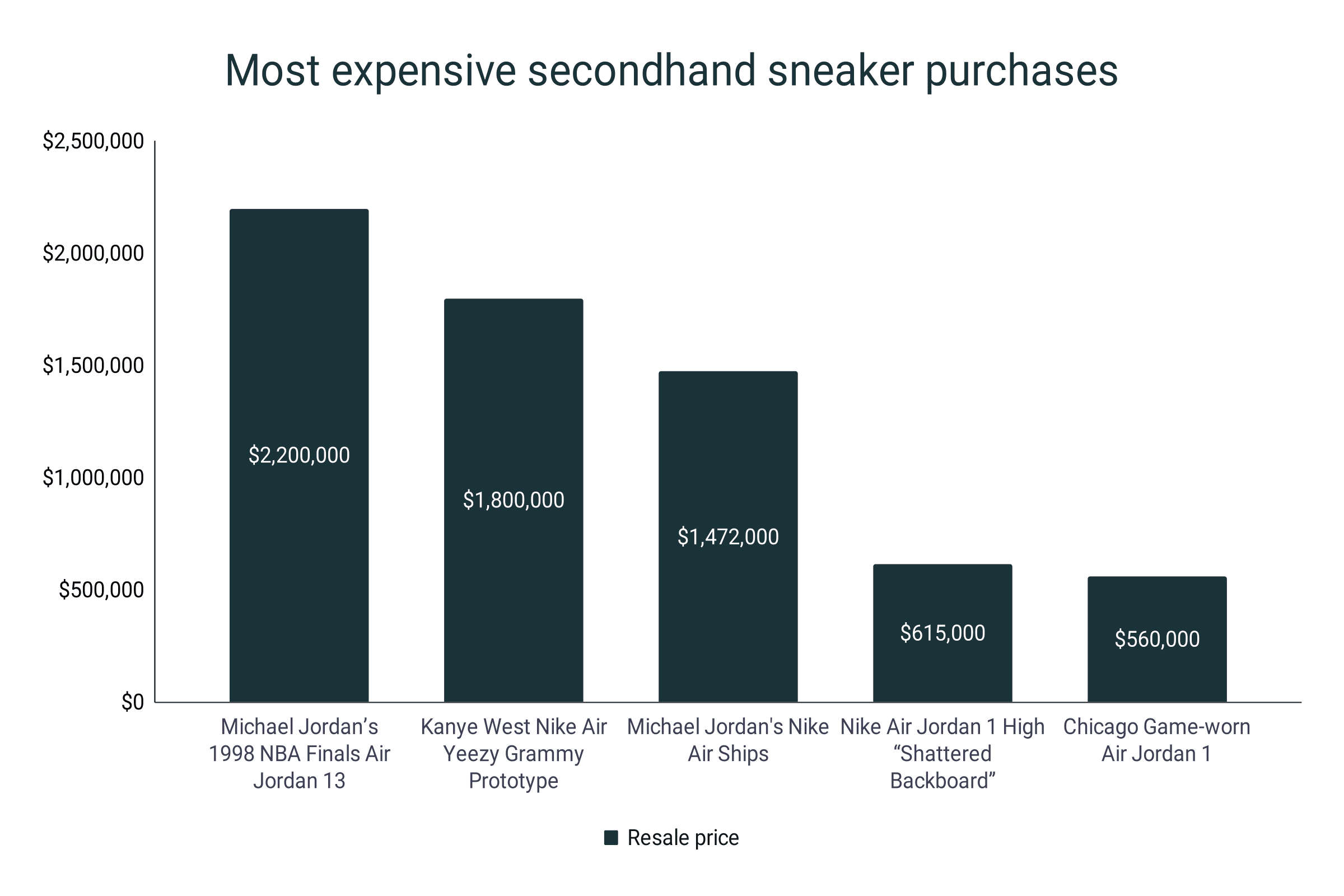

- To date, Michael Jordan’s 1998 NBA Finals Air Jordan 13 is the most expensive sneaker ever to be resold. It fetched $2.2 million in an April 2023 Sotheby auction.

- In April 2021, Sotheby closed the most expensive private sale of the Nike Air Yeezy Grammy Prototype which Kanye West wore at the 2008 Grammy Awards. The sneaker sold for a Guinness world record price of $1.8 million.

- Sold at $1,472,000, Michael Jordan's game-worn Nike Air Ships sneaker is now the most expensive secondhand sneaker sold at an auction.

- At third place sits the $615 thousand price tag of the Nike Air Jordan 1 High Sneaker that Michael Jordan wore in an exhibition game of the Chicago Bulls in 1985. It is dubbed the “rarest of the rare” sneaker and was sold in August 2020.

- Another game-worn sneaker by Michael Jordan, the autographed Air Jordan 1 kicks fetched $560 thousand in a 2020 Sotheby’s auction in New York.

Most expensive secondhand sneaker purchases

|

Sneaker |

Resale price |

|

Michael Jordan’s 1998 NBA Finals Air Jordan 13 |

$2,200,000 |

|

Kanye West Nike Air Yeezy Grammy Prototype |

$1,800,000 |

|

Michael Jordan's Nike Air Ships |

$1,472,000 |

|

Nike Air Jordan 1 High “Shattered Backboard” |

$615,000 |

|

Chicago Game-worn Air Jordan 1 |

$560,000 |

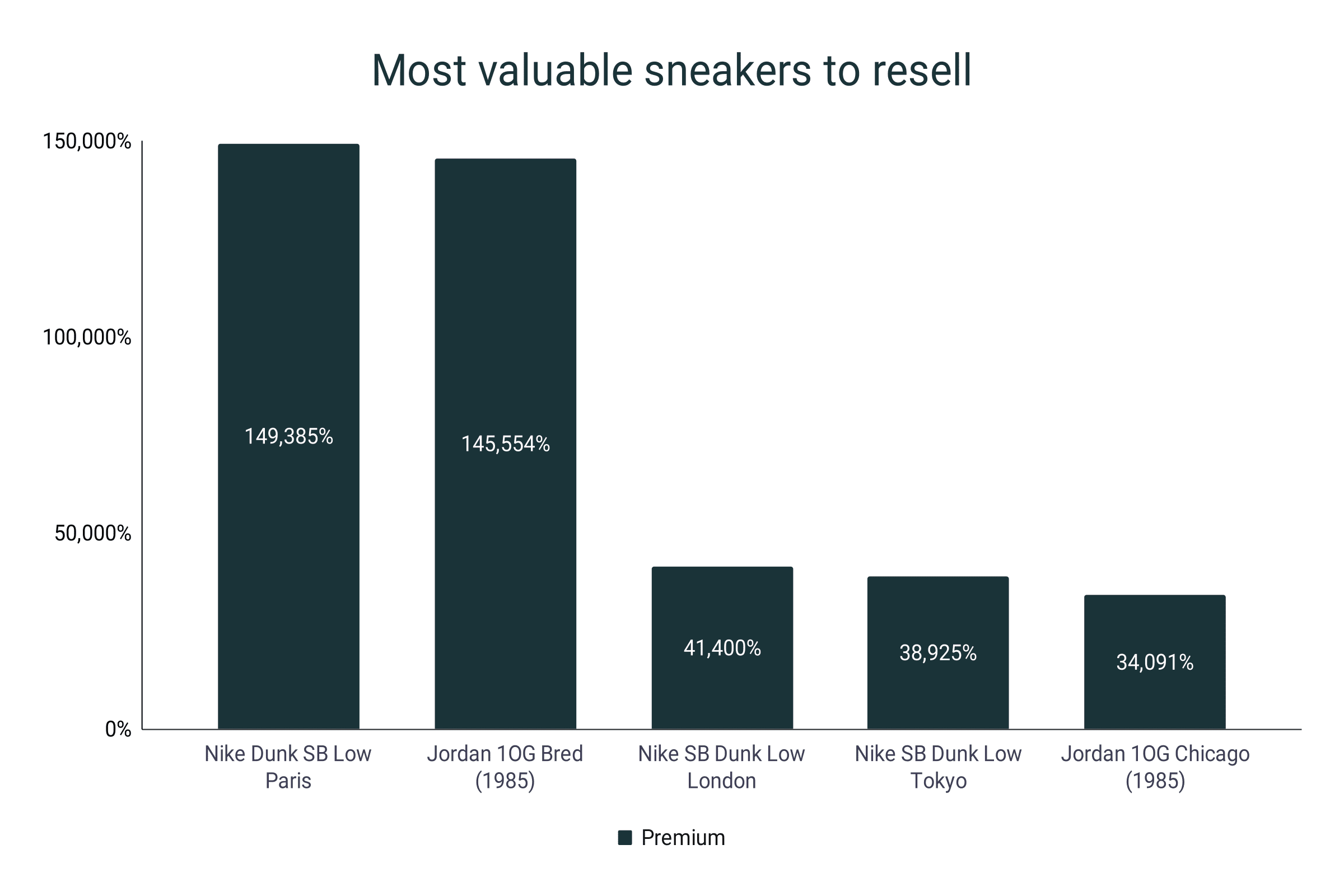

- On the other hand, StockX's list of the most profitable secondhand trainers on the market is led by Nike Dunk SB Low Paris with a minimum asking price of $89,691.

- This is equivalent to a 149,385% premium from its $60 original retail price.

- In 2021, shoe reselling site Proxyeed sold one pair of the SB Low Paris fetched over $130,000.

- The 1985-released Jordan 1OG Bred holds the second-highest price premium at 145,554% of its original price. Its lowest bidding price is $94,675 in 2021.

- Nike SB Dunk Low London and Nike SB Dunk Low Tokyo both have a retail price of $60 when first released. Today, the lowest asking price for the models are $24,900 and $23,415, respectively.

- The percent markup for the two trainers is 41,400% and 38,925%, respectively.

- Another 1985 silhouette, the Jordan 1OG Chicago (1985) completes the list of most profitable resale trainers. In 2021, it has an asking price of $22,224, about 34,091% price premium when resold.

Most valuable trainers to resell

|

Sneaker |

Retail price |

Lowest asking price |

Premium |

|

Nike Dunk SB Low Paris |

$60 |

$89,691 |

149,385% |

|

Jordan 1OG Bred (1985) |

$65 |

$94,675 |

145,554% |

|

Nike SB Dunk Low London |

$60 |

$24,900 |

41,400% |

|

Nike SB Dunk Low Tokyo |

$60 |

$23,415 |

38,925% |

|

Jordan 1OG Chicago (1985) |

$65 |

$22,224 |

34,091% |

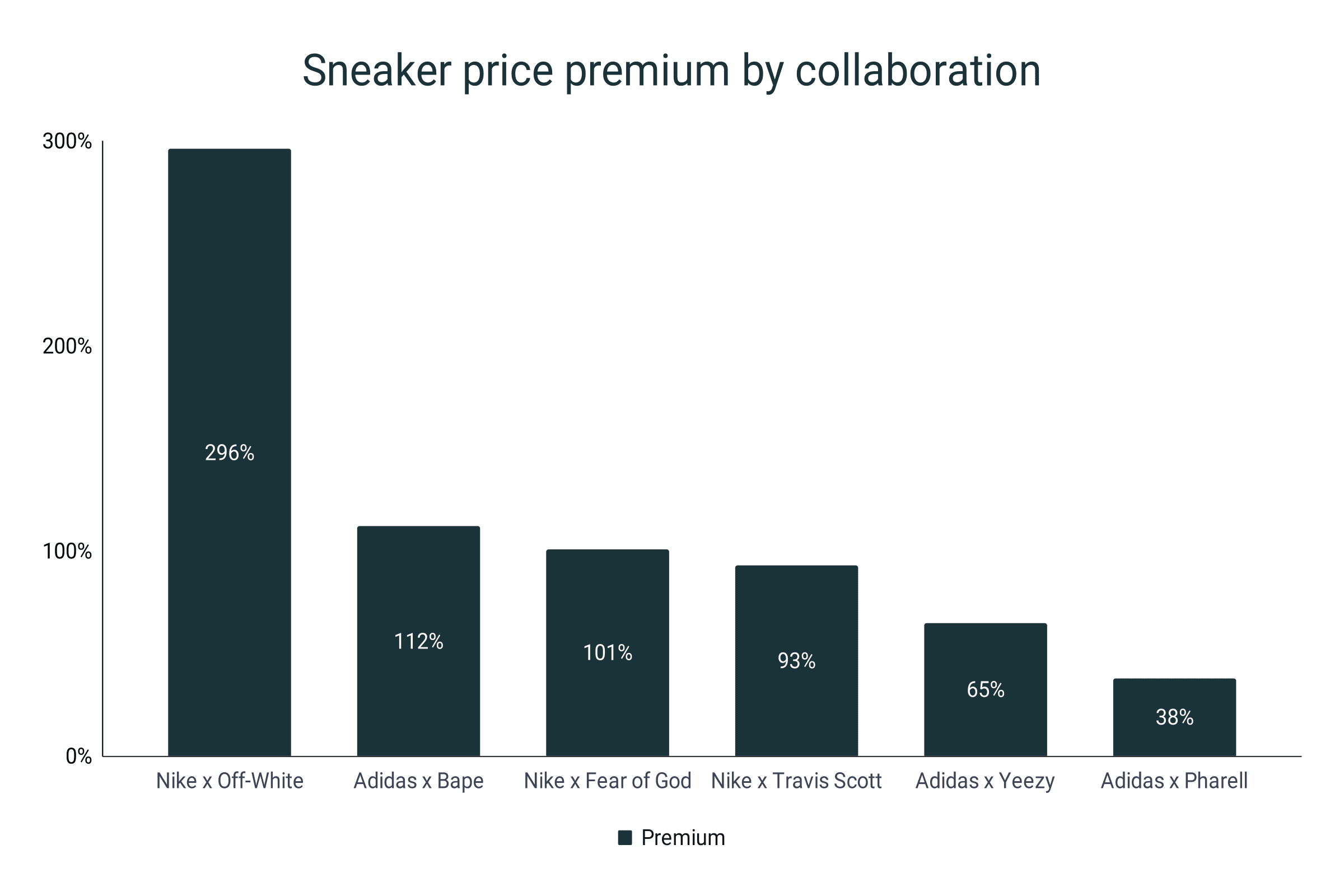

- In the secondary sneaker market, Nike x Off-White collabs generate an average of 296% premium when resold.

- At 112%, Adidas x Bape sneaker collaborations are the second most profitable.

- Nike’s collaborations with Fear of God and Travis Scott register a 101% and 93% increase from its retail price when sold in the resale market.

- Meanwhile, the Yeezy and Pharell Williams silhouettes with Adidas accumulate 65% and 38% price premiums.

Sneaker price premium by collaboration

|

Collaboration |

Premium |

|

Nike x Off-White |

296% |

|

Adidas x Bape |

112% |

|

Nike x Fear of God |

101% |

|

Nike x Travis Scott |

93% |

|

Adidas x Yeezy |

65% |

|

Adidas x Pharell |

38% |

Sources

https://www.marketdecipher.com/report/sneaker-resale-market#:~:text=Global%20Sneakers%20Resale%20Market%20was,period%20of%202023%20to%202032.&text=pre%2Dloved%20sneakers%2C%20further%20increasing,the%20used%20sneaker%20resale%20market.

https://www.statista.com/statistics/1202148/sneaker-resale-market-value-us-and-global/#:~:text=In%202019%2C%20it%20was%20estimated,billion%20U.S.%20dollars%20that%20year.

https://secondmeasure.com/datapoints/sneaker-resellers-putting-their-best-foot-forward/

https://stockx.com/news/state-of-resale/

https://www.statista.com/chart/24313/stockx-gross-merchandise-volume/

https://greyjournal.net/hustle/finance/global-sneaker-resale-market-estimated-at-6-billion/#:~:text=Trainers%20have%20always%20been%20a,many%20people%20around%20the%20globe.